- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: 401k over-contribution in 2018, reported in 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

Need some guidance on how to address.

While I over-contributed the 401k by about $1500 in 2018 (had two jobs and mis-calculated), I caught it before the end of the year, and had the 401k company issue me a refund. However, they issued the refund in early 2019, and this year sent me a 1099R-2019 for the over-contribution, with a P distribution on it.

Using 2018 TurboTax to amend my 2018 taxes, using the 1099R-2019, the P code indicates it is for 2017 overpayment, not 2018.

Now I'm confused as to how to address this. Am going to contact the 401k firm tomorrow. Do they need to issue me a 2018 1099R, or do I simply claim this as income in 2019???

Just want to pay what I need to do correctly. Thx

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

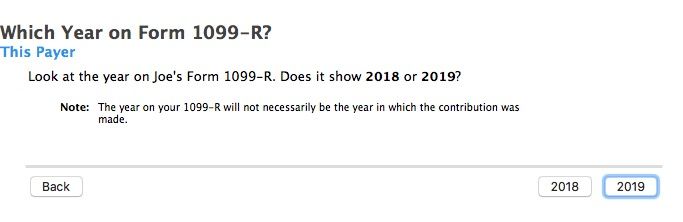

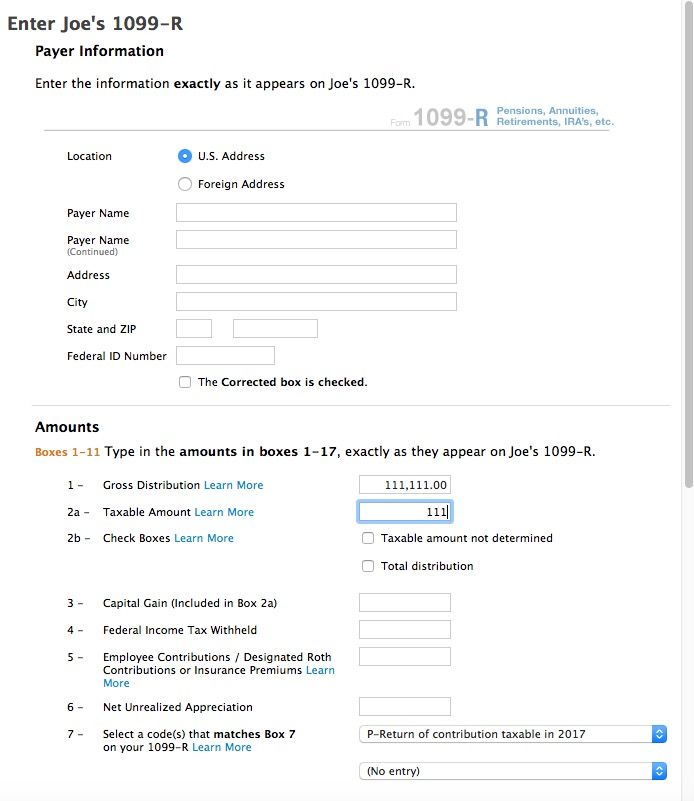

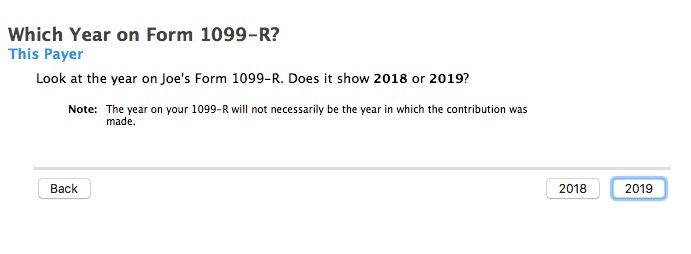

A code P when entered into the 2018 software will ask what year the 1099-R is for. Choose 2019 and then the taxable in 2017 changes to taxable in 2018. The year on the 1099-R advances the "taxable in year" by 1 each year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

A code P when entered into the 2018 software will ask what year the 1099-R is for. Choose 2019 and then the taxable in 2017 changes to taxable in 2018. The year on the 1099-R advances the "taxable in year" by 1 each year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

Champ,

Thank you for the quick reply. I was able to select 2019, which makes me now pay additional taxes for 2018. Perfect. Per my understanding, I have to mail this in to both the Federal and State agencies. A pain, but can do so. Thx again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

Code P should add it to line 1 on the 1040 as wages since it replaces the taxable wages that were not taxed on the original 2018 tax return.

Amended returns can only be mailed. It is suggested that you mail with a tracking service since that is your only proof of mailing and The IRS received it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

Good idea of tracking this. Will do.

A Related question: I added in the 1099R, printed out the package for both Fed and State. The Turbotax cover page mentions the "payment due." However, for the Fed package, there are 4 identical "2019 Form 1040-ES Payment Vouchers", all for the same amount, and almost double the "payment due" calculation from TurboTax. They all say to "detach here and mail with your payment."

Form 1040x says I owe the same as what TurboTax calculates.

