- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What is bonus depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

Basically, bonus depreciation allows you to write off an additional 50% of the cost of eligible property that you begin using during the current tax year. It's considered "special" or a "bonus" because when this IRS rule first went into effect, it was expected to be for a very limited time. The provision has been extended several times over the years.

From IRS Pub 946: Special (Bonus) Depreciation:

Bonus depreciation is "a special depreciation allowance under IRS rules that allows you to recover part of the

cost of qualified property, placed in

service during the tax year. The allowance applies only for

the first year you place the property in service. For qualified

property placed in service in 2015, you can take an

additional 50% special allowance. The allowance is an additional

deduction

you can take after any section 179 deduction and before you

figure regular depreciation under MACRS for the year you place

the property in service."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

Basically, bonus depreciation allows you to write off an additional 50% of the cost of eligible property that you begin using during the current tax year. It's considered "special" or a "bonus" because when this IRS rule first went into effect, it was expected to be for a very limited time. The provision has been extended several times over the years.

From IRS Pub 946: Special (Bonus) Depreciation:

Bonus depreciation is "a special depreciation allowance under IRS rules that allows you to recover part of the

cost of qualified property, placed in

service during the tax year. The allowance applies only for

the first year you place the property in service. For qualified

property placed in service in 2015, you can take an

additional 50% special allowance. The allowance is an additional

deduction

you can take after any section 179 deduction and before you

figure regular depreciation under MACRS for the year you place

the property in service."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

Like all depreciation, special (bonus) depreciation will reduce the adjusted basis in an asset. The cost basis remains the same, but the net value of the asset is cost less accumulated depreciation (including special depreciation).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

Am I allowed to take 100% special depreciation on new carpet I installed in my rental property last year?

Is this deduction recaptured when I see the rental property?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

Yes, this is true, unless you opt out of it. See IRS Newsroom.

What is your situation that causes you to ask this?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

I've taken this in a prior years return prepared by a tax accountant. The remaining depreciation schedule is 20 years. I can't seem to figure out which code to use in Turbo Tax to get the 20 year life. All I get is 15 years. Which code should be used?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

Here is a guide for how to go about entering depreciation into TurboTax in order to duplicate the entries that have been made on previous returns to continue the same depreciation.

- Start from the Schedule C or Schedule E section of your return until you get to the Assets/Depreciation section.

- Proceed to the point where you are adding an asset on the page titled Describe This Asset.

- In order to enter the asset exactly as it has been reported in the past, choose the last option on the list, Intangibles, Other Property, then click Continue.

- On the next page titled, Tell Us a Little More, select Other asset type, then click Continue.

- Enter the detailed information about the asset: description, cost, date purchased or acquired. Click Continue.

- Move forward with additional details on the next screen, then click Continue.

- Select the appropriate Asset Class, then click Continue.

- Choose the MACRS Convention, then click Continue.

- Select the Depreciation Method, then click Continue.

- Answer the question regarding Listed Property, then click Continue. There may be some additional background questions as well, keep going.

- You will eventually come to a screen to confirm the Prior Depreciation, enter the data and click Continue.

- Finally, you will see an Asset Summary screen with the current year depreciation amount listed. There is also a check-box here to Show Details. This will open a full description for the asset so you can verify that it matches the previously reported information. If it does not, you can choose to go Back and re-enter the data that needs to be changed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is bonus depreciation

