- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

No. Schedule 3 line 12e is deferral of Self-Employment taxes.

The Coronavirus, Aid, Relief and Economic Security Act (CARES Act) allows employers to defer the deposit and payment of the employer's share of Social Security taxes and self-employed individuals to defer payment of certain self-employment taxes.

Self-employed individuals may defer the payment of 50% of the Social Security tax on net earnings from self-employment income for the period beginning on March 27, 2020 and ending December 31, 2020.

Learn more at Deferral of employment tax deposits and payments through December 31, 2020

To access that section:

- Click on Federal on the left column

- Click on Deductions & Credits at the top

- Look for Self-employment tax deferral then Edit/Add

- Answer Yes or No to Do you want more time to pay your self-employment tax?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

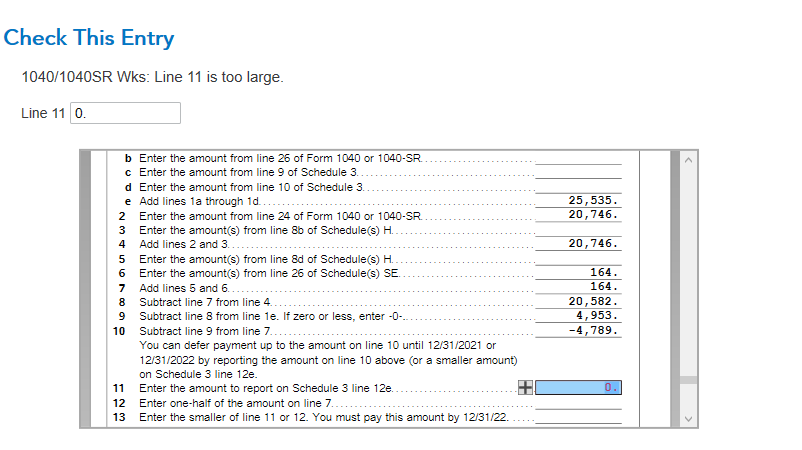

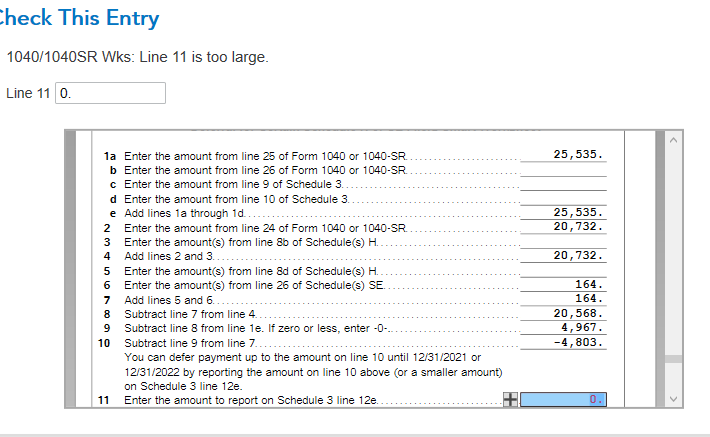

Thank you so much for your quick reply. I did all of that and it is still coming up with an error:

Any other thoughts on why this error keeps coming up? It is the only thing preventing me from filing my taxes. I hate to spend another $100 for LIVE if this is an easy fix?

Also, not sure if I should be claiming QBI? For $3300/income from paypal/ebay

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

No. The form 1099-K is used to report income from merchant services and other third party transaction online. It must be entered on Schedule C, Profit or Loss from Business, as self-employment income.

The Schedule 3, line 12a is for form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gain. You may not need Form 2439 on this particular income.

Below are steps to enter 1099K in Turbo Tax.

- Under Federal, jump to Income and Expenses.

- Scroll all the way down until you get to Self-employment (Schedule C: 1099-MISC, 1099-NEC, 1099-K, expenses), click show more,

- Click start on Self-employment income and expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

I have followed all of the advice that I have received...THANK YOU! I selected know for form 2439 so that is not causing this error.

I have gone through the self-employed section so many times...the error is not there. Could this be a turbo tax glitch?

I don't know why it is saying 0 is too large a number to enter? Please help with any other suggestions. Thank you. I am really stuck

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

First, revisit the section for the Self-employment tax deferral entry:

- Return to the Deductions & Credits section.

- Scroll to Tax relief related to COVID-19 and Show More.

- Select Self-employment tax deferral and select Revisit.

- Answer Yes at the next screen to get back to Let's start by getting your eligible income.

- If you do not want to defer any self-employment income, "Enter your eligible self-employment income" should be blank.

- Select Continue.

- At Tell us how much you'd like to defer, "Enter amount" should be blank.

- Select Continue.

- If you do not want to defer any self-employment income, "Enter your eligible self-employment income" should be blank.

- Scroll down and select Wrap up Tax Breaks and Continue.

- At Charitable Cash Contributions under Cares Act, if you made cash donations to eligible organizations, enter the amount up to $300 for all taxpayers except married filing separate, who would each have a maximum of $150 and Continue. Otherwise, leave this section blank, do not add 0 if this is not applicable.

- I recommend running through the Federal Review again

Just to confirm, reporting Form 1099-K on Schedule C is when you are operating a trade or business. If Form 1099-K was from selling personal items, much like from a garage sale, then there is another way to report that income.

If that applies to you, first, delete Self-employment income & expenses completely by returning to that section and clicking the trash can icon.

