- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbotax Self-Employed Online - American Rescue Plan tax benefit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Self-Employed Online - American Rescue Plan tax benefit

Hello,

I'm using Turbotax Self Employed Online to file my taxes.

I'm done with my federal and tax returns and when I click on "Review" ( as I understand that should be a final step ) I do see:

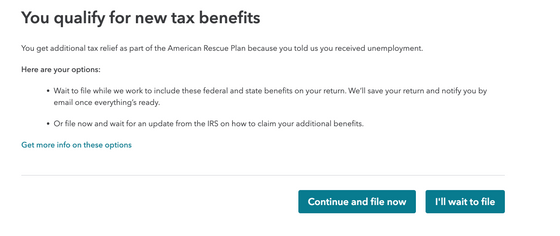

- Wait to file while we work to include these federal and state benefits on your return. We’ll save your return and notify you by email once everything’s ready.

- Or file now and wait for an update from the IRS on how to claim your additional benefits.

So, I did a little bit search on the forum to see what is this about, and I found that Turbotax published an update to Online version to support this deduction -

The Online TurboTax has been updated to reflect the federal tax forgiveness for the first $10,200 of unemployment. The desktop software update is in progress and will be ready soon. -

If Online version was updated, why I can't move forward? Does anyone here have the same problem?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Self-Employed Online - American Rescue Plan tax benefit

You can move forward unless you also need to file a state return. The states have not all been updated. You may be able to file the Federal return now (if using TurboTax Online) and the state later.

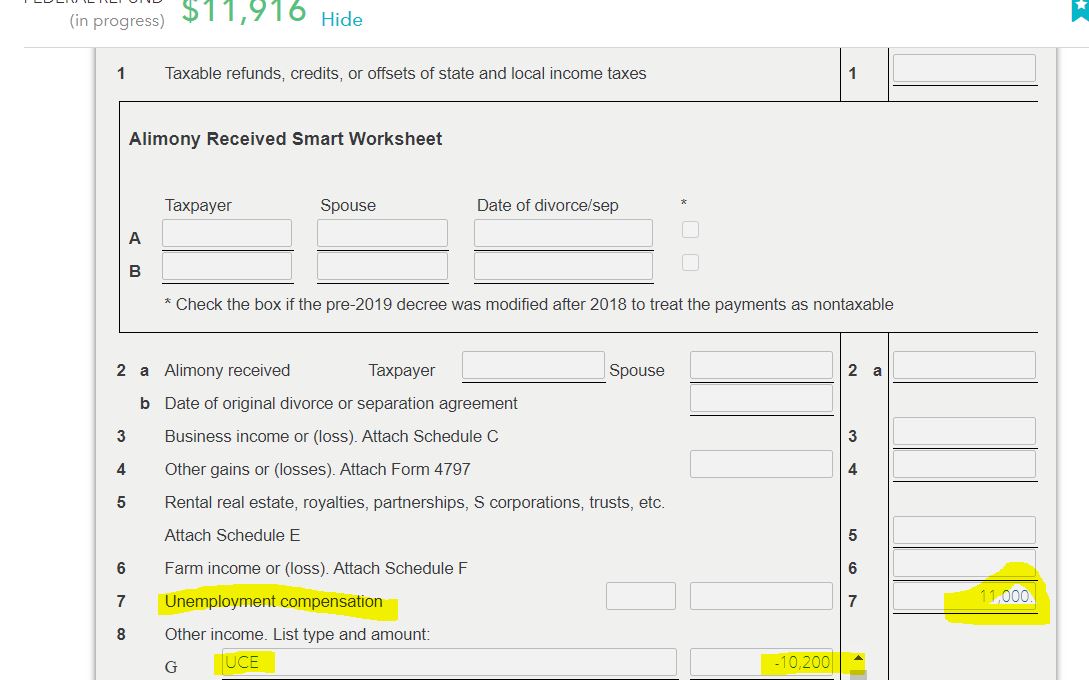

Please check Schedule 1 to see if the unemployment was offset.

Click Tax Home

Click Review if necessary to get Tax Tools on the left side-bar

Click Tax Tools on the left side-bar (you may need to use the scroll bar for the left side-bar to see this)

Click Tools on the drop-down list

Click View Tax Summary on the Tools Center screen

When you do this, Preview my 1040 appears on the left side-bar

Click Preview my 1040 on the left side-bar

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Self-Employed Online - American Rescue Plan tax benefit

Thanks for the Reply.

Yes, I'm filling federal + states tax at the same time, filling jointly ( me + my wife ) .

I'm filling in CA, so unemployment benefits are not taxable ( if that makes any difference ).

I don't think we can take this deduction, because our adjusted income is $151k ( this includes 2020 unemployment benefits my wife received )

but when I'm on Review step I see:

Do I just skip it and click "Continue and file now" or do I need to "wait" until turbotax makes it's update? ( which is weird because link I posted above says it was updated ).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Self-Employed Online - American Rescue Plan tax benefit

Yes, TurboTax Online has been updated for Federal Returns, but not all states are updated.

I would suggest your View/Save/Print your return before filing to make sure your Federal and California returns are correct before filing.

When you do enter your 1099-G, as a California resident, and you get to the state module of the TurboTax program, the software should confirm that your 1099-G is indeed CA state-tax exempt.

Click this link for more info from the California FTB.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Werniman0606

New Member

tukus-raides

New Member

aofigueroa117

New Member

in Education

akanding

New Member

olive917

New Member