- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- incorrect refund

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

incorrect refund

I just don't get it. I received the stimulus money, month's ago. It's not clear to me why it's coming out of my federal refund.

I haven't received the new stimulus payment yet. Is that going to be an issue as well?

Probably should just wait until tax season is over an deal with IRS directly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

incorrect refund

@sailfish wrote:

I just don't get it. I received the stimulus money, month's ago. It's not clear to me why it's coming out of my federal refund.

I haven't received the new stimulus payment yet. Is that going to be an issue as well?

Probably should just wait until tax season is over an deal with IRS directly.

If you have $1200 on the Form 1040 Line 30, it is not coming out of your 2020 federal tax refund, it is adding to the federal tax refund. If the amount shown is not correct the the IRS will remove this credit from the refund when they process your tax return. That is why it is important for the credit to be correct on your tax return.

The third stimulus is sent directly from the IRS. It is not included with or a part of your 2020 federal tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

incorrect refund

Yes you already got it. But you tried to get it again on line 30. It's not coming out of your refund. Your refund was the wrong amount. Your refund was too high. It should not have even been in your refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

incorrect refund

Where in turbo tax do we enter the economic recovery amount? For example - Is it in FEDERAL TAXES / Deductions and Credits. I want to skip directly to the entry point to adjust the number. The feds want me to claim the $1200 which was dir deposit on Jan 4th 2021 for my 2020 return. Thanx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

incorrect refund

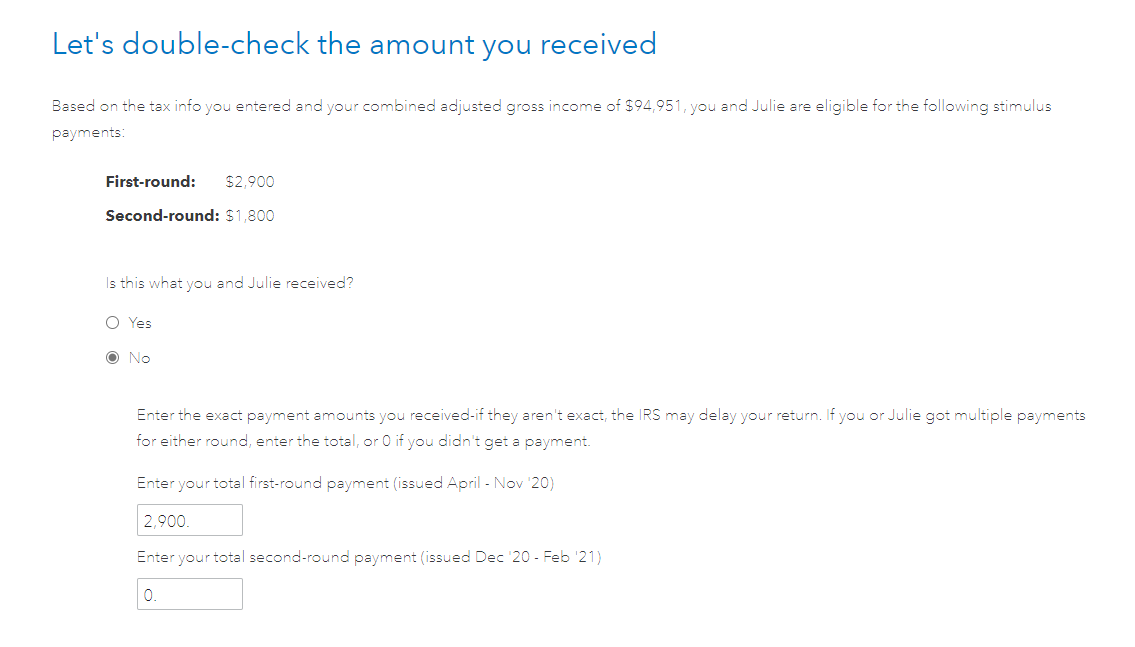

In the Federal section, select the Federal Review interview section at the top of the screen.

This will take you to the input section for the Recovery Rebate credit.

Be sure to indicate the actual amount of each stimulus payment you received on the page that asks if you received a stimulus payment.

Please see the attached link for more information on who can claim the credit.

Recovery Rebate Credit eligibility

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

incorrect refund

Did you ever get an answer because I just found out my federal return has been lowered by $2100 and it claims due to the child tax credits. If so much unemployment shouldn’t be taxed how does my refund go down? It should of gone up. Also according to tt it should of when they adjusted that. But the irs lowers it. That doesn’t even make sense

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

incorrect refund

First wait for the IRS letter of explanation they will send in the next couple of weeks. If you still don't understand then contact TT support for personal assistance as this PUBLIC forum is not the right place to discuss this affectively especially this year with all the craziness ...

Please use the following link to contact Customer Support for further assistance.

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lilcharlesshortt13

New Member

mwong00

New Member

htownprop

New Member

Mohit

Level 3

sozdemirezgi

New Member