- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Changing IRS Payment Date

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing IRS Payment Date

How do I change the date my IRS tax due will be debited from my checking account? When I filed, the due date was April 15 and now has been extended to May 17. Don't want to pay any earlier than necessary.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing IRS Payment Date

TO CANCEL A TAX PAYMENT YOU SCHEDULED

If your return was accepted, you cannot change your payment method or payment date. The only thing you can do is cancel the payment and then pay by a different method on your own.

- Call IRS e-file Payment Services 24/7 at 1-888-353-4537 to ask about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling.

- Cancellation requests must be received no later than 11:59 p.m. ET two business days prior to the scheduled payment date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing IRS Payment Date

My question exactly. Thank you for answering.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing IRS Payment Date

It's complicated! From the IRS site, I learned about the EFTPS payment system, which, however, Turbo Tax does not use when paying taxes through Turbo Tax. Getting verified and access to that site takes about one week including receiving a PIN and access code! When on the EFTPS site, an agent there (via phone) is able to access your scheduled payment through the IRS site and cancel that payment for you. After the Turbo Tax originally scheduled payment is cancelled, you may then schedule a payment on the EFTPS site. You cannot automatically cancel the original scheduled payment yourself on the EFTPS site because that vehicle is not used by Turbo Tax. I don't know which pay system Turbo Tax uses, or why they cannot arrange a change-date through their system.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing IRS Payment Date

@cwlfal891 wrote:

It's complicated! From the IRS site, I learned about the EFTPS payment system, which, however, Turbo Tax does not use when paying taxes through Turbo Tax. Getting verified and access to that site takes about one week including receiving a PIN and access code! When on the EFTPS site, an agent there (via phone) is able to access your scheduled payment through the IRS site and cancel that payment for you. After the Turbo Tax originally scheduled payment is cancelled, you may then schedule a payment on the EFTPS site. You cannot automatically cancel the original scheduled payment yourself on the EFTPS site because that vehicle is not used by Turbo Tax. I don't know which pay system Turbo Tax uses, or why they cannot arrange a change-date through their system.

TurboTax sends the bank routing number and account number for direct debit of federal taxes owed with the federal tax return. The IRS debits the account based on the bank information provided and on the date selected.

Go to this IRS website for how to cancel a federal tax payment - https://www.irs.gov/payments/pay-taxes-by-electronic-funds-withdrawal

- Once your return is accepted, information pertaining to your payment, such as account information, payment date, or amount, cannot be changed. If changes are needed, the only option is to cancel the payment and choose another payment method.

- Call IRS e-file Payment Services 24/7 at 1-888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling.

- Cancellation requests must be received no later than 11:59 p.m. ET two business days prior to the scheduled payment date.

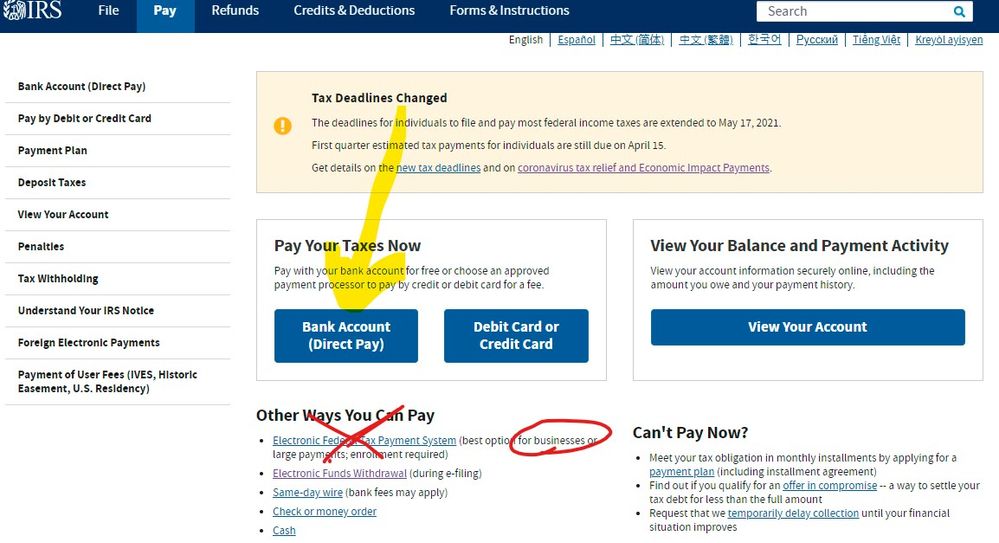

Go to this IRS payment website to make a federal tax payment using Direct Pay - https://www.irs.gov/payments

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing IRS Payment Date

How can I see what I selected as my payment date for both federal and state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing IRS Payment Date

@chilton57 wrote:

How can I see what I selected as my payment date for both federal and state?

Look at the Federal Filing Instructions page and the State Filing Instructions page for how you chose to pay the taxes owed and the date of payment.

To access your current or prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

When you sign onto your online account and land on the Tax Home web page, scroll down and click on Add a state.

This will take you back to the 2020 online tax return.

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year's return. Choose the option Include government and TurboTax worksheets

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing IRS Payment Date

The site you signed up for is used for businesses ... for individuals you use this site:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

figueroalizzy

New Member

matt1235

Level 2

user17691990447

Level 1

Joshva8609

New Member

bbarczykowski

New Member