- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

More info.....it depends:

Be careful....many currently retiring NC-State/Federal/Military people find out they are not eligible for the NC-exemption of those pension $$. A person retiring in 2015 found they would need more than ~30 years of service before they could get that exemption.

As long as you had 5 years of service credited before 12 Aug of 1989...then you would qualify for the "Bailey Settlement" .

The procedure is the same in TurboTax every year, so (perhaps) print this out for next year and file it.

____________________________________________________

IF..you still qualify

Go back and edit the 1099-R form in the Federal section.

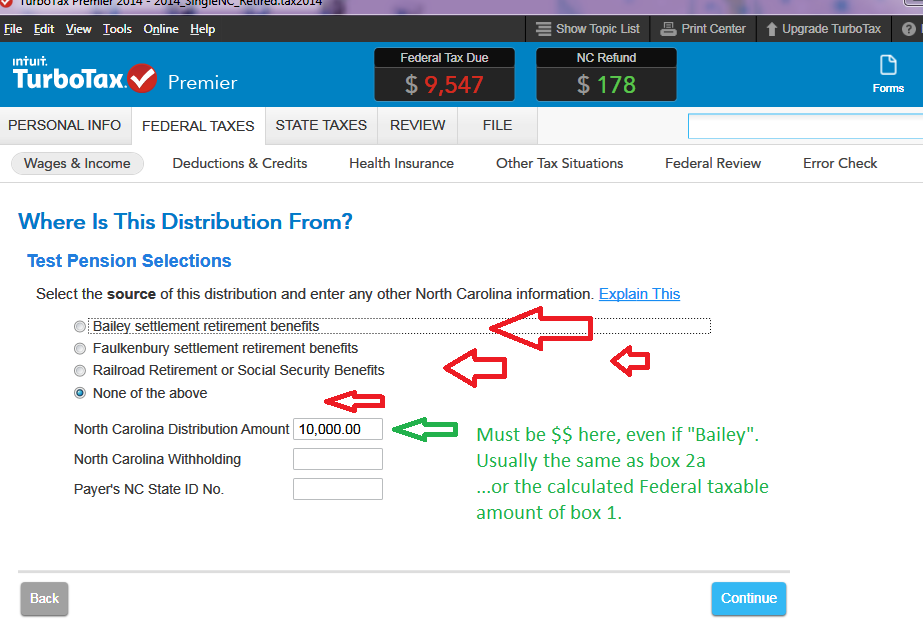

After you enter your 1099-R form, and "Continue" thru the pages that follow it...until you find the selections for:

1) "Bailey settlement...."....................<<<<you are selecting this one

2) "Faulkenbury settlement...."

3) "Railroad Ret-SS.........."

4) "None of the above"

You need to select the "Bailey Settlement..."

Your NC Distribution Amount is the same a box 2a of the 1099-R form (or the calculated federally-taxable amount from box 1, if 2a is empty)....... that same $$ will be removed in the NC section depending on what selection you made above.

(Picture Below)

.....Far fewer retired Military/Fed/NCStateMunicipalTeacher employees can exempt their Pension $$ if they retired this year. BUT...IF you were into your NC-State or Federal/Military pension system, 5 years as of 12 Aug 1989, you can choose the "Bailey Settlement..." and all of that particular 1099-R will be exempted from NC taxation...otherwise you will likely choose "None of the above"

So that 5-years employment/service by 12 Aug 1989 is critical

.......if you weren't employed by the NC or Federal Gov't body early enough to meet that deadline...then your Pension distribution is not exempt from NC taxation

____________________________________________