- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Fraudulent Charges by Intuit/Turbo Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fraudulent Charges by Intuit/Turbo Tax

You have to understand there is no such thing as a "company" anymore, only invisible likely equity traders and call centers therefore there is of course no one to help us when we are charged fraudulently by Inuit and Turbotax because there is no real company. It's all contracted out. Look at all those platforms listed. This is an octopus, an amoeba, arms all over and no one talking to anyone, no one in charge...by design. This is the definition of a "company" in America now. It has gotten terrible. I am one of those people that used the "free" version then after a whole day was extorted into paying for the "Premium" service to file my taxes. I paid it but this was months ago and now I see the charge again on my account. Of course, in trying to get a hold of anyone in the "company" or on this site, there is no way to report it TO THEM. BY DESIGN. But we can play hardball too. I am reporting this fraud to my State Attorney General's Office. To my State Dept of Corporations. SEC and the IRS so they know this sht is going on and anywhere I can find. I got a call from a local news station because this isn't the first they have heard about this with Turbotax/Intuit. I've just had it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fraudulent Charges by Intuit/Turbo Tax

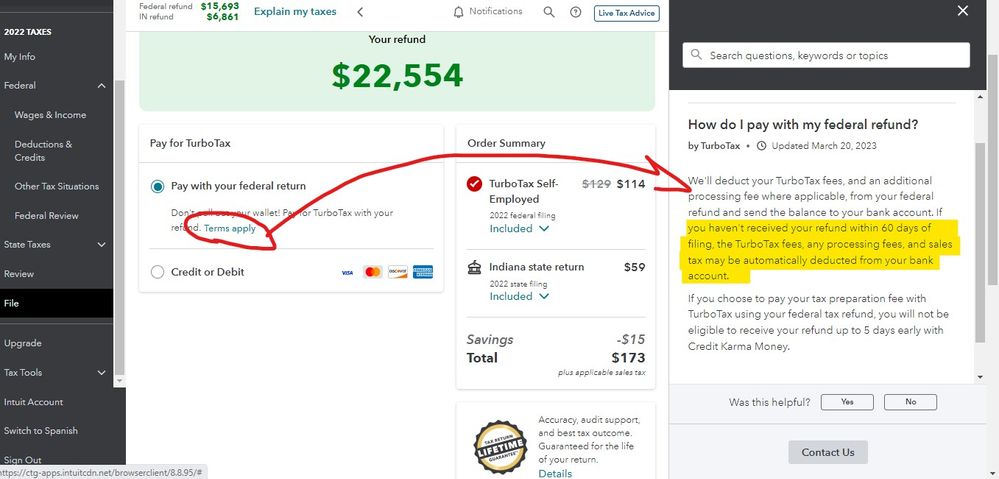

If you entered income or information that went beyond the very simple return supported by the Free Edition, that is why you ended up in a paid version of the software. Then....did you choose to pay your fees from your federal refund? If so, you signed an agreement saying that if the IRS took too long to issue your refund, the fees could be deducted from your account. Is that why you have the misunderstanding that you paid twice? Do you actually see TurboTax fees being charged twice in your bank or credit card account?

No one in the user forum can resolve a billing issue. If you have a question about your TurboTax fees or billing, make sure you use the word “billing” in your request for help. Do not use the word “refund.”

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

When you choose "refund processing" TurboTax gets its fees when the IRS releases your refund. Your refund goes to the third party bank. The bank takes out your fees and then that bank sends the rest of the refund to you. BUT-----if it takes too long for the IRS to issue your refund, or if the IRS seizes your refund for some reason, the fees are deducted from your bank or credit card account.

How can I see my TurboTax fees?

https://ttlc.intuit.com/questions/2565973-how-do-i-review-my-fees-in-turbotax-online

What is Refund Processing Service?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fraudulent Charges by Intuit/Turbo Tax

WHY DO I HAVE TO PAY? I WANT THE FREE EDITION

The information that you can enter in Free Edition is pretty limited now. Thanks to the new tax laws that began for 2018 returns, there are no more simple Form 1040EZ or 1040A's. Everything goes on a Form 1040 that has three extra "schedules" with it, and if you need any of those schedules, you are not able to use the Free Edition. Using the standard deduction instead of itemizing does NOT mean you will not need any of those schedules.https://ttlc.intuit.com/questions/4511011-what-happened-to-the-1040a-and-1040ez If you started in the Free Edition and entered any data that required any of those three schedules, you have to upgrade to a paid version and if you are watching the screens carefully you are alerted to the upgrade.

When you chose to “start” in the Free Edition —

Directly below the words “Free Edition” there is a blue link that says “For simple tax returns only” If you click that link it brings up this information:

You can file with TurboTax Free Edition if you have a simple tax return.*

*A simple tax return is Form 1040 only.

