- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- underpayment penalty, where is this form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

underpayment penalty, where is this form?

underpayment penalty I need to modify this form and I can't find it. I'm in the middle of filing my 2024 taxes. thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

underpayment penalty, where is this form?

The form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts can be accessed if you are using a TurboTax Desktop product as follows:

- Click on "Forms" in the upper right corner of your TurboTax screen to switch to "Forms Mode"

- In your left panel scroll down to "Form 2210"

- The "Form 2210" will display in your right panel

- At the bottom left of your screen click on "Delete Form"

- A pop-up box will appear .

- Select "Yes" to confirm your deletion of "Form 2210"

If you need to get back to the TurboTax entry screens that are related to the underpayment of taxes, to review your entries, you can do the following:

You can get there as follows:

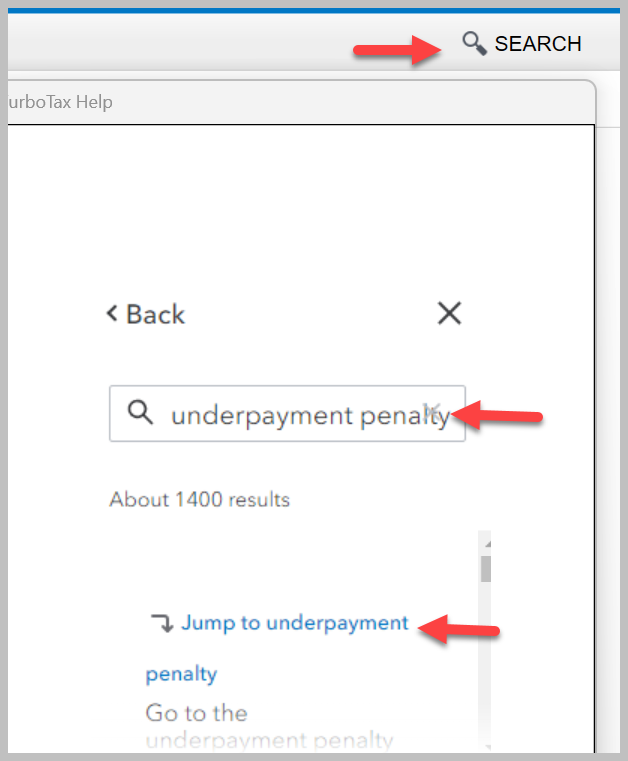

- Click on the search icon at the upper right of your TurboTax screen

- Type "underpayment penalty"

- Click on the link "Jump to underpayment penalty"

- If you can answer yes to all three questions you may be able to avoid some or all of your penalties.

Your screens will look something like this:

Click here for information on entering your estimated tax payments.

Click here for "How Do I Make Estimated taxes"

Click here for additional information on "How to Determine What to Pay and When"

Click here for common questions on Estimated taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

meltonyus

Level 1

bill Pohl

Returning Member

rkplw

New Member

jjon12346

New Member

bees_knees254

New Member