- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What is IRS treas 310 tax ref

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Hi Dashley,

The same thing happened to me! Although I did file 2019 taxes on February 6th of this year, there was an error and it got kicked out; so I submitted the corrections on March 16th and they told me it will take up to 12 weeks or longer before it's resolved or finished processing and I get my refund. (That was BEFORE the outbreak!) My payment was also based on 2018 income rather than 2019; so I got less than the full $1,200 as well.

BUT--My understanding is that any shortfall - in other words, if they based it on 2018 and they should have used 2019, it will be made up in 2020 anyway, since this payment is actually an advance payment based on 2020 income. (WTF, right?) So...when you file your taxes in 2020 (provided you make less than $75,000), any difference should be deducted from any taxes owed, or if no taxes are owed it should be refunded/added to your refund. Not to worry if you make OVER $75,000 in 2020, because my understanding is also that you will not be penalized if you go over - in other words, you won't have to pay any of that back. It's SO confusing, I know! But hopefully, this will all work out - We just might have to wait a little longer...! Best wishes!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

It was only upto 3 children.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Either quickly do them like I did. In which I received my tax money back within 2 weeks. Or as long as you fit the criteria for the non filers then I would highly suggest you take a look and go that route.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Today I received a refund for my 2019 filing which amounted $150 more than I file for refund, in addition to $1200 stimulus deposit last week. What is this additional $150 refund about?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Hey this is Paul Lancaster I am trying to see how long it will be before I find out if I get my taxes back or not

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

When will me and my wife and son get the stimulus checks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

@Lancaster19841993 wrote:

Hey this is Paul Lancaster I am trying to see how long it will be before I find out if I get my taxes back or not

To check the status of an e-filed return, open up your desktop product or log into your TurboTax Online Account. You can find your status within the TurboTax product.

If accepted by the IRS use the federal tax refund website to check the refund status - https://www.irs.gov/refunds

If accepted by the state use this TurboTax support FAQ to check the state tax refund status - https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

@Lancaster19841993 wrote:

When will me and my wife and son get the stimulus checks

Go to this IRS website for stimulus payment information FAQ's - https://www.irs.gov/coronavirus/economic-impact-payment-information-center

Use this IRS website for stimulus payment status or to update your bank account - https://www.irs.gov/coronavirus/get-my-payment

Use this IRS website for get my payment FAQ's - https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

When will the single Dependent get there Simulation check

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

@Bossup99 A person who is or who can be claimed as a dependent does not get a stimulus check.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Hi! so i had an issue with my tax return and had to mail them another form, which I did a week before covid lockdown, making my refund about 1200. I received an IRS TREAS 301 TAX REF for 1200 but idk if it's my refund or my stimulus check especially bc i don't know the exact amount my refund is for. Are stimulus checks definitely being registered as "IRS TREAS 301 TAX REF"? I'm worried that the IRS may not have received my additional form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Hi shanb, My guess is that the $1,200 deposit you received was the economic relief, a.k.a. stimulus payment, which will also be listed as "IRS treas 310 tax ref", just like your federal refund deposit. I had to send in a correction as well and was informed that it could take 12 WEEKS or more to process! One way to check is to go to the IRS "Where's My Refund" page to check your refund status: https://sa.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp. I did, and it said, "Your tax return is still being processed." (NOTE: I had to input my originally filed expected refund, NOT the corrected amount.) If the result says it's still being processed, then the deposit was definitely for the relief payment. Hope you get more relief SOON!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

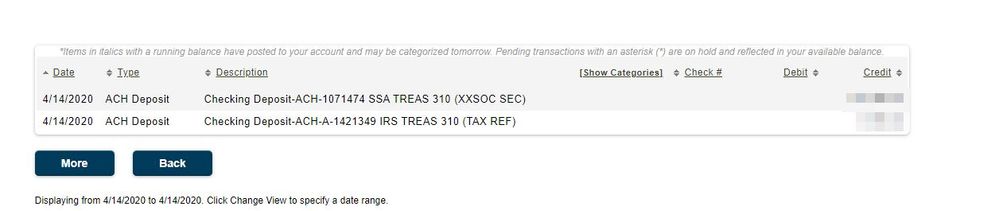

Thank you! Looks like the SSC one is your stimulus and the Tax Ref one is your refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Oh ok! thank you!! You must be right. I just hope they got my additional form. I've looked at the tracker too but don't trust it. haha. Appreciate the help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kthomann35

New Member

marya912

New Member

tpgrogan

Level 1

QRFMTOA

Level 5

in Education

JKGab

Level 2