- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

To complete the Recovery Rebate Credit Worksheet, you'll need to input a value in both the first-round and second-round boxes. If you didn't receive a second payment, you must add a 0. Do not leave the box blank.

What is the Recovery Rebate Credit?

The Recovery Rebate Credit is authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the COVID-related Tax Relief Act. It is a tax credit against your 2020 income tax. Generally, this credit will increase the amount of your tax refund or decrease the amount of the tax you owe.

The Recovery Rebate Credit was eligible to be paid in two rounds of advance payments during 2020 and early 2021. These advanced payments of the Recovery Rebate Credit are referred to as the first and second Economic Impact Payments.

Individuals who received the full amounts of both Economic Impact Payments do not need to complete any information about the Recovery Rebate Credit on their 2020 tax returns. They already received the full amount of the Recovery Rebate Credit as Economic Impact Payments. You received the full amounts of both Economic Impact Payments if:

- Your first Economic Impact Payment was $1,200 ($2,400 if married filing jointly for 2020) plus $500 for each qualifying child you had in 2020; and.

- Your second Economic Impact Payment was $600 ($1,200 if married filing jointly for 2020) plus $600 for each qualifying child you had in 2020.

Who can claim the Recovery Rebate Credit?

Eligible individuals who did not receive the full amounts of both Economic Impact Payments may claim the Recovery Rebate Credit on their 2020 Form 1040 or 1040-SR. To determine whether you are an eligible individual or the amount of your Recovery Rebate Credit, complete the Recovery Rebate Credit Worksheet in the Instructions for Form 1040 and Form 1040-SR.

Generally, you are eligible to claim the Recovery Rebate Credit if you were a U.S. citizen or U.S. resident alien in 2020, cannot be claimed as a dependent of another taxpayer for tax year 2020, and have a Social Security number valid for employment that is issued before the due date of your 2020 tax return (including extensions).

You must file Form 1040 or Form 1040-SR to claim the Recovery Rebate Credit even if you are normally not required to file a tax return. Anyone with income of $72,000 or less can file their Federal tax return electronically for free through the IRS Free File Program. Free File is a public-private partnership between the IRS and many filing and tax preparation software providers who provide their brand-name products for free. The safest and fastest way to get a tax refund is to combine electronic filing with Direct Deposit.

Get the information you need from your account

Log in to your Federal tax account information online to view what you may need when you electronically file your 2020 tax return (Form 1040 or Form 1040-SR). Two important reasons to have an account now are:

- In the coming weeks, individuals with an account on IRS.gov/account will be able to view the amounts of the Economic Impact Payments they received.

- Some people will need the amount of their adjusted gross income from 2019 if they use different software to file their tax returns for 2020.

Be sure you have this important information that you'll need to file your tax return for 2020 by visiting Secure Access now to prepare and set up your own Federal tax account online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

I received your reply. It didn't answer my question. Read my question again and you will understand why your answer didn't address my question. I DID try to input an amount of the stimulus payment, but it wouldn't ACCEPT it, which is why I asked the question. I ended up clearing out my entries and starting over. That fixed the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

Hi!

Did you ever get this resolved? I'm encountering the same issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

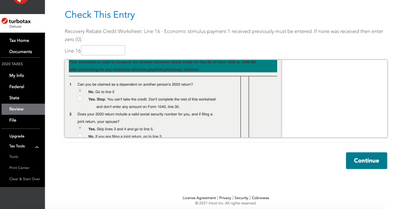

I am stuck on the same issue. It doesn't happen until you get into review. It says there is one issue and it takes you to a page with the Recovery Rebate Credit Worksheet under the heading, "Check this Entry."

I am not trying to get more money. I believe my family received the correct amount. There is nothing to change since I entered the information on the page you point out in your reply.

It will not let me pass this page. I type in the info and the continue button does nothing but blink when I click on it.

Thank you for your help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

Please see the information below for assistance. You will need to delete the worksheet and start over or clear it and start over.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

Thank you for replying.

Trying to delete the worksheet does not seem to work either. I follow the prompts mentioned in the link you provided, but it doesn't seem to work. Maybe it is my pop-up blocker.

The attached image is the page that I cannot get past. I have cleared and started over four times now and I can never get past this page.

This is an update:### I noticed in the first expert reply to this thread, "Individuals who received the full amounts of both Economic Impact Payments do not need to complete any information about the Recovery Rebate Credit on their 2020 tax returns."

My family did receive the full amount, so we should not need to fill out this worksheet or any information about the "Recovery Rebate Credit." Correct?

