in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Found information digging deep into my Turbotax account last night!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Found information digging deep into my Turbotax account last night!

Unemployment tax refund

*I hope this might help others*

I received and extra refund check in the mail 2 months ago from my state and no it was not a Stimulus check It was an actual state refund. I filed my taxes back in Feb before the law went into effect. I did received fed and state tax then next mont in March... so I ended up paying fed taxes on the 10,200. I only got the extra state tax refund because of a dependent so the state owned me more child income tax... if that is the case does not seem like I'm getting Unemployment refund from fed. My transcript has not change since July. Which the last change was only 290 $0 owed but my income changed on my Transcript, the 10,200 was taken off.... Also adjusted in a very hard area to find in Turboxtax.

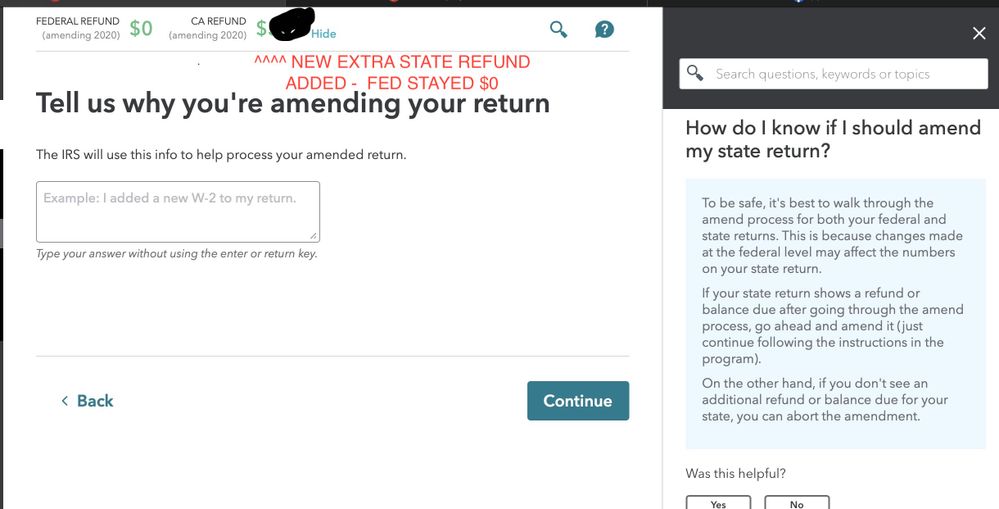

If I act like I'm going to amend (even though I'm not fully going through with it) my state changes to the extra refund I did receive my fed stays at $0. With the original fed Refund amount but state shows the new total with my first state Refund amount and the added amended Refund amount. ***LET ME BE CLEAR ALSO*** I did not amend my return , this happened on it own. NOR AM I AT ALL SAYING THIS IS ANYONE ELSES SITUATION. JUST THOUGHT I WOULD SHARE MY NEWS. I can’t seem to find when this updated in turboxtax either. Hope this makes since. See photos below (none of my sensitive information is exposed).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Found information digging deep into my Turbotax account last night!

It is possible that the exclusion of the unemployment does not change your federal refund especially if you used the 2019 earned income to compute the EIC or CTC. Take a look at the actual return ... if the amount on line 24 of the 1040 is already zero then there is nothing to get by amending.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Found information digging deep into my Turbotax account last night!

I did, I went all the way to the end of acting like I was amending. Turboxtax said it was better to go off of 2019. I did check and 1040 line 24 is $0. I'm just glad there is no more wondering and waiting....

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

TheHolyHolden

New Member

HollyP

Employee Tax Expert

lukethe4th

Returning Member

user17619471540

New Member