Then, follow these steps:

- From the left menu, go to Federal and select the first tab, Wages & Income

- Add more income by scrolling down to the last option, Less Common Income, and Show more

- Scroll down to the last option, Miscellaneous Income, 1099-A, 1099-C and Start

- Choose the last option, Other reportable income and Start and Yes

- Enter the applicable description and amount and Continue

- First, enter Form 1099-K as received. It is essential that the full amount be entered. Be sure to include in the description: Personal Property Sales (For example, the entries were Description Personal Property Sales and 100)

- Next, repeat this process with the cost of the items sold. The IRS allows a deduction for personal property up to the amount of the sale.

- You should be at Other Miscellaneous Income Summary with the Personal Property Sales amount listed.

- Select +Add Another Income Item on the lower left side.

- At Other Taxable Income enter Cost of Personal Property for description and the negative amount and Continue. (To continue with the example, the amount would be -100.)

- Now returned to Other Miscellaneous Income Summary, select Done.

[Edited 02/20/2021 | 5:15 AM PST]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

I am having this same issue with my filing. I had income in 2020 from a part-time consulting gig (1099-NEC) and every time I try to file, the system says to fix the same screen as the other guy.

| 1040/1040SR Wks: Line 11 is too large. |

I do not want to defer anything as I am getting a refund, but the system has a glitch and won't allow me to file over this. I called and waiting on hold for 40minutes to be told I need to pay another $60 to speak to a CPA. I already called a CPA and they said it must be a glitch as I entered it correctly. I am soooooo frustrated.

1099-NEC income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

Please read this link, about how one user was able to resolve this problem. Here afre the steps he took.

- The error is generated because when you delete something under the self employed section of income, it leaves an incomplete form and just starts a duplicate when you go back to redo it.

- Manually go through the forms section and delete all of the 1099NEC and the section c duplicates. Delete just the duplicates.

- in Turbo Tax online, go to tax tools>tools>delete a form. look for all duplicate 1099-NEC and Schedule C's.

- If using the software, go to forms and delete the duplicates.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

I used the advice that was given to me last week to count that money as earned yard sale money.

the truth is I paid more for the items than I earned.

this made the most sense to me.

I filed my taxes on Sat.

it must be a system glitch. It is super annoying!

thank you all for taking the time to provide advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

Thank you for the wonderful advice!

I have received great advice from this community. It made more sense to input the eBay income as yard sale money as opposed to a small business, which it isn’t!

In outing it in as extra income this way also lowered my audit risk😁.

thank you all!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

I'm lost from Joanna's answer. Need more specifics about "under Federal jump to Income and Expenses".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

How Form 1099-K is entered in TurboTax depends on why the form has been received.

If it was received for selling personal items, much like in a garage sale, and the purpose is not to run a trade or business, then the IRS allows this to be reported as Other Income for the Personal Property Sales.

While the IRS does allow costs incurred to offset the income, it must not create a loss.

If your Form 1099-K meets this criteria, then follow these steps in TurboTax to report Form 1099-K as received, and also report the Cost of Personal Property.

- From the left menu, go to Federal and select the first tab, Wages & Income.

- Add more income by scrolling down to the last option, Less Common Income, and Show more.

- Scroll down to the last option, Miscellaneous Income, 1099-A, 1099-C and Start.

- Choose the last option, Other reportable income and Start and Yes.

- Enter the applicable description and amount and Continue

- First, enter Form 1099-K as received. It is essential that the full amount be entered.

- For a description, include Form 1099-K and Personal Property Sales if this is coming from personal items sold similar to selling items at a garage sale.

- Next, enter an adjustment to reflect the cost of these items as an offsetting, negative amount up to the amount of the income.

- For the cost description, include Form 1099-K and Cost of Personal Property

- In other words, if the goods cost you $100, but Form 1099-K was for $10 in sales, the maximum cost allowable would be $10.

- First, enter Form 1099-K as received. It is essential that the full amount be entered.

If your Form 1099-K income is from an intent to earn money from a trade or business, enter Form 1099-K in the Income section of your Self-employed income & expenses. Report the cost of those sales as an other miscellaneous expense for your business.

@bofamam2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

This year I received a 1099K from Ebay and also from Paypal.

I am thinking some of the income may overlap?

Plus the 1099K from paypal says card not present transactions which indicates to me that I used paypal who then charged my account...why am I including this as income? And do I include this with the ebay income?

This is crazy!

Please help.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

I am assuming this is a business of sorts you are running. At the very minimum selling items on the internet. Rather than be confused by whether the 1099K was also included elsewhere, I would record the activity directly on the schedule c.

- Go to self employment income and expenses

- enter the business information

- total up all of the money received in sales (make sure it is at least as much as your 1099-K's combined). The part where they ask the type of income received, like 1099K, 1099 Misc, just type in cash and enter the amount.

- record the expenses associated with it, such as the value of the items you sold.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year I received a 1099-K for income earned from ebay/paypal. I have one error I cannot get passed: Enter the amount to report on schedule 3 line 12e?

No, I do not run a small business. I have sold stuff on ebay totaling $1900. The paypal 1099K I don't understand. I do use paypal to purchase items that are then charged to my credit card.

The 1099K from paypal is not income based. Is explicitly says card not used in transaction.

Thanks,

Stacy

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thedustinmartin

New Member

markmuse120

New Member

jack

New Member

user17513306027

New Member

andreadaniel75

New Member