- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where to enter payments for previous years' taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter payments for previous years' taxes?

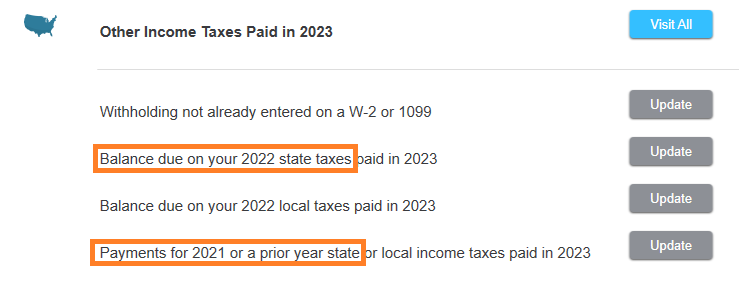

If someone didn't pay 2020 and 2021 federal or state taxes in the years they were due, but did pay them (plus penalties and interest) in 2023, where should they record those payments in TurboTax desktop for 2023? I see a place to enter past-due state taxes paid in 2023 (screenshot below), but I don't see the equivalent for federal. Can anyone help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter payments for previous years' taxes?

Federal tax you paid is not deductible on a federal return. There is a handful of states in which you can enter federal tax paid on the state return. But you cannot ever deduct penalties and interest you paid for the back taxes.

There are several states that allow you to enter the federal tax you paid on your state return--Alabama, Iowa. Missouri, Montana, and Oregon. If you are filing in one of these states watch for the deduction when you prepare your state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter payments for previous years' taxes?

Federal tax you paid is not deductible on a federal return. There is a handful of states in which you can enter federal tax paid on the state return. But you cannot ever deduct penalties and interest you paid for the back taxes.

There are several states that allow you to enter the federal tax you paid on your state return--Alabama, Iowa. Missouri, Montana, and Oregon. If you are filing in one of these states watch for the deduction when you prepare your state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter payments for previous years' taxes?

@xmasbaby0thanks for the reply.

You wrote:

There are several states that allow you to enter the federal tax you paid on your state return--Alabama, Iowa. Missouri, Montana, and Oregon. If you are filing in one of these states watch for the deduction when you prepare your state return.

While using TurboTax desktop (Windows), I didn't see anywhere to enter the info mentioned above in the state return, even though it is one of the states you listed.

Is that even going to matter, though? In other words, is it likely to reduce any amount of taxes owed or to increase any refund? Or is this calculation a sub-component of trying to determine whether to take the standard deduction vs. itemizing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter payments for previous years' taxes?

If you are taking the standard deduction, it will not change anything.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lillyonly2

New Member

user17515633536

New Member

tristendrhoton

New Member

preston-grindle

New Member

user17538710126

New Member