- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where can I find amounts from my K-1 for Box 17 - codes K and V?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find amounts from my K-1 for Box 17 - codes K and V?

Hi. I am hoping to get your help figuring out what fields have the amounts I need to enter into TurboTax Online. I have tried using Live Chat but to no avail, because the live accountants can't see my business forms. I need your help!

Background

I own 100% of an S Corp and am also an employee of the company. I use TurboTax for Business (desktop) to do my business taxes. The desktop app auto-generates the business forms shown/mentioned here.

TurboTax Online Form

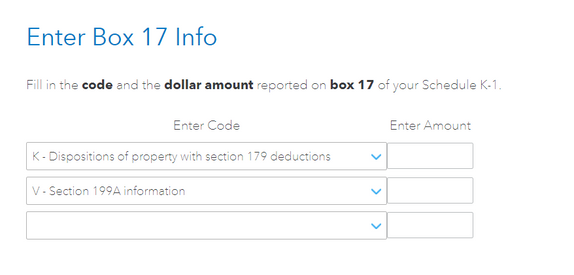

I am now entering data from my K-1 into TurboTax Online but have hit a snag. It is asking me to fill in amounts for Box 17, K and V (see screenshot below).

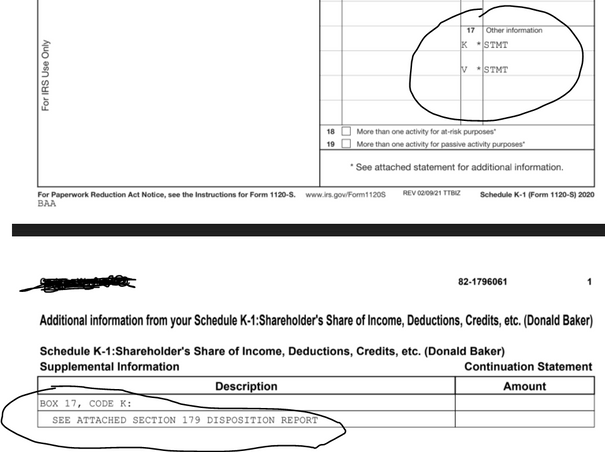

But when I look at my K-1, it says "STMT" for both of these. There is no "amount" listed. Furthermore, the next page in my return also tells me to see the Section 179 Disposition report for code K (see screenshot below).

Box 17, code K

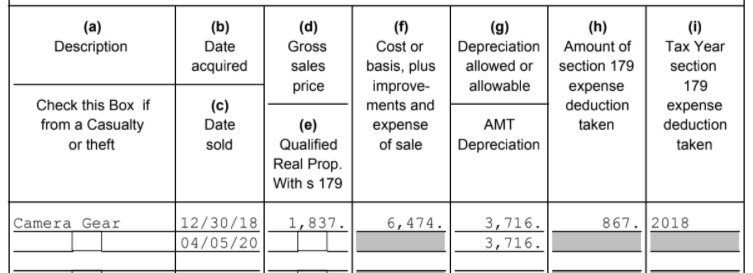

When I look at the 179 Disposition Report, there are several numbers on it. I don't know which one to enter into TurboTax Online for Box 17, code K (see screenshot below).

Box 17, code V

It's a similar story with the 199A worksheet to get the amount for Box 17, V. There are three values in the worksheet I can choose from. I don't know which one TurboTax Online wants. Is it ordinary business income, W-2 Wages, UBIA of qualified property, or Section 199A dividends?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find amounts from my K-1 for Box 17 - codes K and V?

@its-just-me wrote:

Also, a few screens after the one asking me for Box 17 info., I am asked for the details of my 199A income. Here, I can enter every value from the 199A. So I'm not sure about the "V" box

That is correct; you enter all the values from your 199A in that screen.

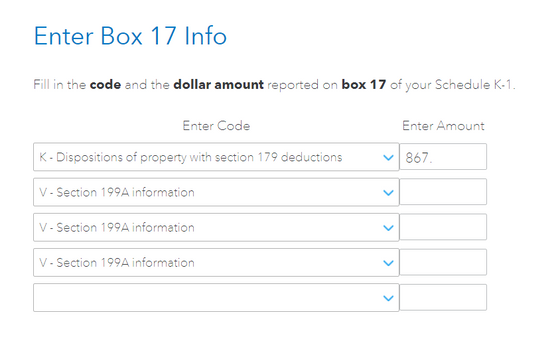

Do not enter multiple Code Vs as shown in your screenshot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find amounts from my K-1 for Box 17 - codes K and V?

Start your TurboTax Business program and enter Forms Mode. You should see Statement A directly below your K-1 in the list of forms (on the left side of the screen). That statement should have all of the information you need for Line 17 with the V code.

Your Section 179 deduction (that is now subject to recapture) appears to be $867 for the K code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find amounts from my K-1 for Box 17 - codes K and V?

Thank you very much tagteam for your response.

Unfortunately, Statement A is what I was looking at when trying to figure out what to put for the V code. There is only a list of items... nothing that says "V" code. Is it the amount in the "Section 199A Dividends" field?

Roger that re: the K code! Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find amounts from my K-1 for Box 17 - codes K and V?

@its-just-me Your Statement A should have all of the categories with a figure or figures in those categories which you would enter in your personal income tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find amounts from my K-1 for Box 17 - codes K and V?

Thank you so much @Anonymous_! That is definitely what I am looking at. So are you suggesting that I create three entries for V to reflect the three different amounts I have?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find amounts from my K-1 for Box 17 - codes K and V?

No, @its-just-me, you just need one entry for the V code and the program will prompt you for the details.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find amounts from my K-1 for Box 17 - codes K and V?

Also, a few screens after the one asking me for Box 17 info., I am asked for the details of my 199A income. Here, I can enter every value from the 199A. So I'm not sure about the "V" box

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find amounts from my K-1 for Box 17 - codes K and V?

@its-just-me wrote:

Also, a few screens after the one asking me for Box 17 info., I am asked for the details of my 199A income. Here, I can enter every value from the 199A. So I'm not sure about the "V" box

That is correct; you enter all the values from your 199A in that screen.

Do not enter multiple Code Vs as shown in your screenshot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find amounts from my K-1 for Box 17 - codes K and V?

God bless you @Anonymous_! Thank you so much. I can now file -- that was the last thing!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mwchoh

New Member

iwonbo2012

New Member

adamsarwar

New Member

mchismarich

New Member

user17587462525

New Member