- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- More info.....it depends: Be careful....many currently re...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

More info.....it depends:

Be careful....many currently retiring NC-State/Federal/Military people find out they are not eligible for the NC-exemption of those pension $$. A person retiring in 2015 found they would need more than ~30 years of service before they could get that exemption.

As long as you had 5 years of service credited before 12 Aug of 1989...then you would qualify for the "Bailey Settlement" .

The procedure is the same in TurboTax every year, so (perhaps) print this out for next year and file it.

____________________________________________________

IF..you still qualify

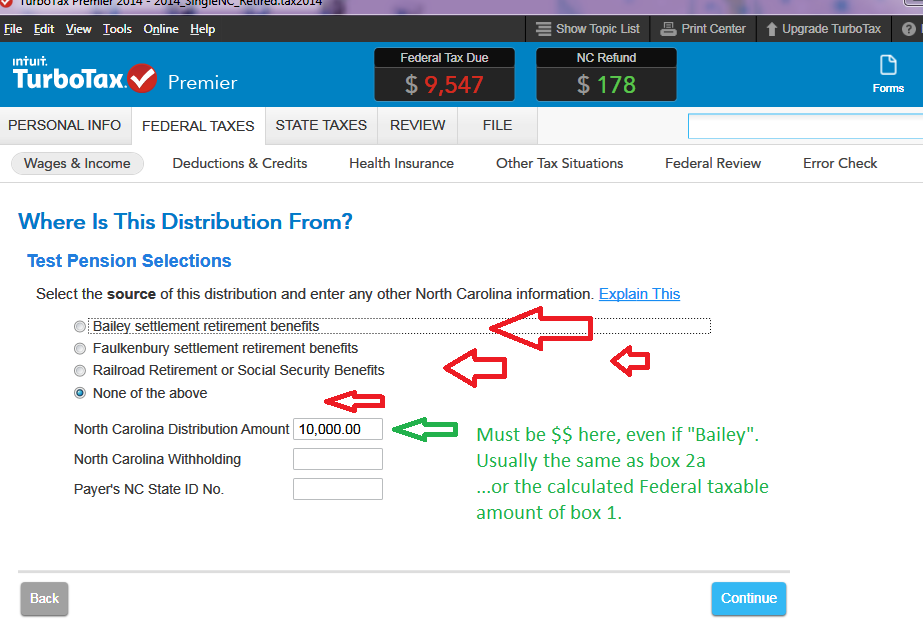

Go back and edit the 1099-R form in the Federal section.

After you enter your 1099-R form, and "Continue" thru the pages that follow it...until you find the selections for:

1) "Bailey settlement...."....................<<<<you are selecting this one

2) "Faulkenbury settlement...."

3) "Railroad Ret-SS.........."

4) "None of the above"

You need to select the "Bailey Settlement..."

Your NC Distribution Amount is the same a box 2a of the 1099-R form (or the calculated federally-taxable amount from box 1, if 2a is empty)....... that same $$ will be removed in the NC section depending on what selection you made above.

(Picture Below)

.....Far fewer retired Military/Fed/NCStateMunicipalTeacher employees can exempt their Pension $$ if they retired this year. BUT...IF you were into your NC-State or Federal/Military pension system, 5 years as of 12 Aug 1989, you can choose the "Bailey Settlement..." and all of that particular 1099-R will be exempted from NC taxation...otherwise you will likely choose "None of the above"

So that 5-years employment/service by 12 Aug 1989 is critical

.......if you weren't employed by the NC or Federal Gov't body early enough to meet that deadline...then your Pension distribution is not exempt from NC taxation

____________________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

More info.....it depends:

Be careful....many currently retiring NC-State/Federal/Military people find out they are not eligible for the NC-exemption of those pension $$. A person retiring in 2015 found they would need more than ~30 years of service before they could get that exemption.

As long as you had 5 years of service credited before 12 Aug of 1989...then you would qualify for the "Bailey Settlement" .

The procedure is the same in TurboTax every year, so (perhaps) print this out for next year and file it.

