- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where do I specify in Turbo Tax that I would like to file as a qualified joint venture with my spouse?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I specify in Turbo Tax that I would like to file as a qualified joint venture with my spouse?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I specify in Turbo Tax that I would like to file as a qualified joint venture with my spouse?

I'm not certain about your use of the term "qualified joint venture." You and your spouse do not file your tax return "as a qualified joint venture." You file your tax return as married filing jointly. If you have an business that you own jointly, you can choose to treat the business as a qualified joint venture, provided that the business is not an LLC or a corporation.

You don't actually tell TurboTax that your business is a qualified joint venture. When you choose to treat the business as a qualified joint venture you report it on your tax return as two separate businesses, one owned by each of you. You split all the income and expenses according to whatever percentage of ownership you agreed on, and each of the two businesses reports its share.

See the following link on the IRS web site for more details.

(When you first start to enter a business in a joint return in TurboTax, it will ask who owns the business. One of the choices is "Both of Us." But if you select that, it will just tell you to go back and enter two separate businesses, as I described above.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I specify in Turbo Tax that I would like to file as a qualified joint venture with my spouse?

I'm not certain about your use of the term "qualified joint venture." You and your spouse do not file your tax return "as a qualified joint venture." You file your tax return as married filing jointly. If you have an business that you own jointly, you can choose to treat the business as a qualified joint venture, provided that the business is not an LLC or a corporation.

You don't actually tell TurboTax that your business is a qualified joint venture. When you choose to treat the business as a qualified joint venture you report it on your tax return as two separate businesses, one owned by each of you. You split all the income and expenses according to whatever percentage of ownership you agreed on, and each of the two businesses reports its share.

See the following link on the IRS web site for more details.

(When you first start to enter a business in a joint return in TurboTax, it will ask who owns the business. One of the choices is "Both of Us." But if you select that, it will just tell you to go back and enter two separate businesses, as I described above.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I specify in Turbo Tax that I would like to file as a qualified joint venture with my spouse?

I do not see an option when adding a new business of marking it to be owned by "Both of Us". What is the best way to do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I specify in Turbo Tax that I would like to file as a qualified joint venture with my spouse?

Go to Business

- Select Business Profile

- The first question is Business is owned by:[Update]

- First question is : The business is owned by:

- Select Both of us.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I specify in Turbo Tax that I would like to file as a qualified joint venture with my spouse?

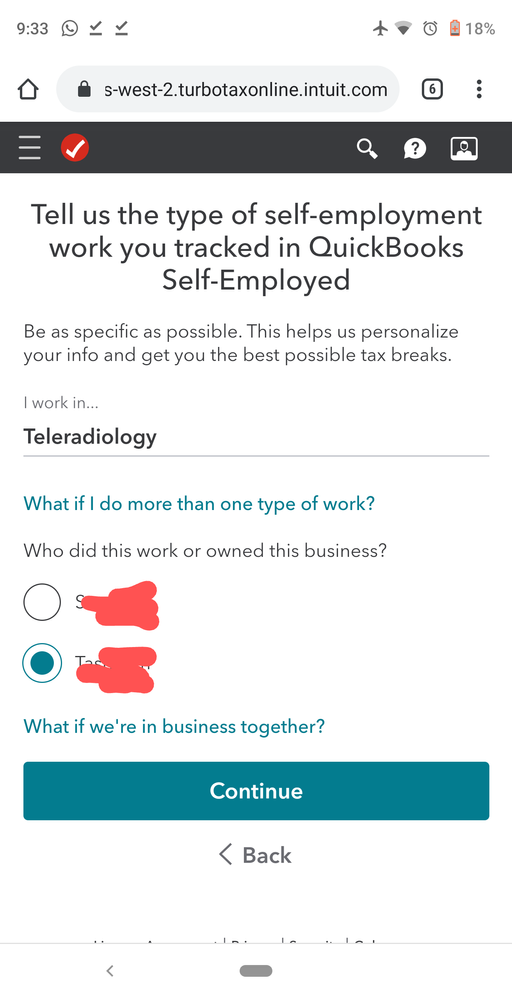

I am using self employed version. When I try to edit I get the screen attached:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I specify in Turbo Tax that I would like to file as a qualified joint venture with my spouse?

In the screenshot you posted, mark the radio button for your name.

Since the business is owned by both you and your wife as a qualified joint venture, you have to create a Schedule C for each of you. First go through and mark that the Schedule C belongs to you and enter your share of the income and expenses. Then create a separate Schedule C for your wife and enter her share of the income and expenses.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilenearg

Level 2

xiaochong2dai

Level 2

hannahcastellano15

New Member

jigga27

New Member

anonymouse1

Level 5

in Education