- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, enter your Foreign Interest received in the Income section, as if you had received a 1099-Int. If you paid foreign taxes, enter them in box 6 of that 1099 INT. This is then reported on schedule B. If you paid Foreign Tax, you can enter it for a possible credit in the Foreign Tax Credit section under Deductions & Credits.

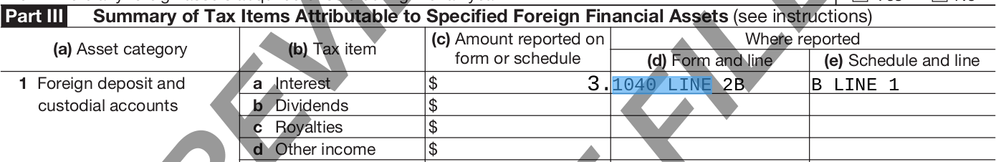

For Form 8938, enter the interest amount, line it appears on (Form 1040, Line 2b), then (Schedule B, Line 1). If you have no income reported on your tax return related to your foreign accounts, you don't need to enter them on the 8938. These would be reported on FinCEN Form 114, which is filed separately from your tax return.

If you had more than $10,000 as a Maximum Balance in any of your accounts, (including those you reported interest income from on Form 8938), you would need to file a FinCENForm 114, which is not handled by TurboTax. Click here to file FinCENForm 114: https://bsaefiling.fincen.treas.gov/main.html

Also, see this for reference: Comparison of Form 8938 and FBAR Requirements.

**Mark the post that answers your question by clicking on "Mark as Best Answer"