- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Trying to understand 1-person LLC taxes (paid myself as W-2)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

I'm trying to prepare my 2022 taxes (using TurboTax Deluxe, if you care).

In Jan I got hired as a software engineer for a non-US company who at the time was unable to hire me as W2.

Given the size of the monthly payments I expected to earn in 2022 from them, it looked like S corp would be advantageous. So, in the beginning of 2022, I created a 1-person LLC. I set myself up as a W-2 employee of my LLC and paid myself on payroll. I also created a solo 401k.

However, in May, they opened a US entity and were able to hire me as W2. I stopped doing work for my LLC (but I've kept the business legally open), since its only customer was the company who converted me to W2. So my LLC's earnings were less than $100k for the year, and it probably doesn't make sense to file a late election for S corp.

I'm starting to feel worried that I'm getting taxed "twice" (or more than I should). My 1-person LLC paying me W-2 payroll already had taxes withheld. (For example, I've paid FUTA and SUTA via payroll.)

How can I clear up this mess and minimize the "cost" of this "mistake"?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

You have a couple of options, but first a bit of explanation. As single member LLC, the IRS considers you a "disregarded entity" unless and until you file an election to be treated as an S-Corp. As a disregarded entity, you file your business income and expenses on Schedule C - Profit or Loss from Business (Sole Proprietorship). You are self-employed as far as the IRS is considered. You are not supposed to pay yourself as a W-2 employee. You pay your Social Security and Medicare tax via Schedule SE. If you have elected S-Corp status (and you can make the election when you file) you file your business income and expenses on Form 1120-S. You treat yourself as an employee and pay yourself via W-2. Any net profit the Company has (including the expense of paying you as an employee) is reported as income on a K-1.

So, what are your options? You can file Schedule C (you will need to upgrade to TurboTax Self-Employed) and report your payroll expenses as if you were paying a 3rd party. While not the correct way to do things, you won't be penalized. You won't be the first person to do that. Your other option is to file an 1120-S, and make an election to be treated as an S-Corp with your return. You will need to purchase TuboTax Business. If you make the S-Corp Election, you will have to file an 1120-S each year, even if you have no income and no expenses, unless and until you revoke your S-Corp election. If you remain a disregarded entity, you will only have to file Schedule along with your personal tax return IF you have self-employment income and/or expenses to report.

Either way, if you paid Social Security that is in excess of the withholding amount on the $137,000 of earnings subject to taxation for 2022, you will be credited for that on your tax return, whichever way you file. There is no earnings limit on the Medicare tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

@DavidD66 , thank you so much for your answer! 💪

I'm thinking about taking the approach where you said "file Schedule C and report your payroll expenses as if you were paying a 3rd party."

You said "While not the correct way to do things, you won't be penalized." So, would it pass (be acceptable) if I were chosen to be audited?

Since I'll be using TurboTax (upgraded), I won't necessarily even be aware of forms Schedule C and Schedule SE. How / where can I ensure that TurboTax (and therefore the IRS and state of GA) know the right values for everything so that I'm not double-paying for Medicare, FUTA / SUTA, or anything else?

I really appreciate your help!

Thanks 😀

P.S. When you wrote "you will only have to file Schedule along with" did you mean "Schedule C"?

And you referred to "TurboTax Self-Employed" and "TurboTax Business", but I'm guessing you mean "TurboTax Home & Business" for both of them, since the only upgrade options I see from Deluxe are to "Premier" or "Home & Business".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

If you are using the Desktop installed program (Home & Business is a Desktop version) you can even stay in Deluxe. All the Desktop programs have the same forms. You just get more help and guidance in the higher versions. The Self Employed version is the name for the Online web version.

But Turbo Tax Business is a completely separate program from Home & Business. Business will not do a personal 1040 return. Home & Business is for 1040 returns that need Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

@VolvoGirl Oh ok, thank you. Yeah I've definitely been confused about the product delineation / versions. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

First thank you for your questions and answers. My issue is related. That is why I am writing here instead of creating a separate post.