Situations covered in TurboTax Free Edition include:

- W-2 income

- Limited interest and dividend income reported on a 1099-INT or 1099-DIV

- Claiming the standard deduction

- Earned Income Tax Credit (EIC)

- Child tax credits

- Student Loan Interest deduction

Situations not covered in TurboTax Free Edition include:

- Itemized deductions

- Unemployment income reported on a 1099-G

- Business or 1099-NEC income

- Stock sales

- Rental property income

- Credits, deductions and income reported on schedules 1-3

How does TurboTax make any money?

Customers with more complex tax situations will file with our paid TurboTax products that provide all the additional forms and guidance they need. We also offer additional benefits that go beyond filing your taxes, but they are optional and are not required to file simple taxes for free. We hope that, over time, as our customers with simple returns need more capabilities as their financial situations change (for example owning a home, having a child, managing investments), they have loved our products and services so much that they will choose our paid TurboTax offerings to prepare and file their returns.

Or—-Use this IRS site for other ways to file for free. There are 8 free software versions available from the IRS Free File site

https://apps.irs.gov/app/freeFile/

How can I see my TurboTax fees?

https://ttlc.intuit.com/questions/2565973-how-do-i-review-my-fees-in-turbotax-online

If your TurboTax fees are higher than expected, you can reduce them by removing add-ons:

- Remove Premium Services

- Remove MAX Defend & Restore

- Remove a state

- Remove PLUS Help & Support

- Remove Pay With Your Refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fraudulent Charges by Intuit/Turbo Tax

1. Yes, paid fees out of refund IN FEBRUARY. This charge just showed up in the past two days. Let me tell ya, this is so common, there is an OPTION when you call the general # to talk to someone about AN OVERCHARGE. It's an OPTION on the call. If it's one of the OPTIONS, gosh, maybe it's because this has happened to so many people. Maybe fix it? I know, crazy. See original comment. Nobody's in charge, by design.

2. Didn't find out I would have to pay to file until 3/4 of the way through and had to pay for highest service levels to the tune of over $200. This is deception and extortion. I had already entered all the information, spent the whole day. C'mon, you folks know the game...otherwise you would not wait to tack it on AT THE END of the process. It's deceptive tactics and really low. IRS has already published extensively on this but going to report it anyway. Nothing's changed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fraudulent Charges by Intuit/Turbo Tax

Did you get your refund yet (minus the fees)?

If the IRS is taking too long to send your refund you still have to pay the fees after a certain time. Or maybe the IRS adjusted your return and it wasn't big enough to cover the fees.

See What if the IRS reduces your refund or delays it.

Then when the IRS does send your refund they won't take the fees out again.

And, Why you got charged,

You should have received about 4 emails asking for the fees. If you don't pay they will debit your account. You had to agree to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fraudulent Charges by Intuit/Turbo Tax

If you e-filed in February and made the choice to pay from your refund, the only thing you did in February was e-file and make that choice. TurboTax did not receive the money for its fees in February. TurboTax was supposed to get its fees when the IRS actually issued your refund.

When you chose to pay from your refund, you also agreed that if your refund was delayed, after a certain amount of time, TurboTax could take its fees from your account. TurboTax has waited since you e-filed in February for the IRS to issue your refund. If your refund still has not been issued, TT finally took its fees from your account. You would have received several emails alerting you to the withdrawal of those fees from your account.

When/if you receive your refund, the fees will not be deducted a second time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fraudulent Charges by Intuit/Turbo Tax

And...once you file your tax return, only the IRS is in control of issuing your refund. If your refund is delayed, then only the IRS can tell you why. You may want to look on the IRS site to see if there are any notes or messages about your refund. Have you received a request to verify your identity? Or have you received a message saying your return is under review?

Once your federal return has been accepted by the IRS, only the IRS has any control. TurboTax does not receive any updates from the IRS. Your ONLY source of information about your refund now is the IRS.

You need your filing status, your Social Security number and the exact amount (line 35a of your 2022 Form 1040) of your federal refund to track your Federal refund:

To call the IRS:IRS: 800-829-1040 hours 7 AM - 7 PM local time Mon-Fri

Listen to each menu before making the selection.

First choose your language. Press 1 for English.

Then do NOT choose the first choice re: "Refund", or it will send you to an automated phone line.

Instead, press 2 for "personal income tax".

Then press 1 for "form, tax history, or payment".

Then press 3 "for all other questions."

Then press 2 "for all other questions." It should then transfer you to an agent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fraudulent Charges by Intuit/Turbo Tax

If you see a fee and pay it, you are considered to be satisfied with the service.

You had the option to drop TurboTax at any time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fraudulent Charges by Intuit/Turbo Tax

The contract you signed tells you what will happen if things are delayed ... here is the FAQ from the option page :

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jast64068

Returning Member

DevB

New Member

NoneOfYourBusiness3

New Member

snugglybear

Returning Member

snugglybear

Returning Member