- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: 1/2 of our Stimulus has been taken

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

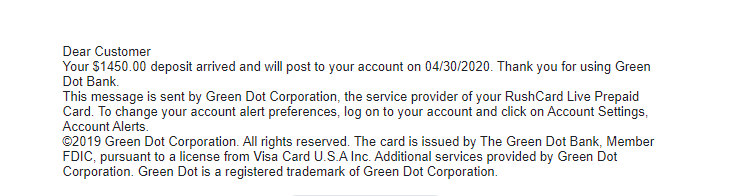

No, neither of us owe any kind of child support, we received our full refund this past (and every) year just fine. Both of our kids live with us. The only kind of debt either of us has are that I have defaulted student loans; but we file an 8379 every year, so that isn't taken either (plus I'm aware that they aren't supposed to take Stimulus for student loans). Has anyone heard of anyone else having this happen? And it was EXACTLY half. I got the message from Green Dot this morning that $1450 would be deposited; we should have received $2900 (2 adults, + 2 kids, with one of them not counting towards this credit because he's 17). And yes, we filed jointly, so both stimulus payments should have been together.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

IRS FAQ:

a letter about the Payment will be mailed to each recipient’s last known address within 15 days after the Payment is made. The letter will provide information on how the Payment was made and how to report any failure to receive the Payment.

hope that helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

Thanks; yeah, I guess that's what we'll have to do, wait until we get a letter. To correct the above I typed, we have 2 kids, but one was 17, so only one qualified for the Stimulus credit. So it was $2400 + $500 = $2900...and our pending deposit is $1450. I appreciate the response.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

Are you aware of limits based on AGI?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

Sorry, here's the link:

https://www.irs.gov/pub/irs-utl/how_do_I_calculate_my_eip.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

Our AGI was a little over $28,000, so definitely not applicable in this case.

I appreciate the reply, though; again, the amount pending is exactly half of what was anticipated, so it certainly appears that one of ours was taken for some sort of unknown offset. We've little recourse but to wait for the letter from the IRS (or try to reach a call center, although whether they'll have information on stimulus payments seems dubious).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

@Stinkerbellkity @Patrick73 - that is a good point on the AGI... what is on line 8B of your tax return..

if that number is greater than $150,000, then the stimulus will be reduced by (X-150,000) * 5%. where X is the number on line 8B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

@Patrick73 - the only authorized offset if for back child support. the stimulus can't be garnished for any other reason.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

I'm aware, and yet...

I even called the State child support division JUST to make sure (although I already knew the answer), and they of course confirmed I owed nothing in that regard.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

Could it be for your regular tax refund minus the fees?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

Is it possible for the Stimulus amounts to be sent in 2 equal payments, to the same account (and me only have gotten a notification for one), since we're technically 2 separate taxpayers, although having filed jointly? It seems unlikely, since I hadn't heard of anyone else having this happen & it would be odd to "split the dependent", but just brainstorming. You know, the old "When all logical solutions are exhausted, only the illogical remains".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

No, that was received weeks ago, and the date of the 30th matches the information in the "Get My Payment" portal. I appreciate the reply, however!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

Someone else posted on another thread that the exact same happened to them; Green Dot shows $1450 pending for the 30th, they are expecting $2900. Appears to be a Green Dot issue. Makes me feel better that it isn't isolated, anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

The EXACT same thing just happened to me and my husband. Was expecting $2,900 and only got $1,450. And we do not have or use Green Dot. It was deposited into our bank account . I also owe on student loans that have been defaulted . I'm livid! I have no idea what to do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1/2 of our Stimulus has been taken

@tdc_18 - student loans should have nothing to do with it. the only garnishment that was permitted under the CARES ACT is back child support.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hickmond38

New Member

janaly304

New Member

ra4677004

New Member

hornbergermichael555

New Member

lucasmyamurray

New Member