- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Your dependent filed a return without saying he could be...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My son claimed himself on his taxes but he's my dependent. He's 19 full time student lives at home and pays no bills. How do I correct this? Can I still E file?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My son claimed himself on his taxes but he's my dependent. He's 19 full time student lives at home and pays no bills. How do I correct this? Can I still E file?

Your dependent filed a return without saying he could be claimed on your return and your return was rejected? AFTER his return has been fully processed and he has received his refund, he has to file an amended return that says he can be claimed as a dependent on someone else’s return. Amended returns (form 1040X) have to be printed and mailed. They cannot be e-filed; it takes the IRS a couple of months to process them. Meanwhile, since your e-filed return has been (or will be) rejected, you now have to print and mail it in to the IRS. You will not be able to e-file. Remember that when you mail a return, you need to include copies of your W-2, etc. with your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My son claimed himself on his taxes but he's my dependent. He's 19 full time student lives at home and pays no bills. How do I correct this? Can I still E file?

Your dependent filed a return without saying he could be claimed on your return and your return was rejected? AFTER his return has been fully processed and he has received his refund, he has to file an amended return that says he can be claimed as a dependent on someone else’s return. Amended returns (form 1040X) have to be printed and mailed. They cannot be e-filed; it takes the IRS a couple of months to process them. Meanwhile, since your e-filed return has been (or will be) rejected, you now have to print and mail it in to the IRS. You will not be able to e-file. Remember that when you mail a return, you need to include copies of your W-2, etc. with your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My son claimed himself on his taxes but he's my dependent. He's 19 full time student lives at home and pays no bills. How do I correct this? Can I still E file?

Where on the 1040x is the blank/area where my son will say he is my dependent/someone else can claim him as a dependent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My son claimed himself on his taxes but he's my dependent. He's 19 full time student lives at home and pays no bills. How do I correct this? Can I still E file?

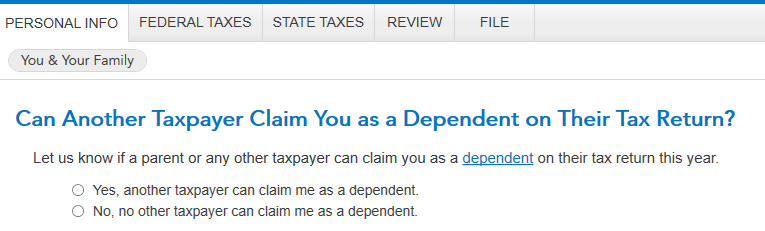

When you amend the return using TurboTax go back into My Info and scroll to the dependent information. It asks the question there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My son claimed himself on his taxes but he's my dependent. He's 19 full time student lives at home and pays no bills. How do I correct this? Can I still E file?

Q. Where on the 1040x is the blank/area where my son will say he is my dependent/someone else can claim him as a dependent?

A. Nowhere on the actual 1040X. You attach a copy of the revised 1040, which will have that box checked. You will include it in Part II Explanation of Changes, on the 1040X.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

golfinforgod

New Member

molina_mark

New Member

jasmika79

New Member

Taxquestioner98

New Member

17694777598

New Member