- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I accidentally marked "someone can claim" me as a dependent but no one did.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

does this mean we can still amend a 2018 return since that’s the one they were looking at for stimulus checks? like amend that we cannot be claimed as a dependent so there’s still a possibility to get the stimulus before 2020 taxes are filed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Ok ... since amended returns will take 4 to 6 months to process amending a 2018 return this late in 2020 is a waste of time ... just wait for the credit on the 2020 return you will file in 4 months.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Filed amendment to irs back in May, to verify I cannot be claimed as dependent after I accidentally marked it when I filed, will they look at it or should I call them ? It still says I will not receive stimulus check

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

@Softballmomma13 Do not get your hopes up that amending will result in a stimulus check this year. The reality is that it is taking a VERY long time for the IRS to process amended returns. The "normal" four months is taking a lot longer. If you cannot get the stimulus money this year, if you are not someone else's dependent for 2020 you can get the stimulus money on your 2020 return that you will file in 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Hello, my partner accidentally marked "someone can claim" me as a dependent but no one did. I did call the IRS and they told me to just file in 2021, the issue is that I have no income. How is that going to work? From what I have read online the IRS will reject the filing as it will appear as an empty tax return. I was wondering if someone can help me and others with what needs to be done.

Will the IRS have another non-filer system for 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

@Dvega22 wrote:

Hello, my partner accidentally marked "someone can claim" me as a dependent but no one did. I did call the IRS and they told me to just file in 2021, the issue is that I have no income. How is that going to work? From what I have read online the IRS will reject the filing as it will appear as an empty tax return. I was wondering if someone can help me and others with what needs to be done.

Will the IRS have another non-filer system for 2021.

You can file the 2020 tax return and if you are eligible receive the Recovery Rebate Credit (stimulus payment) on the federal tax return Form1040 Line 30.

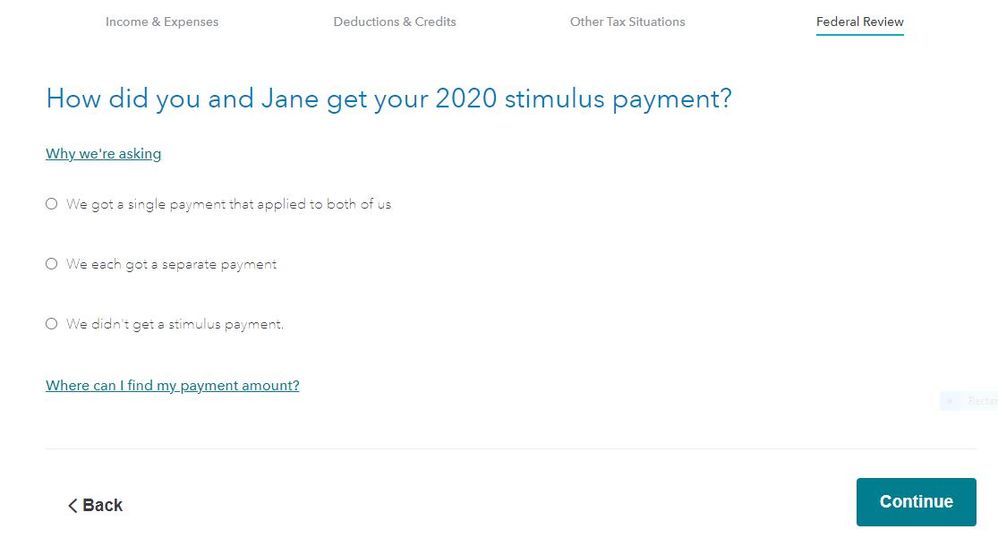

In the Federal Review section of the TurboTax program you are asked about the stimulus payment received in 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

@Dvega22 - suggest using the free version; no need to pay for a tax return when there is no income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

There is no need for a non filer program this year since there will be a refundable credit on the return to allow efiling the return. This will avoid the mess that happened last year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

I'm in the same boat and put that I could be claimed as a dependent, but my mother did not end up claiming me. My question is, what was I supposed to click in that section if none of the boxes pertained to me? The boxes are "someone can claim: you as a dependent, your spouse as a dependent, spouse itemizes on a separate return or you were a dual-status alien". None of those pertain to me, if I go through amending my 2020 returns, are you allowed to just leave it blank?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Yes, you would leave the question blank, or say, "no, noone can claim me as a dependent."

Please know, however, that for the third stimulus, dependents are eligible for an economic recovery payment. This was not the case for the first and second stimulus payments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Thank you so much for your response!

I am aware that adult dependents receive the stimulus this time around, but in my special circumstance, my mother makes above the threshold, so she does not receive one. But since I am living on my own, the stimulus is imperative to my situation!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

@ReneeM7122 - can we please re-address your response?

the issue is CAN the mother claim @bgrperez ? the issue is not was he claimed? see the difference?

the situations is clear, if the mother makes above the threshold, she is not eligible for the stimulus and the dependent child who CAN be claimed wouldn't be eligible either. The child must click the box the they CAN be claimed by someone else.

The taxpayer has the option to claim or not claim a dependent, but that doesn't change the answer from the dependent's perspective, CAN they be claimed? it's always the same response, regardless of what the parent decides to do,.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

Ok so I marked I could be claimed as a dependent on my 2019 taxes. What I had to do, was amend me 2019 taxes.. and only thing I changed was the box that indicated I could be claimed.. when I filed 2020 taxes, I did the recovery rebate credit and I received the 2 stimulus I missed on my taxes for 2020. Since I amended 2019.. I made sure that when I filed for 2020 that I would be sure the box being claimed as a dependent was not selected and now I’m good. Hope that helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

@sc921a

This helps a lot! Because I was wondering if then I would receive the 2021 stimulus sometime this year or if I’m going to have to do the recovery rebate for my 2021 taxes next year to get it. Thank you for your input!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally marked "someone can claim" me as a dependent but no one did.

@NCperson

From earlier comments that I read, my understanding was if the child makes over $4,100 in a year and doesn’t live under the parents for over 6 months in the past year (either physically living with them or parents monetarily paying for their living) Then the parent CANNOT claim the dependent. Under that definition then I cannot be claimed by my mom. So for 2020 taxes my mother cannot claim me and did not claim me, so I messed up on my end, because I thought parents could technically claim you until your 26 regardless of the child’s life circumstance.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lord_Tasho

Returning Member

mle4

Level 2

flagflingr

New Member

inpatel.austin

Returning Member

AJH4

New Member