in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

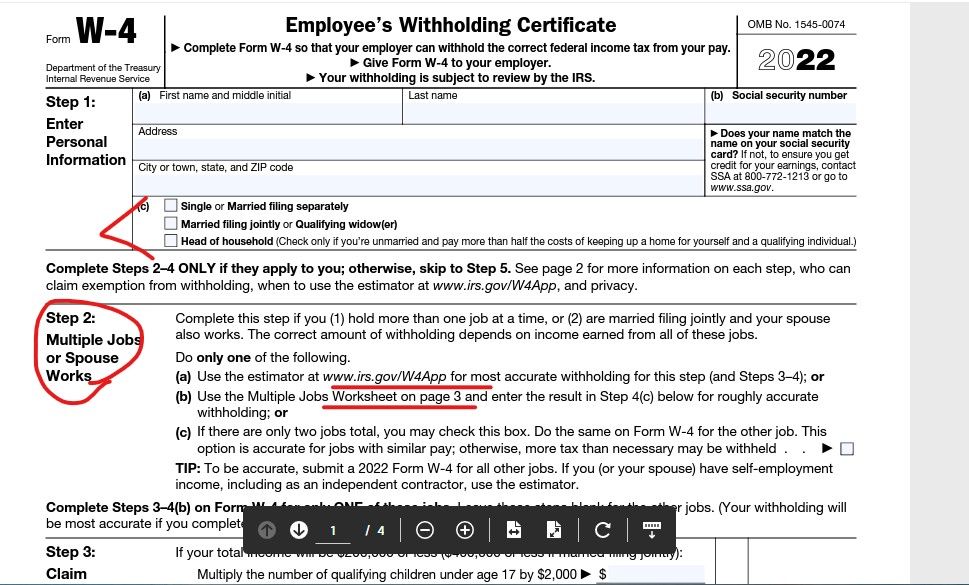

What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

That should not show on the revised W-4, but what it means is "Married but withhold at higher single rate" would result in MORE tax withheld from your wages. Tax withheld at Single Rate is a bit higher than tax withheld at the Married Rate.

This would be a good option if you are married, but your spouse makes a higher income or you are in a tax situation where you usually owe more tax at the end of the year than an average married Taxpayer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

So if I understand correctly, "Married but withhold at higher..." has been changed to Married filing jointly. Is that correct? If so, in that case, what is the reasoning behind section 2(c) on the W-4? If this was truly only a name change difference, then there should be no changes from 1 year to another in taxes right? (for the most part if everything stays the same)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

No, If you wish to have a higher withholding that was indicated by "Married but withhold at the higher single rate" you should select Single or Married filing separately.

Box 2(c) is for two jobs with similar pay, and it clearly states that you should do a W-4 for both jobs.

You're correct that if everything stays the same there will not be a change in your withholding status. If you do want to make an adjustment you should prepare W-4 forms for both you and your spouse.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

okay. Clearly I have been given multiple avenues on this.

1. I use to file Married, withhold at higher tax - That is no longer an option

2. Now it states, "Married Filing Jointly

3. The IRS website states that for W-4 section 2(c) if there are only 2 jobs total (1 job a piece) you may check this box. The description states, "Use this step if you have more than one job OR are married filing jointly and your spouse also works."

4. If the box is checked, "the standard deduction and tax brackets will be cut in half for each job to calculate holdings. What does this part mean? Does this mean more is taken out in taxes or less?

So..

1. If I choose "Married Filing Jointly" is that the same as the old statement, "Married withhold at a high tax"?

2. Does checking 2(c) also deduct additional tax withholdings?

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

1. No, if you choose Married Filing Jointly, that is the same as the old Married Filing Jointly, not the one that allowed you to withhold at a higher rate

2. No, check 2c does not automatically deduct additional withholdings, you actually must do the calculations yourself then enter the additional amount you want withheld on line 4c.

Say you are making $101,000 and your wife is making $43,000. On the right of the table under Married Filing Jointly you will look at the column that says $100,000-$149,000 then at the top you will look for the row that say $40,000-$49,000 and find the point they intersect which in this example is $8,370.

You will enter the $8,370 on line 1 of your W4 page 3, then you will divide this number by the number of times per year you get paid. So if you get paid every other week, you would divide $8,370 by 26 for a total of $321.92. You would then enter the $321.92 as the amount you wanted for extra withholdings on Step 4c of your W2.

The purpose of this is so that you are taxed at the rate you should be with both incomes taken into consideration instead of just your income counted.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

What if you are married and do not want the max taken out? You want more of your paycheck throughout the year. Would the Married filling jointly be the best option?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

@Fancysmile27 -stick with Married- joint

if you want less withheld from your paycheck, look at Step 4b.....on Form W-4

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

Just be aware that you may be subject to interest and penalties if you do not have enough withheld (or otherwise paid) during the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between Married but withhold at higher single rate vs. Married filing jointly? Do I need to choose (c) in step 2?

FYI ... the W-4 used to have a MARRIED BUT WITHHOLD AT THE HIGHER SINGLE RATE option but the new W-4 format there is only SINGLE OR MFS ... so if you still want to withhold at the higher single rate simply choose the SINGLE option ... it is just that simple. OR complete the 2 income worksheets as described above ...

https://www.irs.gov/forms-pubs/about-form-w-4

https://www.bmcc.cuny.edu/wp-content/uploads/2020/02/Federal-W-4-Tax-Form-QA.pdf

https://www.irs.gov/newsroom/faqs-on-the-2020-form-w-4

https://www.nerdwallet.com/article/taxes/how-to-fill-out-form-w4-guide

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

Ryan_TX

New Member

humbolta

Level 2

JoeTaxDad

Level 2

Karl26

Level 1