- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Union dues california tax credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Union dues california tax credit?

My w2 has union dues in box 14.

Does California give a tax credit for union dues in 2022?

How do I enter it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Union dues california tax credit?

Yes. California allows a deduction for union dues in 2022.

Enter your wife’s Box 14 union dues in Deductions & Credits.

- Type union dues in Search (magnifying glass) in the top right

- Tap Jump to union dues

- On “Do you have any employment expenses for W-2 work?”, tap YES

- Answer the questions.

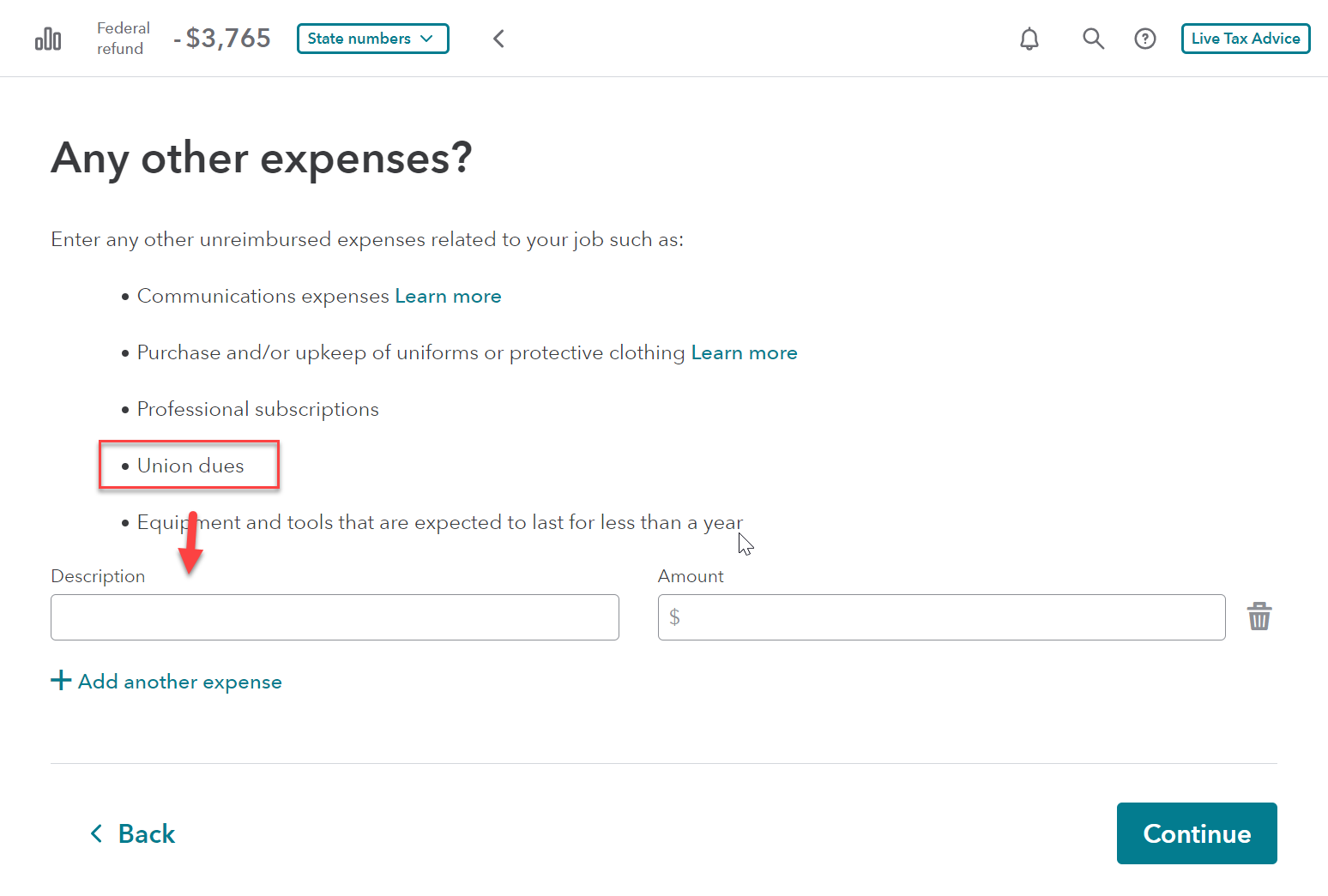

- Union dues are part of the screen “Any other expenses?” TurboTax will transfer those amounts to your California return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Union dues california tax credit?

This would be easier to do if turbo tax would allow a more specific category like "Union Dues" when parsing box 14 of the w-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Union dues california tax credit?

The union dues did not transfer to my California tax return. Only the Federal allowed $300 maximum. Can I enter the union dues as Other Adjustments to Income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Union dues california tax credit?

You can’t claim union dues as part of the $300 Educator Expense deduction.

See: Do teacher union dues qualify for the Educator Expense deduction?

You can claim union dues as an unreimbursed business expense on your California return. Union dues are no longer deductible on your federal return. However, if you enter the amount in Deductions & Credits, TurboTax will move it to California.

- Type union dues in Search (magnifying glass) in the top right corner

- Select Jump to union dues

- On the screen “Do you have any employment expenses for W-2 work?” say YES

- Fill in any info. When you reach “Any other expenses?” enter “Union dues” as your Description and the amount you paid.

Your union dues will appear on line 19 of Schedule CA as Job Expenses and Certain Miscellaneous Deductions. 2% of your California income will be deducted from the amount you can claim.

You will only be able to claim union dues if the amount you paid is more than 2% of your California income and itemize deductions on your California return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Union dues california tax credit?

Thank you very much for this detailed explanation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elliottulik

New Member

bawbfree

New Member

jrmcateer305

New Member

jigga27

New Member

anonymouse1

Level 5

in Education