____________________________________________________

IF..you still qualify

Go back and edit the 1099-R form in the Federal section.

After you enter your 1099-R form, and "Continue" thru the pages that follow it...until you find the selections for:

1) "Bailey settlement...."....................<<<<you are selecting this one

2) "Faulkenbury settlement...."

3) "Railroad Ret-SS.........."

4) "None of the above"

You need to select the "Bailey Settlement..."

Your NC Distribution Amount is the same a box 2a of the 1099-R form (or the calculated federally-taxable amount from box 1, if 2a is empty)....... that same $$ will be removed in the NC section depending on what selection you made above.

(Picture Below)

.....Far fewer retired Military/Fed/NCStateMunicipalTeacher employees can exempt their Pension $$ if they retired this year. BUT...IF you were into your NC-State or Federal/Military pension system, 5 years as of 12 Aug 1989, you can choose the "Bailey Settlement..." and all of that particular 1099-R will be exempted from NC taxation...otherwise you will likely choose "None of the above"

So that 5-years employment/service by 12 Aug 1989 is critical

.......if you weren't employed by the NC or Federal Gov't body early enough to meet that deadline...then your Pension distribution is not exempt from NC taxation

____________________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

So that 5-years employment/service by 12 Aug 1989 is critical

.......if you weren't employed by the NC or Federal Gov't body early enough to meet that deadline...then your Pension distribution is not exempt from NC taxation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

Does the Bailey agreement apply if my service was reserve not active duty?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

Yes, The exclusion applies to retirement benefits received from certain defined benefit plans, such as the Federal Employees' Retirement System, or the United States Civil Service Retirement System, if the retiree had five or more years of creditable service as of August 12, 1989. See Bailey Decision Concerning Federal, State and Local Retirement Benefits for further details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

What about the Thrift Savings Plan? An employee is vested on the employee's portion as soon as they make a deposit to the TSP. NCDOR directive PD-99-2 when discussing vested seems to address this. Similar to the states employee component of the 401 and 457 plans.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

Federal Thrift Savings does qualify under certain conditions.

- Yes, an employee is vested on the employee's portion as soon as they make a deposit into TSP, which for the settlement needs to be prior to 8/12/1989.

- The Court ruled that an employee who is vested in the employee component of the plan is also vested in the employer component for "matching contributions".

- The Court further ruled that an employee is vested in the "employer fixed percentage component" only if the employee had three years of service (two years of service for certain highly ranked employees) as of August 12, 1989.

For other situations refer to the applicable language from NC DOR directive PD-99-2 supplemented 26 Mar 1999 and dated 5 Nov 1999.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

So if an employee began depositing to the Thrift Savings Plan in July 1988, what portion if any of withdrawals from the TSP are exempt? How is this entered in TurboTax since the prompts seem to be all or nothing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

If the employee began depositing in July 1988, then the employee is vested in the employee portion. If the employer contributed matching funds, then the employee is fully vested and thus 100% applies to Bailey settlement. If the employer contributed a defined percentage, then the employee did not meet the three year requirement to be fully vested and thus will need to work the math in the link to figure the exclusion.

As you go through the NC interview in TurboTax you will be asked about the Bailey settlement and if you need to adjust, a box is provided to put in the amount of the retirement that should excluded under Bailey.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

If a federal employee began civil service in March 1986 with 4 years of active military duty (for which a military deposit was made to "buy it back") and his/her Service Computation Date was adjusted to February 1982, would that employee's federal retirement income qualify for the "Bailey Exemption" on the NC State tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

I am in this same situation. Did you ever get an answer? I plan to retire in NC and would love to know if I do a buy in to combine retired military and FERS service, will all of it be exempt. My military service began in 1983 and I started my civil service job as soon as I retired from the military.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I qualify for the North Carolina Bailey Settlement adjustment to my military retirement income?

This was very helpful. Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Vasser-andre

New Member

Danielle4543

New Member

jimmyjackpaul

New Member

iamkimiv

New Member

kas2x5

New Member