- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- VA 529 Plan Carryover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

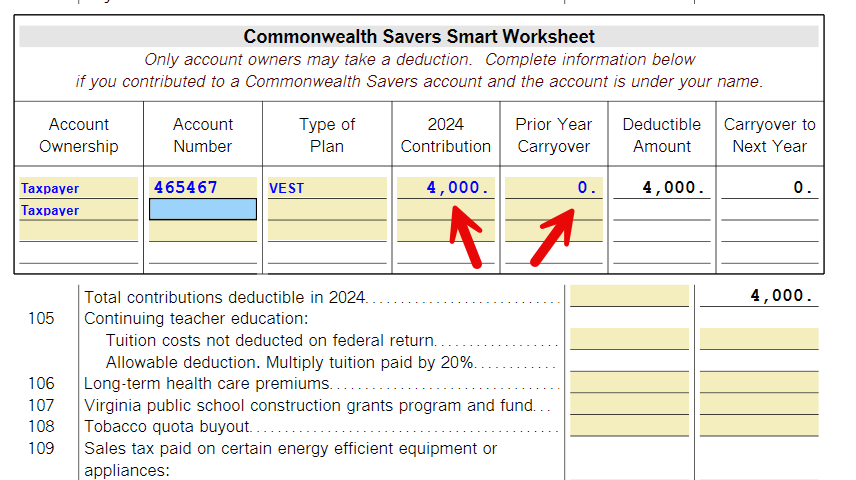

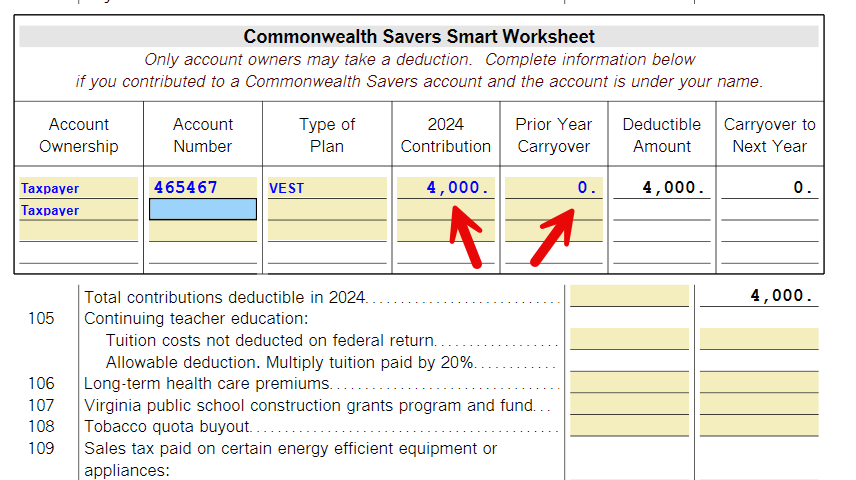

The TurboTax VA State FY24 tax is stating that I have to carry-over funds to next tax year. However, I have not met the $4000 limit on all the accounts listed. I have 6 accounts with contributions totaling $13k. The VA 529 Plan allows a deductible limit of $24k (6 accounts x $4k). Clearly, I have not met the limit, and TurboTax should not be carrying-over any funds.

Is there a bug/glitch in the software or am I missing something?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

Your tax forms need to be correct. It is an odd number. I am sure you have reviewed your tax forms for a checked box or oddity that is out of place. The $4k is per account, it sounds like you know to add the many accounts. You may want to file an extension and /or contact support. I can't take a look at your return today or tomorrow but the phone lines can.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

Something is wrong. A full or corrupted cache can cause problems in TurboTax, sometimes you need to clear your cache (that is, remove these temporary files).

Online version:

- Delete the contributions

- Log out of your return and try one or more of the following:

- Log back into your return.

- Enter the information again.

Desktop version:

- Delete the contributions

- Save your return while closing the program.

- Update the program

- Open

- Enter the information again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

Your solution did not resolve the issue. A carry-over is still stated, and what's weird is it's only for $602. This must be a bug. My concern is if I file, will this be corrected with next year's software? This is unlikely.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

Your tax forms need to be correct. It is an odd number. I am sure you have reviewed your tax forms for a checked box or oddity that is out of place. The $4k is per account, it sounds like you know to add the many accounts. You may want to file an extension and /or contact support. I can't take a look at your return today or tomorrow but the phone lines can.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VA 529 Plan Carryover

Thanks, Amy. After reviewing the worksheet, I realized the contribution was over 4k, hence the carryover. My apologies; it was my error.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DIY79

New Member

Martin667

Level 1

katie-cantrell08

New Member

aaronvaughn1

New Member

in Education

gmarcove

New Member

in Education