- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbotax Premire - Cannot efile due to AGI/PIN mismatch but they are matched!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Premire - Cannot efile due to AGI/PIN mismatch but they are matched!!

I bought the TuboRax premiere for the year 2021 tax.

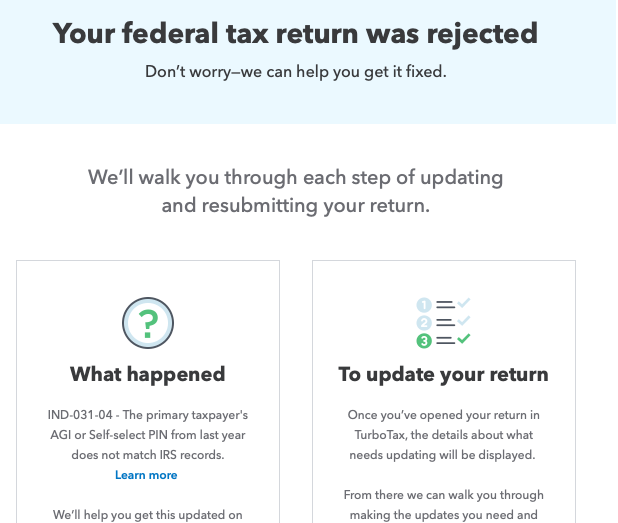

I choose e-file and constantly got rejected email.

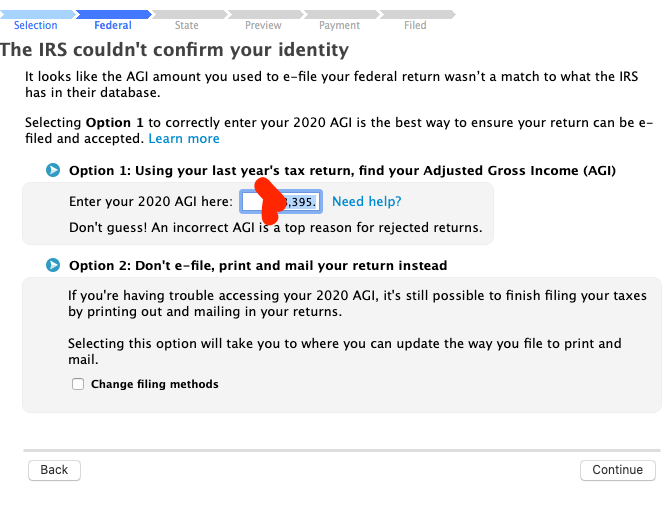

Noticed the possible reason is listed as "IND-031-04 - The primary taxpayer's AGI or Self-select PIN from last year does not match IRS records."

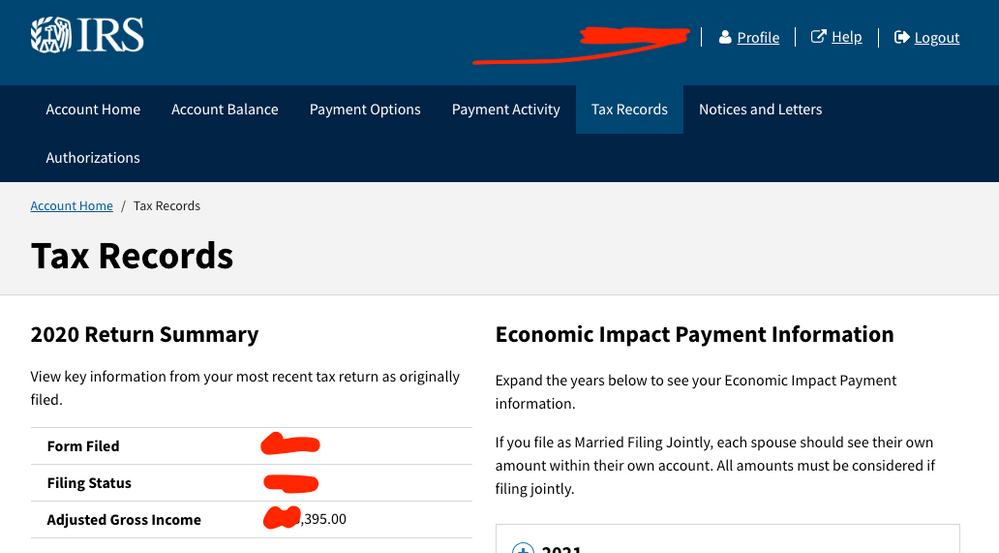

However I am pretty sure my AGI number is correct b/c I got this directly from IRS ID.me ( For anyone who does not knowm ID.me is a website for IRS to trace your tax information. You should register it!)

IRS ID.me:

turbotax

Year 2021 is the first year to e-file. For last year, I believe I mailed the tax, not e-file. ( I acrually bought and used Turbo tax last year (Year 2020) and e-file rejected, so I changed my mind to directly mail the tax info, so there should be no 5-digit e-file PIN for last year).

How do I fix this issue?

If Turbo tax cannot help me e-file for continously 2 years, I don't think I should buy it anymore.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Premire - Cannot efile due to AGI/PIN mismatch but they are matched!!

Please see the below TurboTax help article for a list of potential reasons that returns get rejected due to the AGI and suggested solutions.

What if I entered the correct AGI and I'm still getting an e-file reject?

For additional information, please see How do I fix e-file reject IND-031-04 or IND-032-04?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Premire - Cannot efile due to AGI/PIN mismatch but they are matched!!

I am having the EXACT same issue AND I had federal tax due which I paid on a card with first submission and now when trying to resubmit, Turbo Tax is NOT recognizing my payment and wont file unless I pay AGAIN!!!! I have had a horrible experience this year and after using Turbo Tax since 1997 (yep 24 years!) I may never use again! (I didn't get a free state file with my Deluxe version either)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Premire - Cannot efile due to AGI/PIN mismatch but they are matched!!

The main reason your filing gets rejected even though the AGI matches you listed matches last year’s AGI is because the IRS is millions of flings behind and has not yet recorded your AGI. When I got mine rejected, I checked the IRS website where you can get a transcript of last year's taxes and found that although they had a transcript of my 2019, it said N/A (not available) for 2020. I then went and listed 0 as my AGI on my TurboTax filing. I submitted it and still got it rejected. However, when I looked closely, I saw that the description said that the IRS could not match my wife’s AGI. We file our taxes jointly and although I had changed my AGI to 0, I failed to change my wife’s AGI to 0 as well. I then went ahead and changed here AGI to 0 and VOILA! My filing got accepted! If you want to check your transcript on the IRS website, here is the link. Get Transcript | Internal Revenue Service (irs.gov)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rawalls18

New Member

mertkorkmaz885

New Member

susan106

New Member

nicdev

New Member

esma-melike-karipcin

New Member