- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where is tax exempt interest entered on form 1040

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is tax exempt interest entered on form 1040

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is tax exempt interest entered on form 1040

On Form 1040, Line 2A

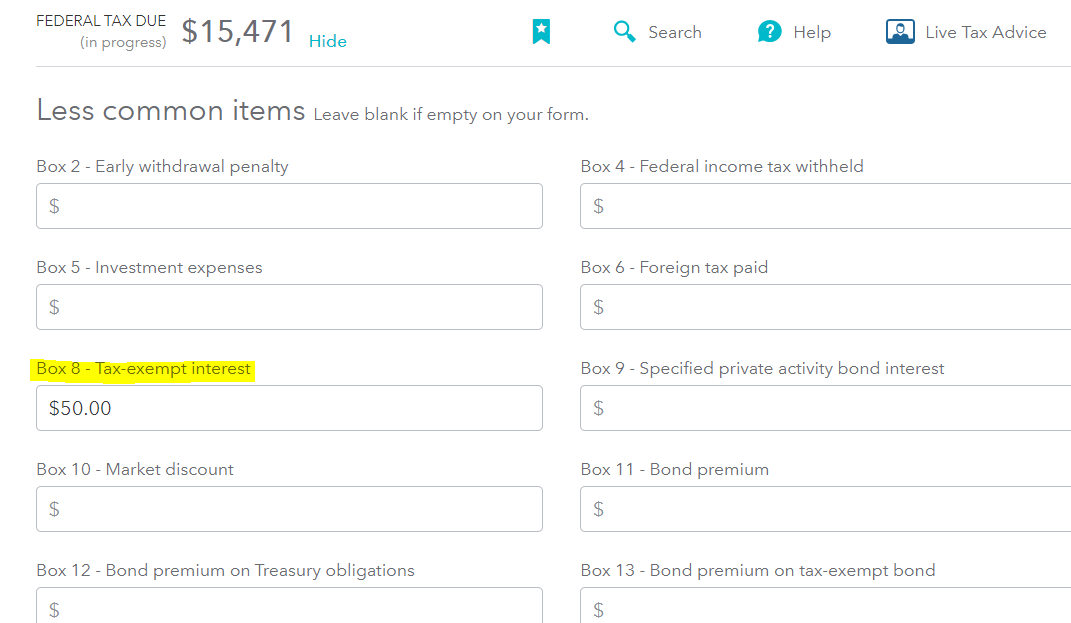

On TurboTax: Federal Taxes-> Wages and Income -> 1099 Int-> Box 8

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is tax exempt interest entered on form 1040

It's reported on line 2a of Form 1040.

To enter tax exempt interest -- whether it's on a Form 1099-INT or not -- in TurboTax Online:

- If you don’t see 2022 TAXES in the left pane, select the dropdown to the right of Income & Expenses on the Hi, let’s keep working on your taxes! page and then select Let’s get started, Pick up where you left off, or Review/Edit.

- Otherwise, in the left pane, select Federal, then Wages & Income. (This is labelled Income & Expenses in TurboTax Self-Employed)

- Scroll down and select the Show more dropdown to the right of Investments & Savings

- Select Start or Revisit to the right of Interest on 1099-INT

- Select Yes on the Did you receive any investment income? screen, then select Continue

- If you see either the Your investments & savings or Here's your 1099-INT info screen, select Add investments or Add another 1099-INT as appropriate, then select Continue

- On the Let's get the info from your 1099-INT screen, select the box to the left of My form has info in other boxes (this is uncommon)

- Enter your tax-exempt interest in Box 8. Select Continue

- Enter any appropriate information on the following screens

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is tax exempt interest entered on form 1040

If you receive a Form 1099-INT, you'll need to include the amount shown in Box 1 on the “taxable interest” line of your tax return. Report any tax-exempt interest shown in Box 8 of the 1099-INT on the “tax-exempt interest” line of your tax return. The total would be entered on line 2a of your Form 1040.

You can enter Tax Exempt Interest by following these steps in TurboTax:

- In your Income Section

- Enter 1099-INT,

- Select Jump to 1099-INT,

- Select Edit next to the 1099 you want to add tax exempt interest to or select

- Add to add a new 1099-INT,

- Select My form has info in other boxes,

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ellenbergerta

New Member

InTheRuff

Returning Member

DX77

New Member

mana1o

New Member

Huxley

Returning Member