- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Turbotax Self-Employed Online - American Rescue Plan tax benefit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Self-Employed Online - American Rescue Plan tax benefit

Hello,

I'm using Turbotax Self Employed Online to file my taxes.

I'm done with my federal and tax returns and when I click on "Review" ( as I understand that should be a final step ) I do see:

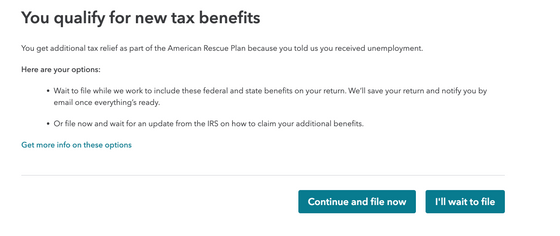

- Wait to file while we work to include these federal and state benefits on your return. We’ll save your return and notify you by email once everything’s ready.

- Or file now and wait for an update from the IRS on how to claim your additional benefits.

So, I did a little bit search on the forum to see what is this about, and I found that Turbotax published an update to Online version to support this deduction -

The Online TurboTax has been updated to reflect the federal tax forgiveness for the first $10,200 of unemployment. The desktop software update is in progress and will be ready soon. -

If Online version was updated, why I can't move forward? Does anyone here have the same problem?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Self-Employed Online - American Rescue Plan tax benefit

You can move forward unless you also need to file a state return. The states have not all been updated. You may be able to file the Federal return now (if using TurboTax Online) and the state later.

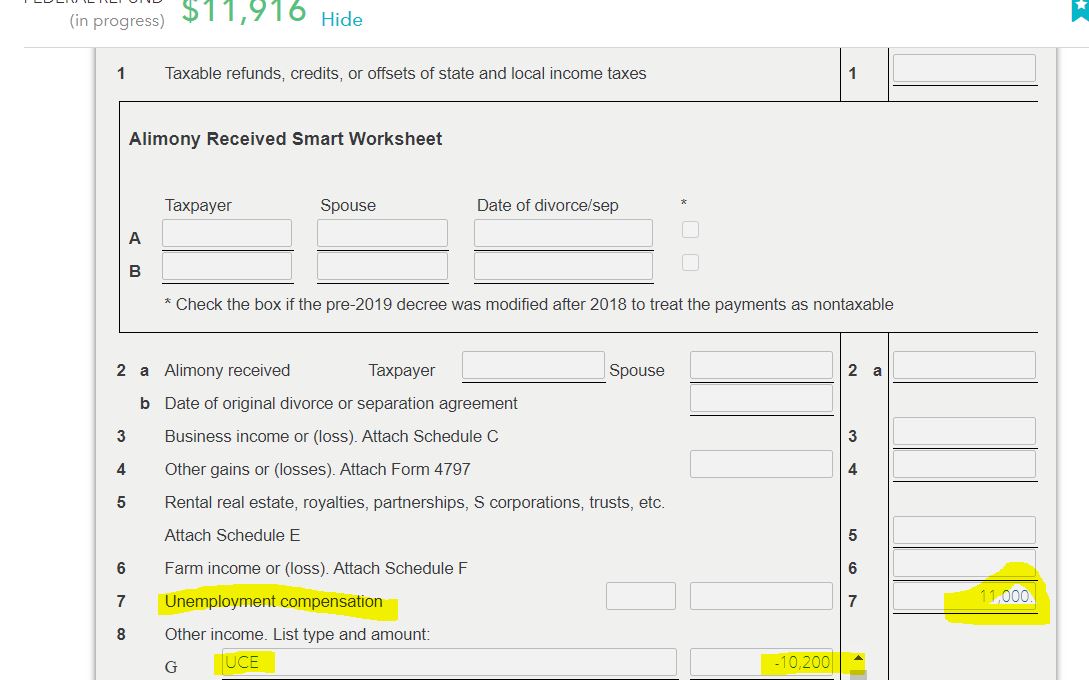

Please check Schedule 1 to see if the unemployment was offset.

Click Tax Home

Click Review if necessary to get Tax Tools on the left side-bar

Click Tax Tools on the left side-bar (you may need to use the scroll bar for the left side-bar to see this)

Click Tools on the drop-down list

Click View Tax Summary on the Tools Center screen

When you do this, Preview my 1040 appears on the left side-bar

Click Preview my 1040 on the left side-bar

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Self-Employed Online - American Rescue Plan tax benefit

Thanks for the Reply.

Yes, I'm filling federal + states tax at the same time, filling jointly ( me + my wife ) .

I'm filling in CA, so unemployment benefits are not taxable ( if that makes any difference ).

I don't think we can take this deduction, because our adjusted income is $151k ( this includes 2020 unemployment benefits my wife received )

but when I'm on Review step I see:

Do I just skip it and click "Continue and file now" or do I need to "wait" until turbotax makes it's update? ( which is weird because link I posted above says it was updated ).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Self-Employed Online - American Rescue Plan tax benefit

Yes, TurboTax Online has been updated for Federal Returns, but not all states are updated.

I would suggest your View/Save/Print your return before filing to make sure your Federal and California returns are correct before filing.

When you do enter your 1099-G, as a California resident, and you get to the state module of the TurboTax program, the software should confirm that your 1099-G is indeed CA state-tax exempt.

Click this link for more info from the California FTB.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

KarenHL

Level 1

SB103

New Member

jhichew

Level 2

steve110

Level 1

ExTexan

New Member