Why does the program take me to this page at all?

Thank you again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

Delete the Recovery Rebate Credit Worksheet and follow these steps to put the information back in.

At the top of your tax return select Federal Review

That will take you to this screen where it asks if you have already received your stimulus payments. If you received the first or second payment already, then select Yes and fill in the information. If you did not receive any payment select No. If you received the first payment only, fill in that amount and put zero (0) for the second payment.

When the screen is correct, you refund will be adjusted for the amount of stimulus payment that will be added to your 2020 refund.

@ GeDoMack

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

I resolved it by clearing out all of my entries and starting over. I had originally entered my Social Security income in the 'W-4' module, which was incorrect. When I started over, I entered my Social Security and other Retirement income in the correct modules and didn't have a problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

I am trying to recover any stimulus money for my dependent which I didn't recieve on either stimulus payment. How can I do so while filing my 2020 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

Make sure that the newborn child is correctly reported as a dependent on your 2020 Federal 1040 tax return. IRS FAQ states:

A qualifying child must have either:

- An SSN that’s valid for employment and assigned to them before the due date of your 2019 return (including the filing deadline postponement to July 15 and an extension to October 15 if you requested it); or

- An ATIN.

An ITIN won’t be accepted for a qualifying child.

Note: When the qualifying child is claimed by spouses filing a joint return, at least one spouse must have an SSN that’s valid for employment for a qualifying child to be considered. If the return isn’t filed by married spouses filing a joint return, the taxpayer filing the return must have an SSN that’s valid for employment for a qualifying child to be considered.

The TurboTax software adds together the entries that you made for receiving stimulus check 1 and stimulus check 2.

Then the software computes the amount of your stimulus check amounts based upon the information that has been entered into the tax software.

If you are due an additional amount, it will be issued as a Rebate Recovery Credit (RRC) on line 30 of the 2020 1040 tax return.

If you believe that you are due a Rebate Recovery Credit (RRC) on line 30 of the 2020 1040 tax return, then you should:

- Check the amounts entered for stimulus check 1 and stimulus check 2, and

- Make sure that you have correctly entered your dependent information.

If there is a difference, it is in one or both of these situations.

In TurboTax Online, you are prompted to input stimulus check 1 and stimulus check 2 information under Review down the left hand side of the screen.

You can also access your stimulus check choices by following these steps:

- Down the left side of the screen, click on Federal.

- Across the top of the screen, click on Other Tax Situations.

- At the screen Let’s keep going to wrap up. Click on Let’s keep going.

- At the screen Let’s make sure you got the right stimulus amount, click Continue.

- At the screen Did you get a stimulus payment? you can update your stimulus check entries.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

I have a similar problem BUT, here is what I have figured out. I filed jointly in 2020 for 2019, but because my spouse had died, I had to submit a paper return. It was mailed on 04/15/2020, and finally processed in late August of 2020. I did not get the first stimulus payment, for which I was eligible at the time, but I did get the second payment for $600. I contacted my US Senator and was told I would be eligible for a credit on my 2020 taxes. Subsequently, I got a W-2 from the IRS for interest owed on the stimulus payment. The Rebate Recovery worksheet would not allow me to enter any information and, at the bottom of the form, it indicated that based on my AGI, I was not eligible. Therein lies the problem. Whereas I was eligible in 2020, based on 2019 income, the Rebate Recovery is based on 2020 income. So according to the IRS, and I looked it up, I am no longer eligible. So why should I have to claim the W-2 as income on a payment that I will never receive?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

The IRS paid everyone interest with a refund on their 2019 return. You received the form because you were paid interest. You must include interest received on your tax return. The interest is not related to the stimulus. I am very sorry for your loss.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

I can't delete my worksheet because it has already accepted payment from me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I get the Recovery Rebate Credit Worksheet to accept my stimulus payment information?

If you were supposed to claim the recovery rebate because you did not receive the first stimulus payment, but you did not and you already submitted your return (it is in a pending status).......you will need to wait until the IRS either accepts or rejects your return, which will be sometime after Feb 12th. If rejected, go back into your return and claim it. If accepted, wait until that return is processed and then file an amended return to claim it. One of the reasons you may need to file an amendment:

- You forgot to report income or claim dependents, deductions, or credits.

The process is the same if you get a refund for the recovery rebate and receive the payment later, you would need to file an amended return. Amending is necessary when you claimed credits (recovery rebate) that you are not eligible for. @bethorourke5

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xjmo

Level 2

tjams4him

New Member

8178253271

New Member

dalatown

New Member

Chey3

New Member