- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I just realized I used the wrong amount for my RMD withdrawal on my return that I just filed. How do I change it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just realized I used the wrong amount for my RMD withdrawal on my return that I just filed. How do I change it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just realized I used the wrong amount for my RMD withdrawal on my return that I just filed. How do I change it?

If you already submitted your return, then you will have to wait until your return has been accepted by the IRS and the amended forms are available then you can Amend Your Return

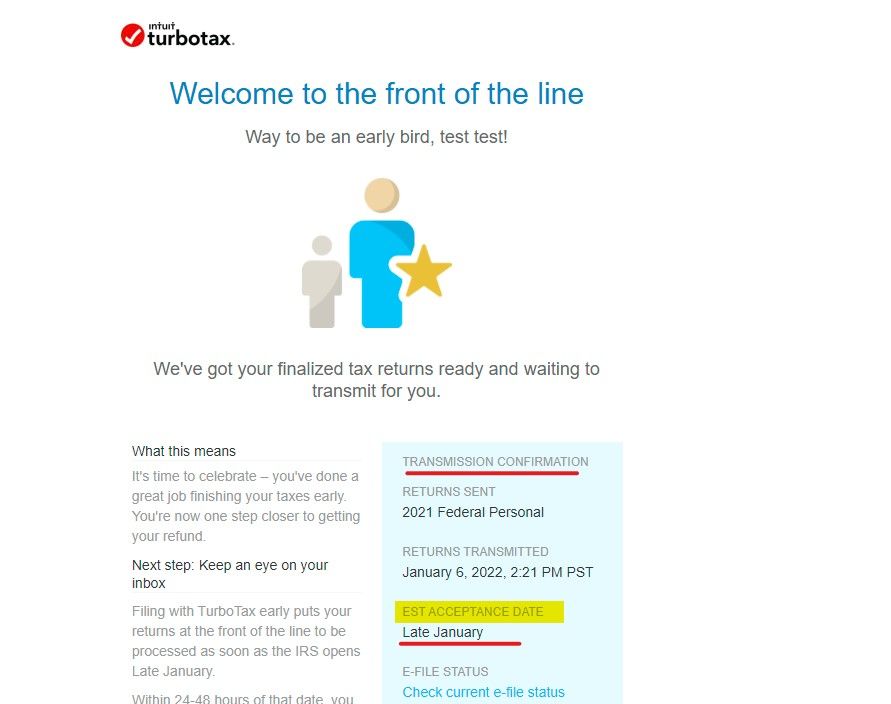

The IRS is not accepting e-file returns yet. If you file or submit your return now, it goes into a "holding tank" until the IRS opens their system to accept the e-filed returns. As of right now, any returns submitted are basically sitting in the post office waiting to be delivered. They are expected to start accepting them the end of January or up to mid February. The exact date has not been announced yet.

Amended forms are generally not available finalized and available until mid- March so, you will need to wait until then if your return is accepted to amend.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just realized I used the wrong amount for my RMD withdrawal on my return that I just filed. How do I change it?

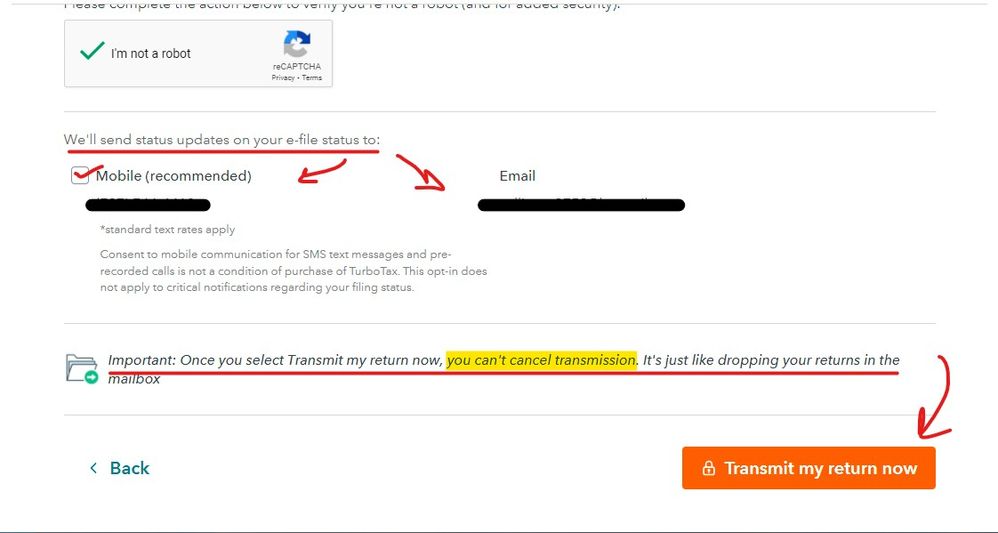

Does anyone actually READ this screen before they file ???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just realized I used the wrong amount for my RMD withdrawal on my return that I just filed. How do I change it?

However, if your filing is rejected for some reason, then you can fix it and resubmit.

(Edited to add]: It's also possible that the IRS will adjust your filing once it receives its copy of the 1099-R.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

inpatel.austin

Returning Member

darylwalker1

Level 3

lynnliying2011

New Member

Raph

Community Manager

in Events

johnmayorga912

New Member