- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why is turbo tax considering my state and city refunds from 2019 and 2020 paid in 2022 taxable? I filed the standard deduction in 2019-2022. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbo tax considering my state and city refunds from 2019 and 2020 paid in 2022 taxable? I filed the standard deduction in 2019-2022. Thanks.

Based on what you told us, you won't pay taxes on your refunds from 2021. That's more money in your pocket."

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbo tax considering my state and city refunds from 2019 and 2020 paid in 2022 taxable? I filed the standard deduction in 2019-2022. Thanks.

Please explain what you are seeing that makes you think the state refunds are being taxed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbo tax considering my state and city refunds from 2019 and 2020 paid in 2022 taxable? I filed the standard deduction in 2019-2022. Thanks.

Thank you.

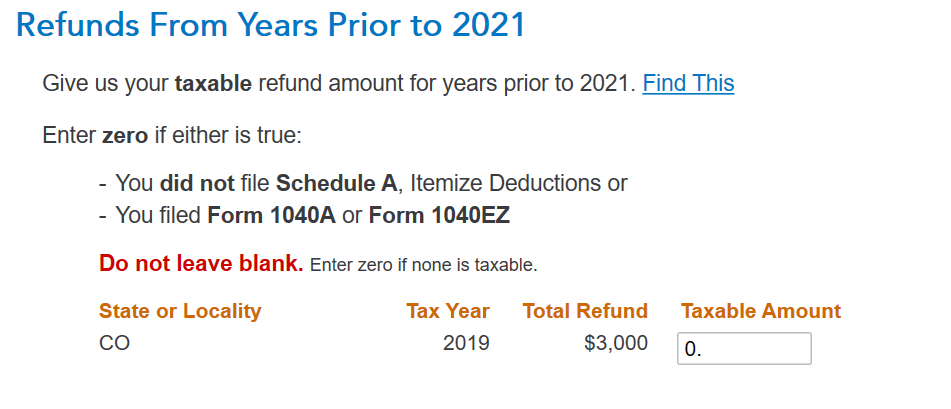

I filed using TurboTax. They used the schedule 1 Line 1 worksheet. The refunds paid in 2022 that were related to 2019 and 2020 state and city taxes are reflected in line 14 (taxable refunds) of that worksheet and thus entered on Schedule 1 line 1 and taxable income. I know I have used the standard deduction since at least 2018. Just can't think of anything. I called turbotax and although they listened and tried to help, they said I would have to upgrade my subscription for live help. What concerns me is that the turbotax site didn't ask if 2019 or 2020 I itemized. It only asked if I did in 2021. When I completed that section, it also said something like, "your refunds are not taxable!" so I didn't realize the 2019 and 2020 refunds paid in 2022 were taxed until seeing the return after paying turbotax. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbo tax considering my state and city refunds from 2019 and 2020 paid in 2022 taxable? I filed the standard deduction in 2019-2022. Thanks.

FOLLOW UP for others benefit. I spoke with turbotax. By the end of the call the representative (accountant) and I concluded that there should have been a question on the website when doing my taxes if I used a standard deduction for 2019 and 2020. That question was asked for about the refund from the 2021 tax year, but not the 2019 or 2020 tax year on my 2022 turbotax. We believed the turbotax software made an assumption I itemized in those years and thus considered my 2019 and 2020 refunds paid in 2022 as taxable. If there is a turbotax representative reading this, please chime in. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbo tax considering my state and city refunds from 2019 and 2020 paid in 2022 taxable? I filed the standard deduction in 2019-2022. Thanks.

TurboTax does have a routine you go through to see if your refund is taxable. If you completed that properly, then your refund should not have shown as taxable on your tax return if you used the standard deduction in previous years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wilsonbrokl

New Member

ddm_25

Level 2

v8899

Returning Member

user17558084446

New Member

Omar80

Level 3