- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

No, once you file a return, you cannot get it back, cancel it, or make changes to your return. It is like dropping it in a mail box.

Do not make any changes to your e-filed return, it will not go through. The IRS is not accepting returns until Feb. 12th, you will have to wait until then to see if your return is accepted or rejected.

If rejected, you can enter or change your information, then re-e-file.

If accepted, you would have to amend your return to make changes or add information.

Also, the Federal amended return (1040X), will not be available until around Feb. 28th (subject to change).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

Once a tax return has been filed it cannot be changed, canceled or retrieved

You will have to wait for the IRS to start accepting or rejecting 2020 tax returns on February 12, 2021

If the return is rejected you can make the necessary changes and e-file again.

If the return is accepted you will have to amend your original tax return. An amended return, Form 1040X, can only be printed and mailed to the IRS, it cannot be e-filed. The IRS will take up to 16 weeks or longer to process an amended tax return.

Before starting to amend the tax return, wait for the tax refund to be received or the taxes due to be paid and processed by the IRS.

See this TurboTax support FAQ on amending a tax return originally completed and filed using the 2020 TurboTax online editions - https://ttlc.intuit.com/community/amending/help/how-do-i-amend-my-turbotax-online-return/01/27577

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

No, once you file a return, you cannot get it back, cancel it, or make changes to your return. It is like dropping it in a mail box.

Do not make any changes to your e-filed return, it will not go through. The IRS is not accepting returns until Feb. 12th, you will have to wait until then to see if your return is accepted or rejected.

If rejected, you can enter or change your information, then re-e-file.

If accepted, you would have to amend your return to make changes or add information.

Also, the Federal amended return (1040X), will not be available until around Feb. 28th (subject to change).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

But it is not like dropping it in the mailbox since it will not be sent to the IRS until the designated process date.

My Federal E-file should be more like a letter that is waiting on the counter to be taken to the mailbox.

Can someone explain why that is not the case as Turbo Tax is literally waiting to send it to the IRS???

Had I not filed already and waited two more weeks to submit an E-file return, guess what? It's still getting to the IRS at the same time as my current one! Is Turbo Tax unable to cancel e-file returns more than 2 weeks from being sent to the IRS? This is honestly ridiculous. My return is only in Turbo Tax servers - not the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

Sorry--- if you e-filed you cannot get it back. When you put it on the server it stays there until the IRS either rejects or accepts it.

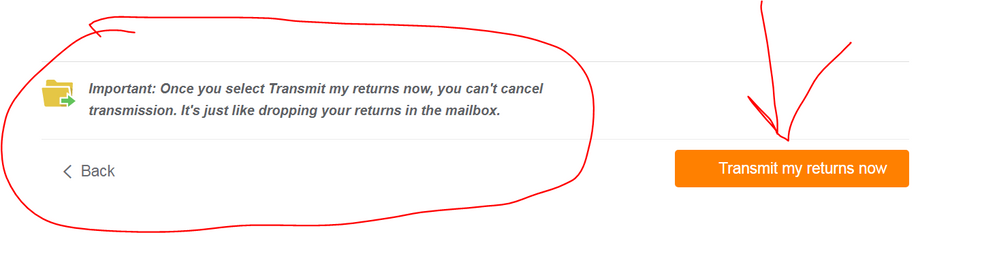

Did you click that big orange button that said “Transmit my return now?” If you did that, you cannot do anything to fix it yet. You have to wait for the email that tells you if your return was accepted or rejected. Those emails will not start coming in until the IRS begins to accept/reject e-files in late January. If you do not see an email, check your spam folder.

You cannot change or add anything on the return that you just e-filed, nor can you stop it. It is too late, just like when you put an envelope in a US mailbox on the corner.

If you left out a W-2, a 1099G, or a dependent, or a 1099 etc…DO NOT change your return while it is “pending.” The changes will go nowhere.

Now you have to wait until the IRS either rejects or accepts your return. If your return is rejected, you will be able to go into your account and make the necessary changes to your tax return and re-submit your return.

If the IRS accepts your return, however, then you have to wait longer until it has been fully processed and you have received your refund. THEN you can prepare an amended tax return and e-file or mail it in. You have to be able to work from that return exactly the way it was when it was e-filed originally. You will need to use a form called a 1040X.