I am using Home & Business is a Desktop version 2022 to file my taxes. Although I got my LLC done last year (oct 2021), I only started to use it for business in 2022. I continued to work on W2s with other companies as an IT BSA/PM. That is my main source of income.

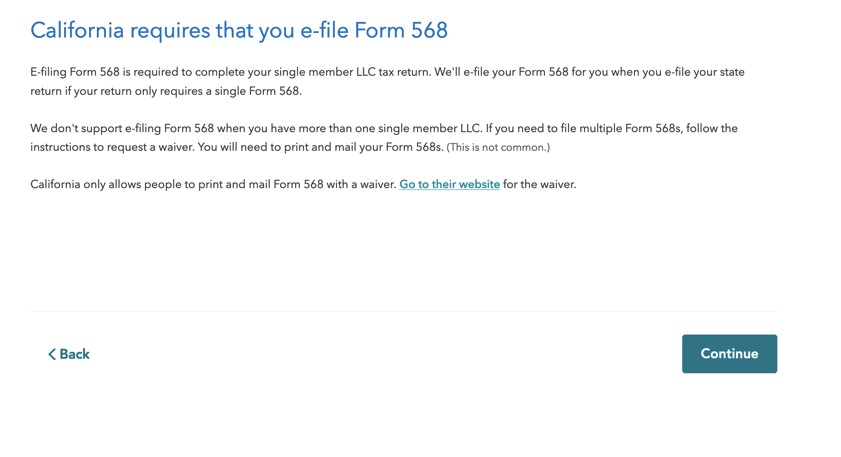

My TT review gives one error. It state that TT can't file my tax because "This returns includes an LLC which is not a disregarded entity. " I can however print and mail my California tax.

There there a way, I can fix it?

Thanks!

Archanaa

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

Perhaps, did you see a screen in the California section of your return entitled, Is [name of your LLC] owned by a single member LLC? If you saw this screen, did you select Yes? Assuming you saw this screen, and selected Yes, go back to that screen and select No. Selecting No might trigger the CA section of TurboTax to consider your LLC as a disregarded entity as opposed to what you are seeing now.

In the event you must print and mail Form 568, CA requires a waiver be included with Form 568 when a taxpayer prints and mails Form 568. Here is the link to the CA website that relates to waivers. Scroll down the page and select Start Waiver to get your waiver request.

Business Entity E-File Waiver Request

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

First, I can't thank you enough for responding so soon.

I checked it again, CA state filing does not ask anywhere such a question. I clicked on the Form and checked each field. Then I checked in .pdf version of 1040.

Please help.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

Perhaps the reason you are not seeing the screens referenced in the prior post is because those screens are only triggered in the initial intake of California information. Thus, as a possible workaround, consider deleting your CA return from TurboTax, and then re-enter it for your business. As you move through the CA section, check if you see the following screens. (Note: the Principal Business information on these screens relates to our test return.)

The first screen, Business Summary, inquiries about SMLLCs and CA. If you see this screen, select Edit next to your business. On the next screen which asks whether your business is owned by a SMLLC, select yes, and that response should trigger the last screen in this post. As you finish the CA section, see if Form 568 has been prepared.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

Thank you!

I will delete it and try again. CA tax is not that bad to re do. I will get back to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

It does not let me delete the CA form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trying to understand 1-person LLC taxes (paid myself as W-2)

Since TT did not allow me to delete CA state tax, I purchased CA tax from TT online and downloaded a fresh copy. (Yes, paid extra $45 but it is okay) It made me do the same steps that I had done with the CA state before but it did not ask for steps you showed.

I will print it and file it via US postal service. I have submitted Form 568, using the link you gave.

Thank you!

Archanaa

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stelarson

Level 1

JazzAlternative

New Member

ranscoste

Level 2

bradsauve

New Member

vikingcat

Returning Member