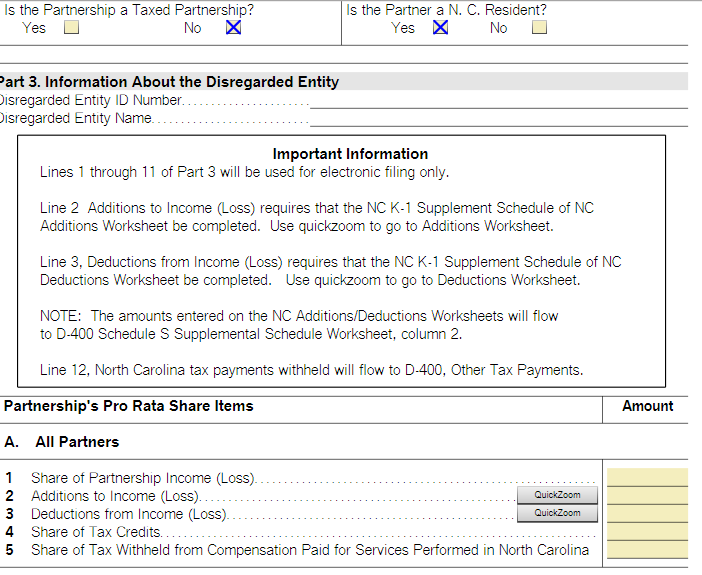

I live in North Carolina, a non-conforming state. I am trying to figure out the various Depreciation entries on the K-1 and Sales Worksheet as a partner in a PTP. The Sales Worksheet has information in columns 10 and 11, "Adjusted for Bonus Depreciation". Col 10 is Cumulative adjustments to basis, -4598, and 11 is Gain Subject to recapture as ordinary income, 2838. I've finished doing the federal adjustments but do not know how to enter these items into the NC K-1 in Turbo Tax Deluxe.

Also, Box 20AH3 has Depreciation Adjustment for Non-Conforming States for the 3 "activities" of Energy Transfer LP. I do not see a relevant place to put these on the NC K-1. These values are 926, -2, and 44 for the 3 activities.

Then there are State Information Schedules for the 3 Activities that have a column 3, Potential Bonus Depreciation adjustment to columns 1 & 2. These values are -5 and 3, respectively for column 1, ordinary income or loss from this activity, and column 3. The other activities have 0 for income and potential bonus dep adjustment.

How are these related, if they are? Below are the only places to make adjustments to the NC K-1 D-403. This is from the NC P K-1 D-403. The first view is the blanks to fill in. The other 2 are the working screens for filling in lines 2 and 3.

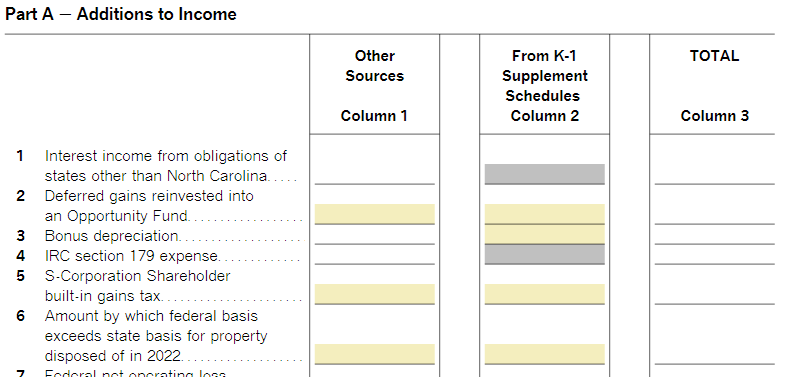

Below: Line A. 2's quick zoom goes to this type of entry (I just selected a section that I think might be relevant, mainly line 3 bonus depreciation.

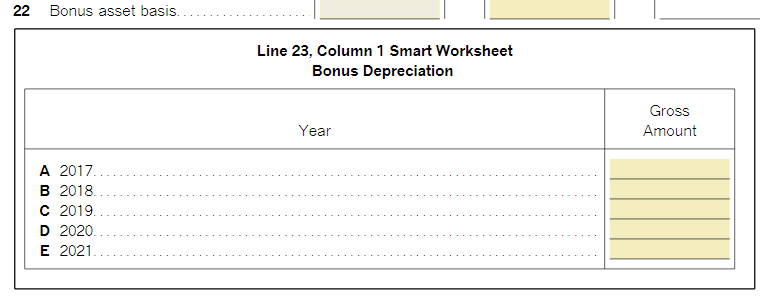

Below: Part B - Deductions from income. Again, there's bonus depreciation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bgramse22

New Member

seelly

New Member

KMJK

Level 3

brice-cunningham

New Member

kwlilly

New Member