Meanwhile, DO NOT go in and start changing anything on your return in the system, or you will make a mess for yourself. Sit tight and wait until you see what the IRS does with the return you just e-filed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

But it is NOT "sitting on the counter" ... when you clicked that transmit now button it WAS like putting it in the corner mailbox ... the return was sent to a POOL (electronic mailbox) where the return will wait for the IRS to come get it (like the postman who empties the mail box) and TT cannot touch it per the IRS regulations ... the screen warned you about this ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

"TT cannot touch it per the IRS regulations"

This is the answer I was looking for - thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

Having this issue in 2022. Turbo tax still has it as pending, the IRS won't accept until Jan 24th. It's just sitting in queue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

@dyounce1017 Yes, that is right. If you e-filed it, it is sitting on a server. You cannot touch it. You cannot pull it back. You cannot make changes. You have to wait until it is accepted/rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

Been on the phone, and one representative said I could. But it's taking 30 minutes to get a straight answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

No. You cannot get it back. The IRS does not allow you to pull your return out of pending. Sorry you filed early with a mistake. You have to live with it until the IRS begins to accept/reject on January 24.

Did you click that big orange button that said “Transmit my return now?” If you did that, you cannot do anything to fix it yet. You have to wait for the email that tells you if your return was accepted or rejected. Those emails will not start coming in until the IRS begins to accept/reject e-files in late January. If you do not see an email, check your spam folder.

You cannot change or add anything on the return that you just e-filed, nor can you stop it. It is too late, just like when you put an envelope in a US mailbox on the corner.

If you left out a W-2, a 1099G, or a dependent, or a 1099 etc…DO NOT change your return while it is “pending.” The changes will go nowhere.

Now you have to wait until the IRS either rejects or accepts your return. If your return is rejected, you will be able to go into your account and make the necessary changes to your tax return and re-submit your return.

If the IRS accepts your return, however, then you have to wait longer until it has been fully processed and you have received your refund. THEN you can prepare an amended tax return and e-file or mail it in. You have to be able to work from that return exactly the way it was when it was e-filed originally. You will need to use a form called a 1040X.

Meanwhile, DO NOT go in and start changing anything on your return in the system, or you will make a mess for yourself. Sit tight and wait until you see what the IRS does with the return you just e-filed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

Were you able to get them to allow changes / delete return in process? Wondering if speaking on the phone would work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

@reynoldsrs No you cannot change anything on a pending return. The IRS does not allow it.

Did you click that big orange button that said “Transmit my return now?” If you did that, you cannot do anything to fix it yet. You have to wait for the email that tells you if your return was accepted or rejected. Those emails will not start coming in until the IRS begins to accept/reject e-files in late January. If you do not see an email, check your spam folder.

You cannot change or add anything on the return that you just e-filed, nor can you stop it. It is too late, just like when you put an envelope in a US mailbox on the corner.

If you left out a W-2, a 1099G, or a dependent, or a 1099 etc…DO NOT change your return while it is “pending.” The changes will go nowhere.

Now you have to wait until the IRS either rejects or accepts your return. If your return is rejected, you will be able to go into your account and make the necessary changes to your tax return and re-submit your return.

If the IRS accepts your return, however, then you have to wait longer until it has been fully processed and you have received your refund. THEN you can prepare an amended tax return and e-file or mail it in. You have to be able to work from that return exactly the way it was when it was e-filed originally. You will need to use a form called a 1040X.

Meanwhile, DO NOT go in and start changing anything on your return in the system, or you will make a mess for yourself. Sit tight and wait until you see what the IRS does with the return you just e-filed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

I would stop likening the process to "putting the envelope in the mailbox" as when something goes in the mailbox - that means it is on the way to the recipient.

That is not exactly the case here as my return is not currently on the way to the IRS - it is sitting in Turbo Tax servers awaiting transmission to the IRS.

Just say - per IRS regulations once the return is submitted to Turbo Tax you are unable to edit or change.

Using the mailbox analogy makes me think Turbo Tax would still be able to delete my return before sending it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I pull back a pending federal return to correct an error? The filing season opens Feb 12th so I would believe the pending return is still in Turbo Tax's system.

If it's in a pending status refile with another software or company. I just did after my return was stuck in a pending status for 48hours that return was accepted in 30mins while my TT return stays in the pending status

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17526117401

New Member

swick

Returning Member

user17524963565

New Member

CTinHI

Level 1

MBSC

Level 3