- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unexpected Increase in Capital Loss Used After Adding 1099-B

Background:

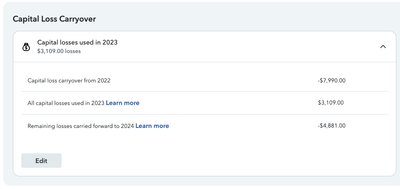

- I had a $7,990 capital loss carryover from last year.

- I understand I can deduct up to $3,000 of this carryover to reduce my taxable income in 2023.

- Before adding my Betterment 1099-B, my tax software showed the expected $3,000 deduction in "All Capital Losses Used in 2023" row.

Issue:

- After importing my 1099-B, the "All Capital Losses Used in 2023" amount jumped to $3,109.

- My Betterment statement only shows a $105 gain, so I'm confused where the extra loss came from.

Questions:

- How could my 1099-B cause this change if it doesn't show any losses?

- Can more than $3,000 in capital loss be used in a single year?

- Could you please explain how this calculation works?

- What should I look for in my Betterment 1099 B to understand this calculation?

Thank you for any insights!

Topics:

April 1, 2024

5:13 PM