- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TT not deducting basis from Roth IRA withdrawal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT not deducting basis from Roth IRA withdrawal

I withdrew some $20,000 from a Roth IRA with an $18,000 basis. TT is reporting the whole withdrawal as income. I tried entering on IRA Information Worksheet, but the result remains the same.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT not deducting basis from Roth IRA withdrawal

Yes, you can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free.

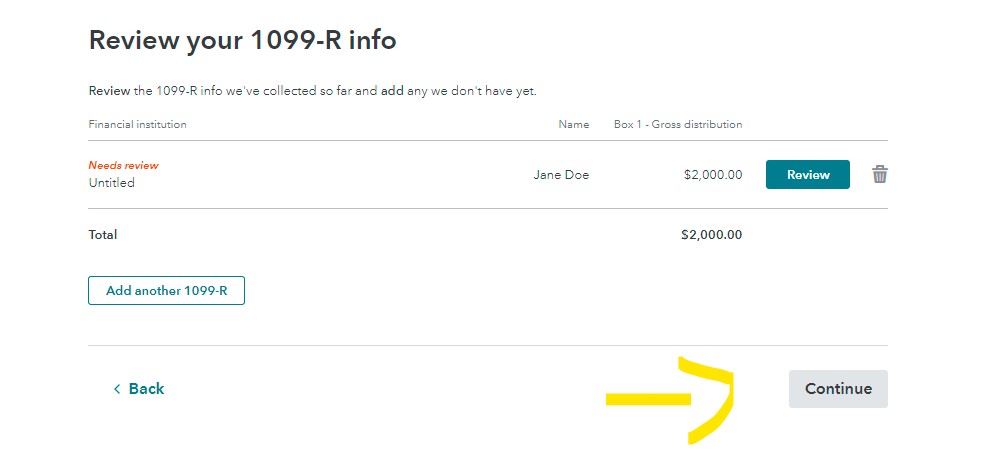

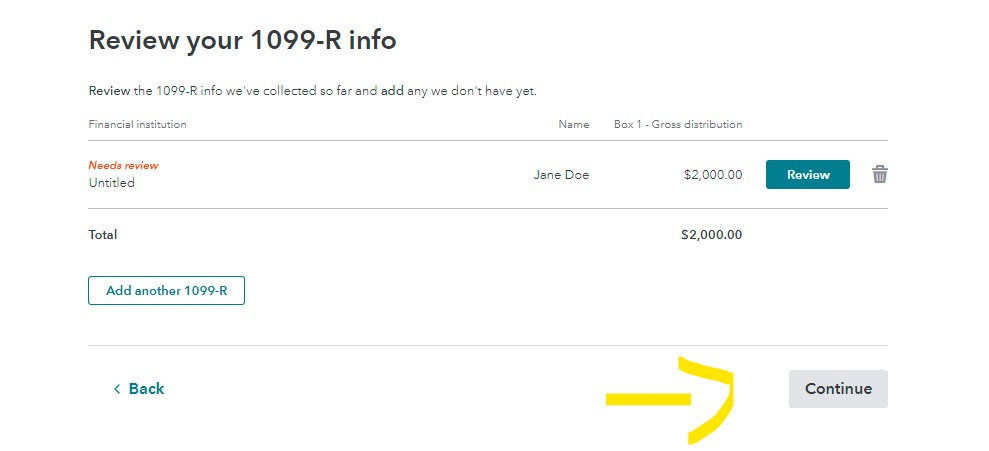

Please follow these steps to enter your 1099-R and the basis of your Roth IRA (step 6):

- Login to your TurboTax Account

- Click on the "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R” and enter your 1099-R

