- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Confirmation of 2019 Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

Can you please confirm that my 2019 taxes have ben completed and filed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

Sounds like you didn't finish filing. Just paying the fees does not file the return. You had to continue on and hit the big orange Transmit Returns Now button. Then you would get 2 more emails saying it was Transmitted and another email saying if it was Accepted or Rejected.

You have to print it out and mail it now. Or finish it and mail.

How to finish a prior year online return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

Did you go all the way through the File tab, through the 3 steps and hit the big orange Transmit Returns Now button?

You can check your efile status here

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

When you efile you get back 2 emails. The first email only confirms the transmission. The second email says if the IRS (or state) Accepted or Rejected your efile.

When you log into your account you should also see the status and if it was Accepted or Rejected, Started, Printed, Ready to Mail, etc. What does it say?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

This is why I'm confused. I received an email stating and showing I paid for the services. When I go to your link you provided, it says in a blue button "Complete a 2019 Return"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

Sounds like you didn't finish filing. Just paying the fees does not file the return. You had to continue on and hit the big orange Transmit Returns Now button. Then you would get 2 more emails saying it was Transmitted and another email saying if it was Accepted or Rejected.

You have to print it out and mail it now. Or finish it and mail.

How to finish a prior year online return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

I have both federal and state returns. Am I going to be penalized now? Or will I be ok if I print and send in mail. Also do I have to purchase more from turbo tax in order to do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

You can print, sign, date and mail the tax returns. Include with the returns any W-2's and Form 1099's which have taxes withheld.

There are no penalties for filing after the due date if no taxes are owed or you are receiving a tax refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

You can finish using desktop software. If you already paid your Online TurboTax fees you can get a download from customer support for free.

To call TurboTax customer support

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

They are available from 5 a.m. to 5 p.m. Pacific time Monday-Friday

https://ttlc.intuit.com/questions/1900990-how-do-i-file-a-prior-year-tax-return

Note: The desktop software you need to prepare the prior year return must be installed/downloaded to a full PC or Mac. It cannot be used on a mobile device.

If you are getting a refund, there is not a penalty for filing past the deadline. If you owe taxes, the interest/penalties will be calculated by the IRS based on how much you owe and when they receive your return and payment. The IRS will bill you for this; it will not be calculated by TurboTax.

So you don't need to start over from scratch ... download the .taxfile from the online system now so you can open it in the downloaded program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

It says it was rejected and I can't figure out why

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

i need to print a copy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

@firedragon7576 wrote:

i need to print a copy

You have to sign onto your 2019 online account using the exact same User ID you used to create the online account.

Close all TurboTax windows on your web browser (including this one). Copy and paste the account recovery website link onto a new web browser window and run the tool.

Use this TurboTax account recovery website to get a list of all the User ID's for an email address. Run the tool against any email addresses you may have used - https://myturbotax.intuit.com/account-recovery

If none of the user ID's received will access your 2019 account, then use the option shown in blue on the account recovery website, "Try something else"

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

To access your prior year tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

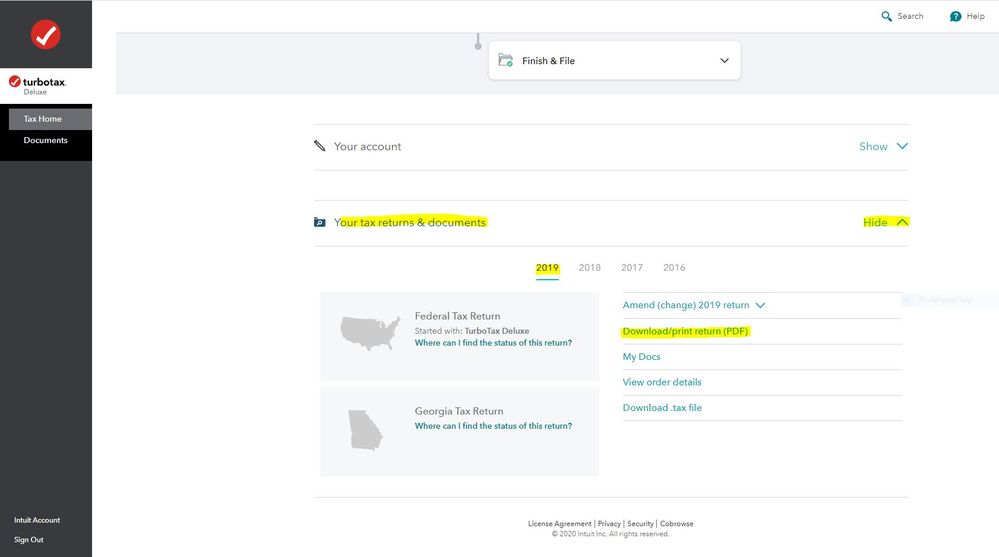

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

OR -

You may have to start a 2020 tax return before the links on the Tax Home web page become available. In that case start the 2020 tax return with the User ID you used for the 2019 return. Once some basic information has been transferred over, Tax Home should be visible on the left column. Click on Tax Home and then the other links will be shown as in this screenshot.

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

I had to pay a tax accountant to help me get my taxes completed. I feel turbo tax service was misleading and I needed to file a completely different way then suggested by turbo tax. Not to mention I was under the impression the taxes were filed. Lack of communication was slow and unclear. I’m asking politely for a full refund for a service that wasn’t complete and I had to pay for somewhere else. Please relay information on how to do this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

Doubt you will get any satisfaction ... there is no refunds on the Online program ever and the downloaded/cd version only has a 60 day refund policy... but you can call TT support and see ...

To contact TurboTax customer service/support use their contact website during business hours. If the problem concerns any type of refund for fees, use the key words billing issues and do Not use the word Refund or you will get a phone number for tax refunds.

Use this website to contact TurboTax support for this situation:

https://support.turbotax.intuit.com/contact/

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

I completed my 2019 taxes but I didn't send them to be processed i have all of my info done on turbotax site how get to screen to completed the process.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

@binnsvera wrote:

I completed my 2019 taxes but I didn't send them to be processed i have all of my info done on turbotax site how get to screen to completed the process.

To access your current or prior year tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

A 2019 tax return can only be printed and mailed, it cannot be e-filed.

Print, sign, date and mail the tax return to the IRS. Include with the mailed return any forms W-2 and 1099 which have taxes withheld. Go to this IRS website for mailing addresses - https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment

There are no penalties for filing a tax return after the due date if filing for a tax refund or there are no taxes owed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confirmation of 2019 Taxes

Have not filed taxes in several years due to low income.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

richardburch14

New Member

jayhidayanto

New Member

franderpolido

New Member

josh

New Member

Wheelerhou

New Member