What are the 2019 Form 1040-ES Payment Vouchers for, and why are there 4 of them, all the same?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

Ignore the 1040ES and any other form that did not change. Those were for 2019 estimated tax that no longer applies.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

Macuser 22, thank you for quick and helpful responses, on a Sunday evening no less!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

Just sitting here waiting for the roast leg of lamb to get done in about 45 minutes - have a good one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

I have the same issue of over contribution in 2018 and got 1099-R in 2019. However, in the 2018 software, I was NOT to select 2019, which makes me can not pay additional taxes for 2018. I am confused how I could change the year to 2018. Please help...Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

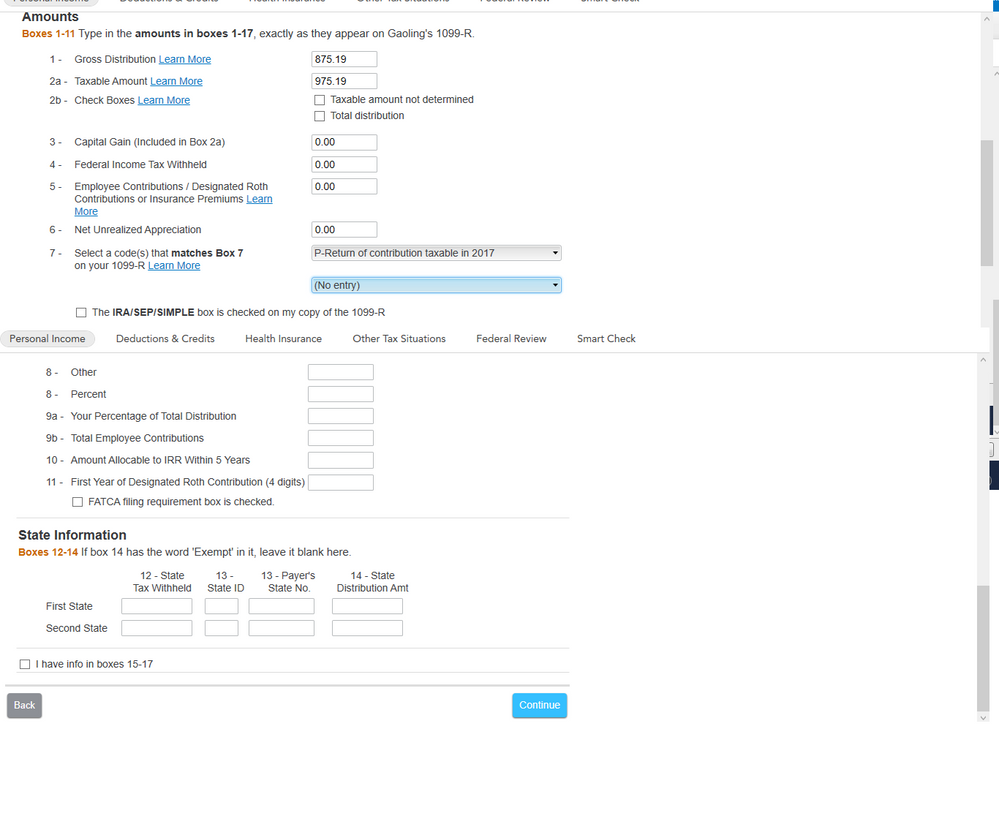

If it is a 2019 1099-R with a code P in box 7 then you will get the screen in the screenshot above, choose that it is a 2019 1099-R if you have the 2018 software installed on your computer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

thanks for your quick response. it is a 2019 1099-R with a code P in box 7. The problem is my TURBO tax 2018 does not support the option to select the 1099-R for the year of 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

@GLZOU19 wrote:

thanks for your quick response. it is a 2019 1099-R with a code P in box 7. The problem is my TURBO tax 2018 does not support the option to select the 1099-R for the year of 2019.

Certainly is does.

Code P advances by a year every year. A 2018 code P is for 2017, a 2019 code P is for 2018.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

Thanks again for your help.

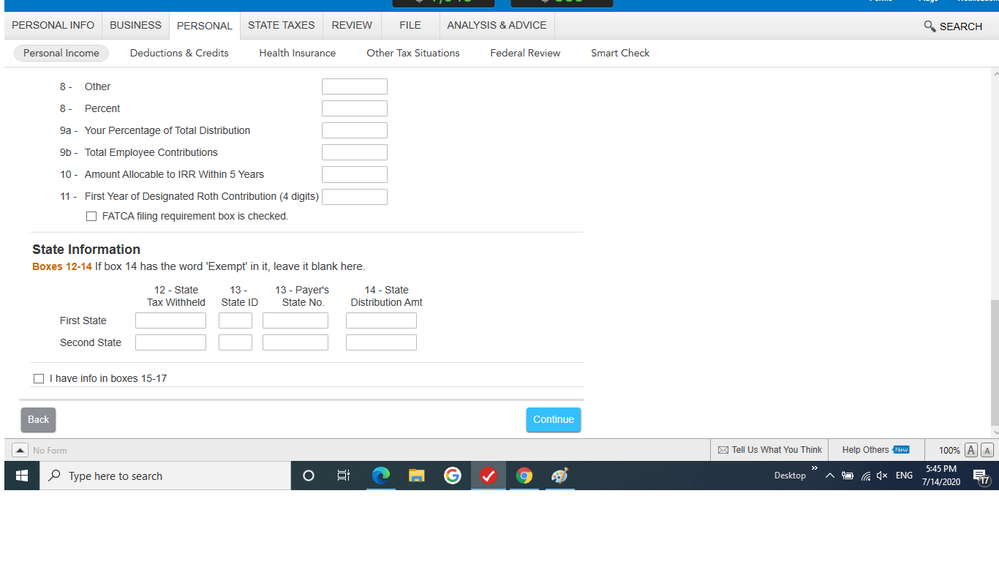

here is what I got if following what you did. How to get the "which year " option? My version is Home and Business 2018. I just could not get the option to select the year of 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

did I miss anything set in the software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k over-contribution in 2018, reported in 2019

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cu006514

Level 1

meade18

New Member

Jersian

New Member

Dusit

New Member

salvadorvillalon54

Returning Member