in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What accounts are included in Foreign Financial Assets for FORM 8938 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What accounts are included in Foreign Financial Assets for FORM 8938 ?

Hello ~ This TurboTax link says for FORM 8938 one can skip the "Amounts Related to Foreign Financial Assets" screen and proceed to the "First Foreign Financial Account" screen to enter the Account Number & the Maximum Account Value (etc.), the reason being that Foreign Financial Accounts are NOT Foreign Financial Assets. But based on my research, Foreign Financial Accounts ARE actually Foreign Financial Assets for tax purposes. Am I missing something here? Thank you !

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What accounts are included in Foreign Financial Assets for FORM 8938 ?

It depends. Let's break this down.

- Foreign Accounts: These are financial accounts held in foreign financial institutions. Examples include bank accounts, brokerage accounts, mutual funds, and retirement accounts. If you have foreign accounts with an aggregate value exceeding $10,000 at any time during the year, you must file the FBAR (FinCEN Form 114) to report these accounts.

- Foreign Assets: These include a broader range of financial interests beyond just accounts. Foreign assets can encompass foreign stocks, securities, interests in foreign entities, and financial instruments or contracts held for investment. If the total value of your specified foreign financial assets exceeds certain thresholds, you must report them on Form 8938 (Statement of Specified Foreign Financial Assets).

With this in mind, the IRS states that "if you have a financial account maintained by a foreign financial institution and the value of your specified foreign financial assets is greater than the reporting threshold that applies to you, you need to report the account on Form 8938. A foreign account is a specified foreign financial asset even if its contents include, in whole or in part, investment assets issued by a U.S. person. You do not need to separately report the assets of a financial account on Form 8938, whether or not the assets are issued by a U.S. person or non-U.S. person".

Basic questions and answers on Form 8938

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What accounts are included in Foreign Financial Assets for FORM 8938 ?

- You are filing a return other than a joint return and the total value of your specified foreign assets is more than $200,000 on the last day of the tax year or more than $300,000 at any time during the year; or

- You are filing a joint return and the value of your specified foreign asset is more than $400,000 on the last day of the tax year or more than $600,000 at any time during the year.

Thank you ~

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What accounts are included in Foreign Financial Assets for FORM 8938 ?

Yes, even though those thresholds pertain to the total value of foreign assets, foreign accounts still need to be reported to ensure comprehensive disclosure of all foreign financial interests. This helps the IRS combat tax evasion and ensure compliance with tax laws. This gives the IRS a complete portrait of your foreign interests.

The IRS is interested in knowing about all your foreign accounts so in a sense, I suppose these could be considered "one and the same" because these are the accounts where your foreign assets are kept.

Do I need to file Form 8938, Statement of Specified Foreign Financial Assets?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What accounts are included in Foreign Financial Assets for FORM 8938 ?

Hello ~ Thank you for your answer! I just have one more question (sorry ...): The link I have mentioned in my original post/questsion suggets that I should skip the "Amounts Related to Foreign Financial Assets" screen and proceed to the "First Foreign Financial Account" screen to enter the Account Number & the Maximum Account Value (etc.). Should I follow the suggestion?

I mean, shouldn't suppose to fill out the INTEREST BOX, under AMOUNTS ATTRIBUTABLE TO FOREIGN FINANCIAL ACCOUNTS, for the total amount of the interests I earned with all the foreign bank accounts I had in 2024 in the "Amounts Related to Foreign Financial Assets" screen before I proceed to the "First Foreign Financial Account" screen to enter the Account Number & the Maximum Account Value (etc.)? Thank you once again !

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What accounts are included in Foreign Financial Assets for FORM 8938 ?

Yes, enter your Foreign Interest received in the Income section, as if you had received a 1099-Int. If you paid foreign taxes, enter them in box 6 of that 1099 INT. This is then reported on schedule B. If you paid Foreign Tax, you can enter it for a possible credit in the Foreign Tax Credit section under Deductions & Credits.

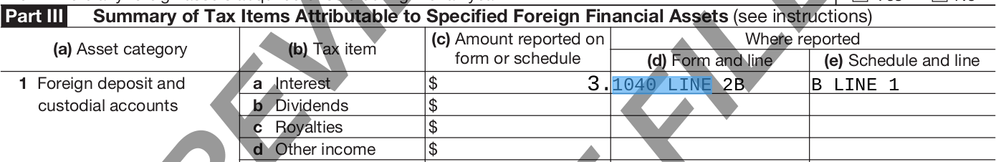

For Form 8938, enter the interest amount, line it appears on (Form 1040, Line 2b), then (Schedule B, Line 1). If you have no income reported on your tax return related to your foreign accounts, you don't need to enter them on the 8938. These would be reported on FinCEN Form 114, which is filed separately from your tax return.

If you had more than $10,000 as a Maximum Balance in any of your accounts, (including those you reported interest income from on Form 8938), you would need to file a FinCENForm 114, which is not handled by TurboTax. Click here to file FinCENForm 114: https://bsaefiling.fincen.treas.gov/main.html

Also, see this for reference: Comparison of Form 8938 and FBAR Requirements.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What accounts are included in Foreign Financial Assets for FORM 8938 ?

Hello, Marilyn ~ Thank you so very much for your answer - I really appreciate it!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524231336

Level 1

Raph

Community Manager

in Events

diitto

Level 2

ffraser1988

New Member

mysert

Level 1