- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Possible 2019 filing Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible 2019 filing Error

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible 2019 filing Error

What is your question about a possible filing error? What is the error?

This is a message forum, not live chat. You have to post all the details of your question and wait for someone to respond. You will get an automated email when someone responds to your question. Do not post any personal information or contact information. This is a public web site.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible 2019 filing Error

I entered the wrong adjusted gross income amount when I completed the e-filing. What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible 2019 filing Error

If the AGI you used was incorrect, the return will be rejected, if it has not already been rejected. What is your e-file status?

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

If the return has been rejected you can correct the AGI and try to re-file it. If you are unsuccessful in re-filing it, you can also try using zero as the AGI. If zero does not work, then print, sign and mail the return.

If you used the wrong AGI, your e-file be rejected. When you get the rejection notice, correct it and re-file.

https://ttlc.intuit.com/community/agi/help/where-do-i-correct-my-agi-in-turbotax-online/00/26311

https://ttlc.intuit.com/community/agi/help/how-do-i-find-last-year-s-agi/01/25947

Your 2018 tax return shows your 2018 Adjusted Gross Income (AGI) If you filed a joint return then the AGI is the same for each of you.

Form 1040 line 7

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible 2019 filing Error

My taxes got rejected because I was claimed as a dependent on my grandma's taxes and didn't claim myself as one. I didn't see the option to claim myself as a dependent when reviewing my taxes. How do I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible 2019 filing Error

If your Grandma claimed you you can not claim yourself. If you don't qualify as her dependent you will gave to print and mail your return and let the IRS sort out who can claim you.

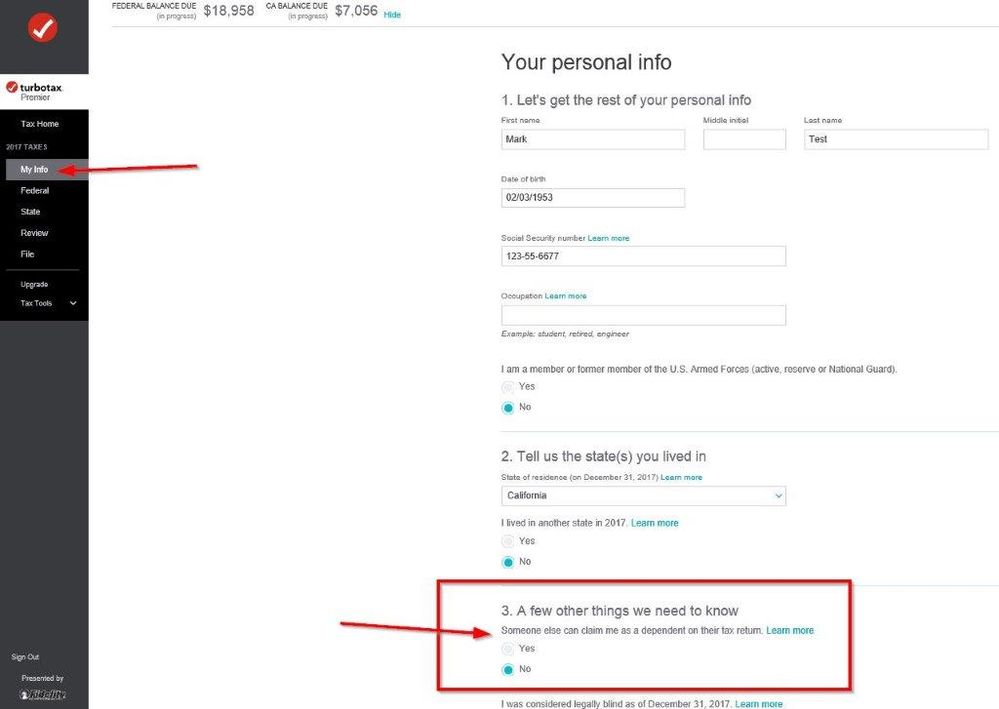

Oh you select if you are a dependent under My Info. Click Edit by your name and go to #3. Someone else can claim me - Yes or No.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

danielplocher

New Member

dac10012

Returning Member

dac10012

Returning Member

cmcgrath61

Returning Member

dac10012

Returning Member