- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I live in North Carolina, a non-conforming state. I am trying to figure out the various Depreciation entries on the K-1 and Sales Worksheet as a partner in a PTP. The Sales Worksheet has information in columns 10 and 11, "Adjusted for Bonus Depreciation". Col 10 is Cumulative adjustments to basis, -4598, and 11 is Gain Subject to recapture as ordinary income, 2838. I've finished doing the federal adjustments but do not know how to enter these items into the NC K-1 in Turbo Tax Deluxe.

Also, Box 20AH3 has Depreciation Adjustment for Non-Conforming States for the 3 "activities" of Energy Transfer LP. I do not see a relevant place to put these on the NC K-1. These values are 926, -2, and 44 for the 3 activities.

Then there are State Information Schedules for the 3 Activities that have a column 3, Potential Bonus Depreciation adjustment to columns 1 & 2. These values are -5 and 3, respectively for column 1, ordinary income or loss from this activity, and column 3. The other activities have 0 for income and potential bonus dep adjustment.

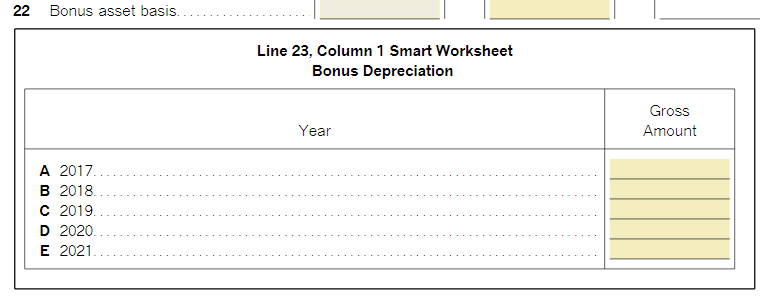

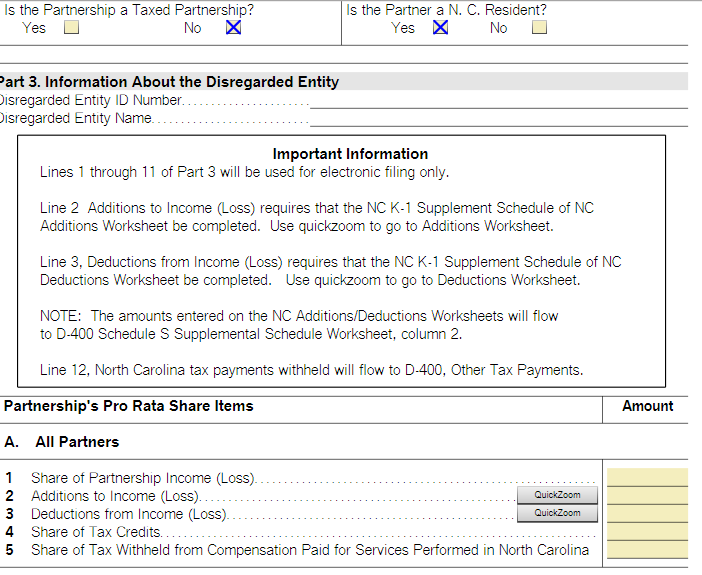

How are these related, if they are? Below are the only places to make adjustments to the NC K-1 D-403. This is from the NC P K-1 D-403. The first view is the blanks to fill in. The other 2 are the working screens for filling in lines 2 and 3.

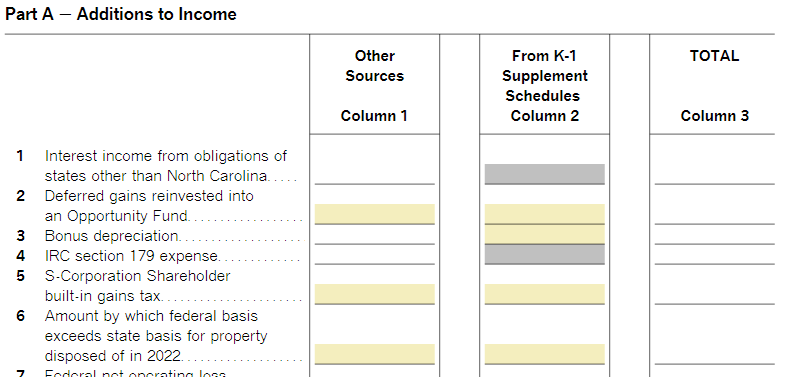

Below: Line A. 2's quick zoom goes to this type of entry (I just selected a section that I think might be relevant, mainly line 3 bonus depreciation.

Below: Part B - Deductions from income. Again, there's bonus depreciation.