- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Unexpected Increase in Capital Loss Used After Adding 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unexpected Increase in Capital Loss Used After Adding 1099-B

Background:

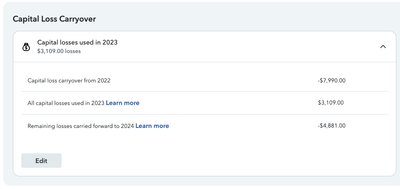

- I had a $7,990 capital loss carryover from last year.

- I understand I can deduct up to $3,000 of this carryover to reduce my taxable income in 2023.

- Before adding my Betterment 1099-B, my tax software showed the expected $3,000 deduction in "All Capital Losses Used in 2023" row.

Issue:

- After importing my 1099-B, the "All Capital Losses Used in 2023" amount jumped to $3,109.

- My Betterment statement only shows a $105 gain, so I'm confused where the extra loss came from.

Questions:

- How could my 1099-B cause this change if it doesn't show any losses?

- Can more than $3,000 in capital loss be used in a single year?

- Could you please explain how this calculation works?

- What should I look for in my Betterment 1099 B to understand this calculation?

Thank you for any insights!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unexpected Increase in Capital Loss Used After Adding 1099-B

Yes. You get to first offset the loss against any gains you have each year so that can use more of it up. Then after applying the loss to the current gains you can take a max loss of 3,000 (1,500 MFS)per year. Turbo Tax does all the calculations for you. Just enter the prior year carryover amount.

The 3,000 is just the max loss you can claim each year AFTER offsetting any gains you have. So you might use more of it up in one year.

On the income page The 2023 column shows the carryover to 2024 (not your current loss for 2023). Schedule D doesn't actually show the carryover amount. To find your Capital Loss Carryover amount you need to look at your return schedule D page 2. Line 16 will be your total loss and line 21 should be a max loss of 3,000. The difference between line 16 and 21 is the carryover loss for next year.

There is also a Carryover Worksheet showing the carryover from the prior year and the current amounts. Then there is also the Capital Loss Carry Forward worksheet showing the amount transferring over to next year.

In the Online version you have to save your return with all the worksheet as a pdf file to your computer to see the Capital Loss Carry Over and Carry Forward worksheets.

In the Desktop program you can go to Forms and find it in the list in the left column.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unexpected Increase in Capital Loss Used After Adding 1099-B

Yes. You get to first offset the loss against any gains you have each year so that can use more of it up. Then after applying the loss to the current gains you can take a max loss of 3,000 (1,500 MFS)per year. Turbo Tax does all the calculations for you. Just enter the prior year carryover amount.

The 3,000 is just the max loss you can claim each year AFTER offsetting any gains you have. So you might use more of it up in one year.

On the income page The 2023 column shows the carryover to 2024 (not your current loss for 2023). Schedule D doesn't actually show the carryover amount. To find your Capital Loss Carryover amount you need to look at your return schedule D page 2. Line 16 will be your total loss and line 21 should be a max loss of 3,000. The difference between line 16 and 21 is the carryover loss for next year.

There is also a Carryover Worksheet showing the carryover from the prior year and the current amounts. Then there is also the Capital Loss Carry Forward worksheet showing the amount transferring over to next year.

In the Online version you have to save your return with all the worksheet as a pdf file to your computer to see the Capital Loss Carry Over and Carry Forward worksheets.

In the Desktop program you can go to Forms and find it in the list in the left column.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unexpected Increase in Capital Loss Used After Adding 1099-B

Thanks. Few questions:

1. What should I check in 1099-B from Betterment to understand 109$ amount?

2. Is there a concept of long term capital loss carryover and short term capital loss carryover?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unexpected Increase in Capital Loss Used After Adding 1099-B

If you sell stocks, bonds, derivatives, or other securities through a broker, you can expect to receive one or more copies of Form 1099-B in January. This form is used to report gains or losses from such transactions in the preceding year. Check your 1099-B for information about the transaction that showed a gain. A gain can be used to offset losses, in addition to the annual $3,000 maximum.

In most cases, a 1099-B form provides information about securities or property involved in a transaction handled by a broker.

This includes:

- A brief description of the item sold, such as “100 shares of XYZ Co"

- The date you bought or acquired it

- The date you sold it

- How much it cost you to acquire it

- How much you received for it when you sold it

- Whether your broker withheld any federal tax

The 1099-B helps you deal with capital gains and losses on your tax return. Usually, when you sell something for more than it cost you to acquire it, the profit is a capital gain, and it may be taxable. On the other hand, if you sell something for less than you paid for it, then you may have a capital loss, which you might be able to use to reduce your taxable capital gains or other income.

See this help article for more information about Form 1099-B.

Carryover losses on your investments are first used to offset the current year capital gains if any. You can deduct up to $3,000 in capital losses ($1,500 if you're Married Filing Separately). Losses beyond that amount can be deducted on future returns as a capital loss carryover until the loss is all used up.

For example, if your net capital loss in 2023 was $7,000 and you're filing as single: You could have a deduction of $3,000 of the loss on your 2023 return, $3,000 on your 2024 return, and the remaining $1,000 on your 2025 return. This is true if you have no capital gains to offset your losses.

Unfortunately, you can't pick and choose which future tax year(s) you wish to apply your carryover to. Carryovers from this year's return must be applied to next year's return.

See this TurboTax help article for more information about capital loss carryovers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Cindy10

Level 1

StephenC

Level 1

JQ6

Level 3

SCswede

Level 3

Tami71

Level 3