- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Will I qualify for both stimulus checks as a credit next year even though my 2019 return had my wife's old itin instead of her new social? paper 1040x still pending.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I qualify for both stimulus checks as a credit next year even though my 2019 return had my wife's old itin instead of her new social? paper 1040x still pending.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I qualify for both stimulus checks as a credit next year even though my 2019 return had my wife's old itin instead of her new social? paper 1040x still pending.

If you did not receive any stimulus payment during 2020, when you file your 2020 federal tax return you should get the Recovery Rebate Credit for you and your spouse.

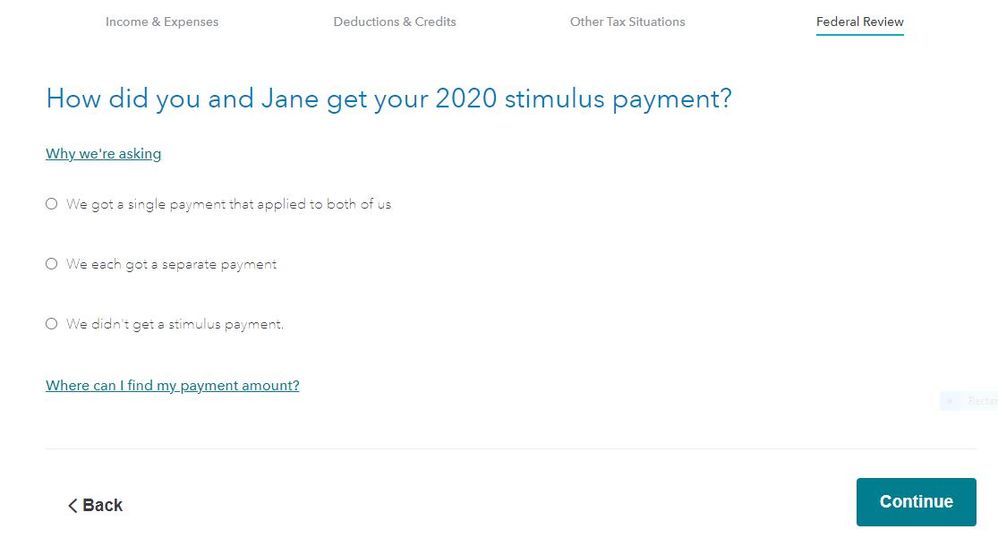

Using TurboTax the program asks about the stimulus in the Federal Review section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I qualify for both stimulus checks as a credit next year even though my 2019 return had my wife's old itin instead of her new social? paper 1040x still pending.

forget about your 2019 return and any amendments.

It is your 2020 tax return that controls.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I qualify for both stimulus checks as a credit next year even though my 2019 return had my wife's old itin instead of her new social? paper 1040x still pending.

yes, you are eligible for both stimulus payments and should see the credit on Line 30 of Form 1040

as a separate note, joint returns were ineligible for the 1st stimulus payment if one of the spouses only had an ITIN.

the new tax law that Congress passed yesterday, changes that rule retroactive to the 1st stimulus payment. Now on a joint return, if one of the spouses only has the ITIN, the other spouse and the children remain eligible for the stimulus payment. The spouse with the ITIN remains ineligible, but it no longer causes the rest of the family to be ineligible. It's premature for the IRS to provide guidance on how this will be adjusted on the 2020 return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ladybulldawg1221

New Member

roybnikkih

New Member

drbdvm81

New Member

Kuehnertbridget

New Member

yiovani22

New Member