- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I forgot to sign my tax return and it has already been mailed. What will happen?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to sign my tax return and it has already been mailed. What will happen?

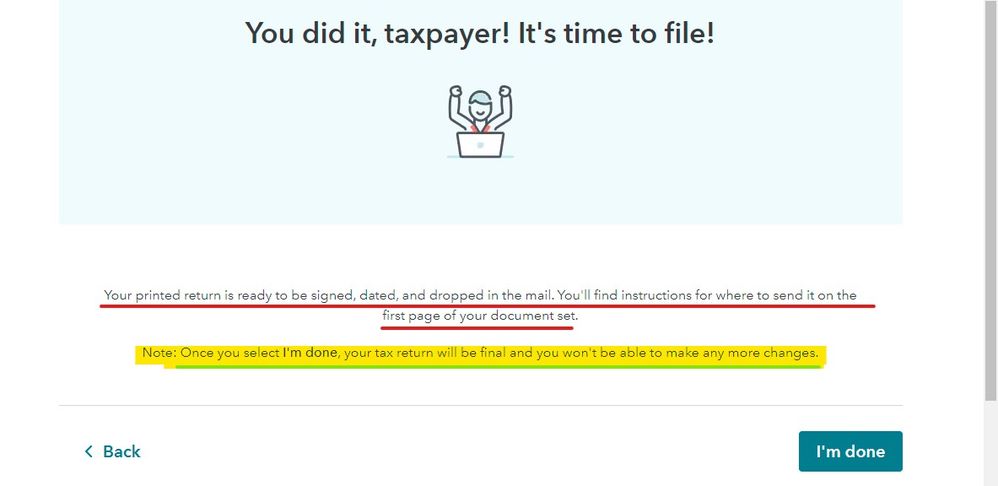

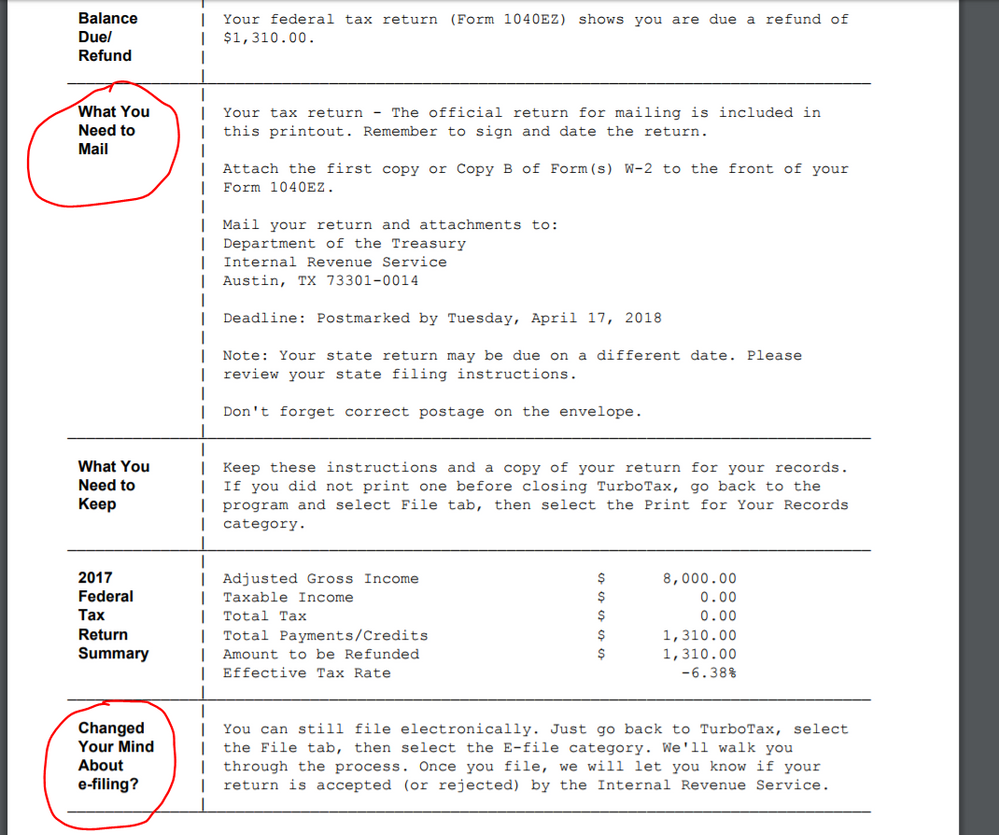

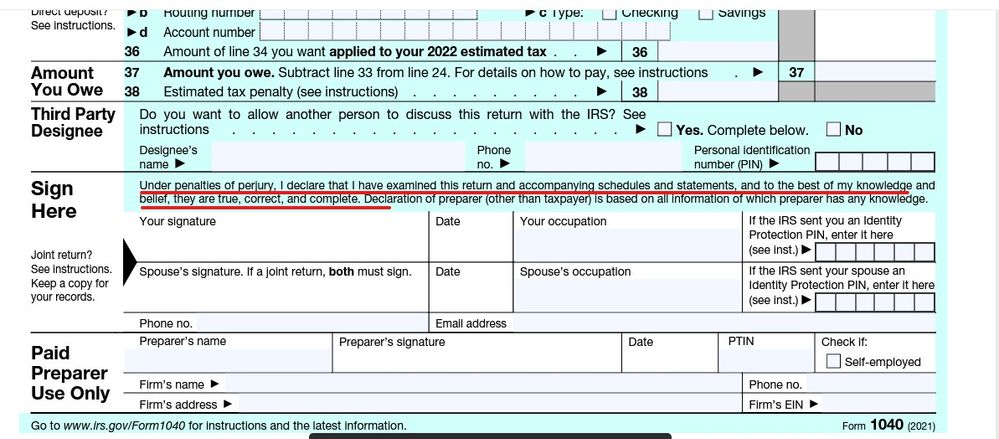

I know it is not in huge neon flashing letters however the instructions are still clearly on the screen and again on the intructions printed with the return ... all you had to do is read them since you are completing your own return using a DIY program. You are responsible for reading all the screens and following all the instructions given. The return is a legal document and they always need a signature on them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to sign my tax return and it has already been mailed. What will happen?

By past experience, the IRS will send you a notice and form requesting that you sign and return it. That process usually took 4-6 weeks, but ever since COVID they are backlogged and those times have greatly increased to 6-9 months.

I would also suggest contacting a live IRS agent.

Call the IRS: 1-800-829-1040 (hours 7 AM - 7 PM) local time Monday-Friday

Click this link for more info from the IRS on Unsigned Returns

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to sign my tax return and it has already been mailed. What will happen?

I forgot to sign my return. I'm not sure how to edit so I can sign it. How much longer will it take to receive my return after I do that ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to sign my tax return and it has already been mailed. What will happen?

You can't e-file without signing, so did you print and mail the return in without signing?

@princkat3

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

slamny

Level 3

invisiblevetslimited

New Member

jco1717

New Member

SGL1

New Member

kraftdarin

New Member