- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbotax 2022 California Estimated Tax Form 3 Missing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2022 California Estimated Tax Form 3 Missing

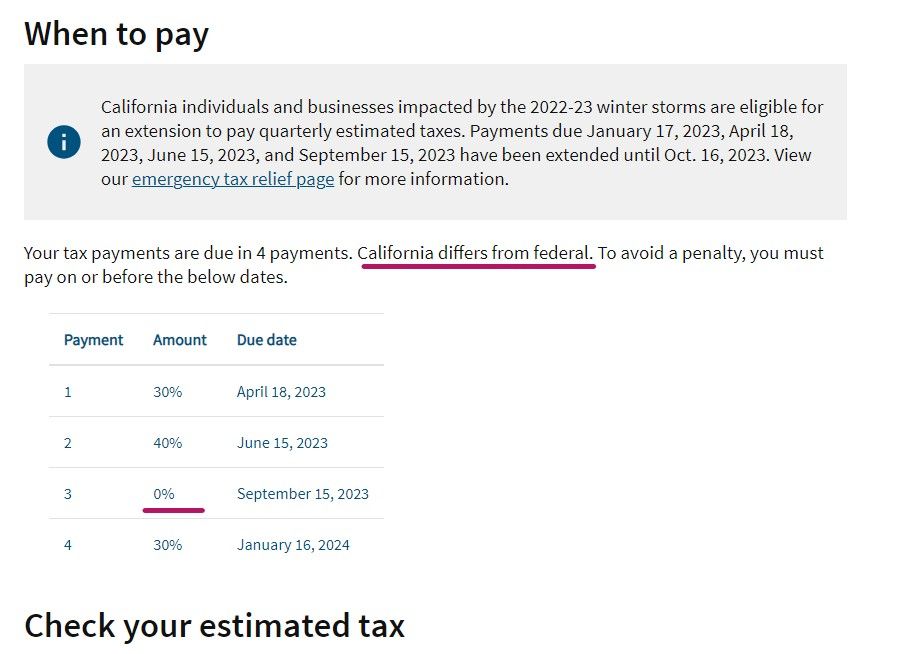

In 2023 the California Franchise Tax Board changed their requirements to add a fourth estimated tax date, September 15th 2023: https://www.ftb.ca.gov/forms/2023/2023-540-es-instructions.html

TurboTax 2022 has not been updated to support this new form. Why not?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2022 California Estimated Tax Form 3 Missing

The 3rd installment doesn’t have to be paid. The 4th is due in January 2024.

Installment Payments – Installments due shall be 30 percent of the required annual payment for the 1st required installment, 40 percent of the required annual payment for the 2nd required installment, no installment is due for the 3rd required installment, and 30 percent of the required annual payment for the 4th required installment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2022 California Estimated Tax Form 3 Missing

Thank you. Do you have the FTB website reference for this statement?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2022 California Estimated Tax Form 3 Missing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2022 California Estimated Tax Form 3 Missing

@clarkmurray see that link you posted. At the very top first paragraph right under General Information.......

Installment Payments – Installments due shall be 30 percent of the required annual payment for the 1st required installment, 40 percent of the required annual payment for the 2nd required installment, no installment is due for the 3rd required installment, and 30 percent of the required annual payment for the 4th required installment.

Don't understand why it lists all 4 dates below. Or doesn't list 0 for the third one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2022 California Estimated Tax Form 3 Missing

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2022 California Estimated Tax Form 3 Missing

They list September because the Feds have 4 payments with one in September ...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Wulin

New Member

valery2

New Member

Jleroux02

New Member

SonomaTom

Returning Member

Fred_R

Level 3