- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Unlawful discrimination dispute settlement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

I have received $45,000 from unlawful discrimination dispute settlement. Employer in the settlement agreement has denied the discrimation allegation but has agreed to pay $45k. My attorney fee to settle this case is 18,000.

My employer will issue a 1099 MISC for 45K. which IRS forms do I need to fill to deduct legal fee of 18k.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

Generally speaking, payments for personal injury or property damage are not taxable, but recoveries for punitive damages or lost wages/income are taxable.

There are a number of variations (like, if you deducted medical expenses in a prior year that are now paid off by the settlement, you have a report a reimbursement of a deduction, and that is taxable. Or, if you received money for your damaged car and the money is more than the car was worth, the excess is taxable). This link provided gives more examples. http://www.irs.gov/pub/irs-pdf/p4345.pdf

Your attorney costs are deductible, but only as far as the damages are taxable (if 50% of your damages are taxable, then 50% of your fees are deductible). And they are a miscellaneous deduction subject to the 2% rule, so you may or may not actually benefit from claiming the deduction.

In a perfect world, you would receive a 1099-Misc from the payer that only lists the taxable part (wages and such).

https://ttlc.intuit.com/questions/1901380-entering-an-award-from-a-legal-settlement-in-turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

I would like to know the following:

1) Which IRS form(s) do I need to fill to deduct Legal fee of 18K.

2) Employee will issue a 1099 MISC showing my total settlement amount of 45K

My net taxable should be 45k MINUS 18K.

Thanks for your help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

Unlawful discrimination claims. You can deduct certain attorney fees and court costs for unlawful discrimination claims, described earlier, on your Schedule 1 line 8 ... you will enter the total 1099 income and then make a separate entry for the attorney fees.

Reporting this in TurboTax will be a two-step process, first to include the 1099-MISC as income and then to make a negative adjustment to remove it.

To include the 1099-MISC as a part of your tax return, follow these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-MISC” (be sure to enter exactly as shown here) and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-MISC"

- Click on the blue “Jump to 1099-MISC” link

- Answer Yes you did receive a 1099-MISC

- Fill in the details from your 1099-MISC then click Continue

- Provide a short description for the reason you received the 1099-MISC then click Continue

- On the next screen titled, “Does one of these uncommon situation apply?” choose the last option, None of these apply and then click Continue

- On the next screen asking if the 1099 involved work like your main job, answer No and click Continue

- On the next screen, check the box that you received the income in 2019 and then click Continue

- Finally, choose “No, it didn’t involve an intent to earn money” and click Continue

- Answer the questions on the next couple of screens to finish the process

Now the income shown on the Form 1099-MISC has been added to your return. Next, it will be “removed” from the return.

Follow these steps:

- Go to Federal Taxes > Wages & Income and scroll to the bottom of the screen to the Less Common Income section (expand the section by clicking Show More if necessary)

- Click Start or Update beside Miscellaneous Income, 1099-A, 1099-C

- Scroll to the bottom of the list and click Start or Update beside Other Reportable income

- Answer Yes to move forward

- Enter a brief description, such as “settlement refund adjustment,” and the amount reported on the 1099-MISC as a negative number then click Continue

- Click Done

When you see your Form 1040 Schedule 1, the amount shown on the Form 1099-MISC will be reported twice on line 8 – once as a positive amount and once as a negative amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

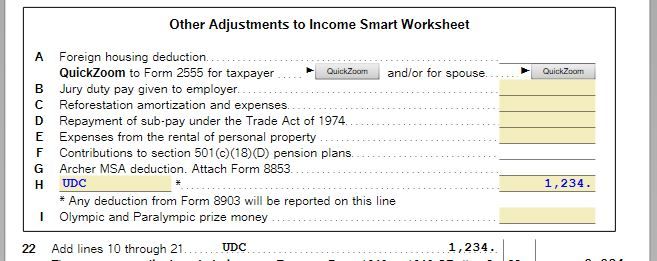

It is reported on the 1040 form schedule 1 line 22 with the identifier "UDC" next to it.

IRS Pub 525 page 30.

https://www.irs.gov/pub/irs-pdf/p525.pdf

TurboTax does not directly support this but it can be entered by using the CD/download desktop software in the forms mode on the 1040/1040SR Worksheet for Schedule 1 line 22.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

Entering as Critter suggests will not enter it as it specified in the 1040 Schedule 1 line 22 instructions. The forms mode is the ONLY way it can be properly done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

Thanks Carter.

I am using Turbo Tax Premier "2019".

I followed your steps to add my income in form 1099 MISC.

For the next steps, I am unable to complete the following steps to negate my income

I do not see "Less Common Income" section. Please help

Now the income shown on the Form 1099-MISC has been added to your return. Next, it will be “removed” from the return.

Follow these steps:

- Go to Federal Taxes > Wages & Income and scroll to the bottom of the screen to the Less Common Income section (expand the section by clicking Show More if necessary)

- Click Start or Update beside Miscellaneous Income, 1099-A, 1099-C

- Scroll to the bottom of the list and click Start or Update beside Other Reportable income

- Answer Yes to move forward

- Enter a brief description, such as “settlement refund adjustment,” and the amount reported on the 1099-MISC as a negative number then click Continue

- Click Done

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

@dbadkn12 "UDC" for attorney or court costs for actions settled or decided after October 22, 2004, involving certain unlawful discrimination claims. See the government instructions for the amount to enter for the "UDC" adjustment

As previously stated go to IRS Publication 525 page 30 - https://www.irs.gov/pub/irs-pdf/p525.pdf

To enter the attorney or court costs click on Forms

When in Forms mode open the 1040/1040SR Wks show in the left hand column at the top. Scroll down the Worksheet to Schedule 1 - Additional income and Adjustments Part II. On Other Adjustments to Income Smart Worksheet Line H enter UDC and the amount in the spaces provided.

This will flow to Schedule 1 Line 22 and the total from Part II to Form 1040 Line 8a

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

@macuser_22 is correct ... switch to the FROMS mode to make the proper entry by doing overrides.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

No "override" is necessary to make the proper entry - it just cannot be done in the interview mode because so few taxpayers need it, they just do not provide an interview for all possible entries - it would add to the complexity and cost for all users, but it is provided for in the forms mode. (As DoninGA posted the screenshot for.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unlawful discrimination dispute settlement

Thank you all for answering my question.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

floydee

New Member

floydee

New Member

BillEngr

Returning Member

Strategic Taxer

Returning Member

rubyskies

Level 2