- Click "continue" after all 1099-R are entered

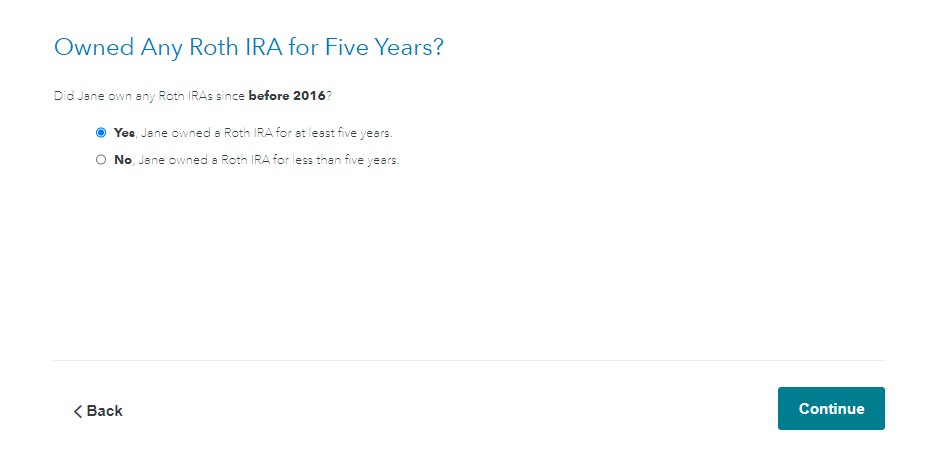

- Answer if you had the Roth account for 5 years

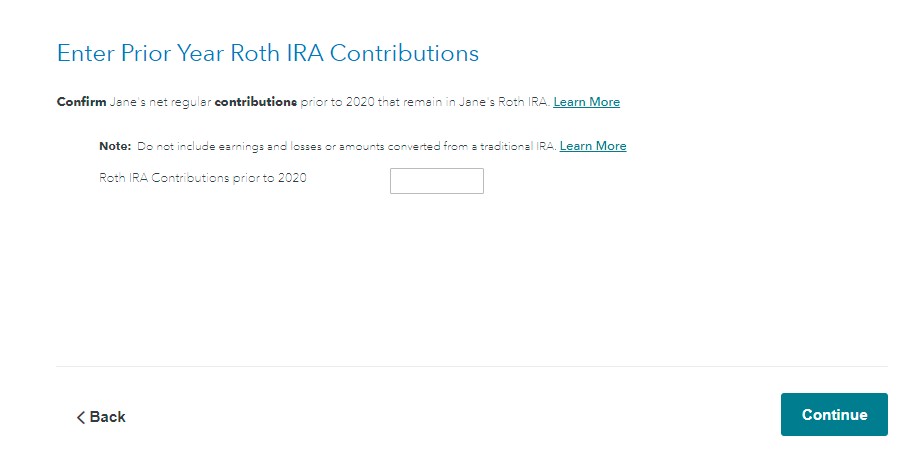

- Continue until "Enter you prior year Roth IRA contributions" screen and enter your net regular contributions prior to 2020 and continue through the rest of the questions.

You can check your entry on line 4 of Form 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT not deducting basis from Roth IRA withdrawal

Thank you for your response, however, I don't get any of those questions. I even tried deleting the 1099-R and reentering it, putting the $18,000 in Box 5 and 3271.75 in Box 6, but nothing changed. TT still shows the Total withdrawal as income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT not deducting basis from Roth IRA withdrawal

Sorry, I didn't go far enough to get to the questions. I did as you instructed and TT still shows the $21,217.45 withdrawal as 2020 income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT not deducting basis from Roth IRA withdrawal

Please enter your 1099-R as shown on the form. Then after you entered all 1099-Rs please click "CONTINUE" on the "Review you 1099-R info" screen. You have to continue for the questions to show up. After you clicked "continue" there first will be a disaster question and then the Roth IRA questions will show up.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT not deducting basis from Roth IRA withdrawal

OK, Looking at the 1040, I see that even though the full withdrawal is shown in the 1099-R section, the basis is deducted on line 4b of the 1040. Thanks.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

Shelton-steve-2017

New Member

florence3

Level 2

ue1

Level 3

Craig-M

Returning Member