- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- You will report it before PayPal takes its cut and then y...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from Paypal?

I am self-employed and earned approximately $1,000 from transactions paid by customers via PayPal in 2018. My question is this: When reporting this miscellaneous income on my 1040 tax return, do I enter the income amount before or after Paypal takes its cut?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from Paypal?

You will report it before PayPal takes its cut and then you will report their cut as an expense.

It would be entered under Other Miscellaneous Expenses>>Bank Charges.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from Paypal?

You will report it before PayPal takes its cut and then you will report their cut as an expense.

It would be entered under Other Miscellaneous Expenses>>Bank Charges.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from Paypal?

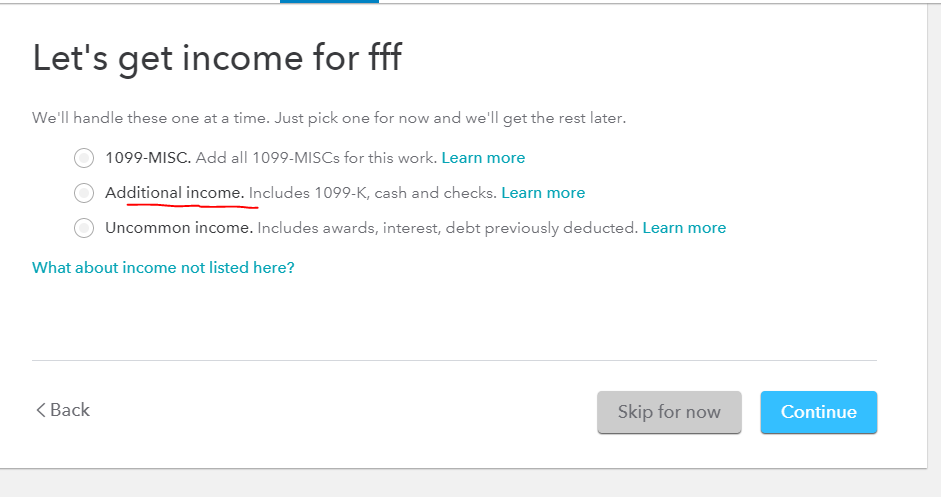

When reporting income coming from PayPal what is it categorized under?

Is it considered a cash payment, a bank payment? Online payment or what?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from Paypal?

If you don't get a 1099Misc or 1099K for it then enter it as Cash

How to enter income from Self Employment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from Paypal?

Great! Thank you so much!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from Paypal?

Follow the interview screens ... go slow and read them carefully ...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shimib

New Member

trancyml

New Member

sassthebat

New Member

Texyman

Level 1

markoo

New Member