in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Section 179 Carryover of Disallowed Deduction from 2021 to 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 Carryover of Disallowed Deduction from 2021 to 2022

Program will not allow me to add the carryover amount on line 10 Form 4562. How do I do this? I have a carryover of disallowed deduction from 2021 to 2022 and it will not let me override it. Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 Carryover of Disallowed Deduction from 2021 to 2022

the 179 carryover is not entered on the 4562 but rather in the carryover section of whatever form the 179 deduction was reported. should be there automatically if you used Turbotax in 2021 and properly transferred the data.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 Carryover of Disallowed Deduction from 2021 to 2022

Mine was carried over but when an error check noted that the amount the program carried over could not be used. I had to make the amount zero to get rid of the red exclamation mark and to stop getting an error message. Why would the program carry forward this amount and then have an error message that the program itself did it wrong? So, now I have tried to manually put the amount in the form and it gets shaded yellow but and the amount will not print out on the form. Is there a problem with the program? In 2021 I had carryover amount on 2021 line 13 of Form 4562 for a new refrigerator I bought for a rental. I believe the program or I should be able to manually enter that amount on line 10 of my 2022 Form 4562 but the program will not let me. What good is Section 179 if it cannot be used? It is like I am not getting a deduction for this refrigerator.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 Carryover of Disallowed Deduction from 2021 to 2022

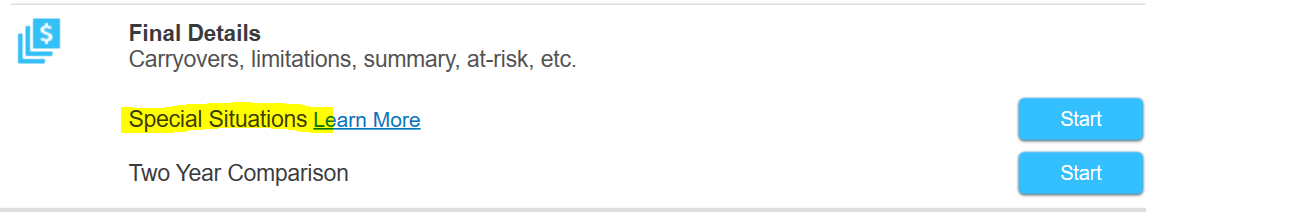

You need to edit the business profile for your business, you will come to a screen that says Final Details and choose the option Special Situations. On the next screen you will see an option saying you have sect 179 carryovers from the previous year. Choose that option and you can enter your carryover amount from the previous year. The amount you enter will show on line 10 of form 4562.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 Carryover of Disallowed Deduction from 2021 to 2022

I have Turbo Tax Premier. I cannot find in the program how to edit business profile. Appreciate your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 Carryover of Disallowed Deduction from 2021 to 2022

In TurboTax Premier, Section 179 carryovers appear at the end of the Rental Property section.

- Open your return and go to Federal Taxes >> Wages & Income >> Rental Properties and Royalties. Click Update.

- From the Rent and Royalty Summary list, click Edit/Update beside the name of the property you need to work on.

- At the bottom of the page, click Done With Rental Property.

- Continue to the page "Section 179 Carryover" and enter your carryover amount(s).

- Continue back to the Rental and Royalty Summary page to save your work.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 Carryover of Disallowed Deduction from 2021 to 2022

I am running into this exact same issue for the carryover from 2022 to 2023. The question for section 179 carryover comes up and it says to enter the amount from last year's form 4562. The options to enter it is section 179 carryover or QBI section 179 carryover. On form 4562 from 2022 for this rental property I have an amount on line 13. The amount there needs to go on line 10 on form 4562 for the rental property this year. I entered the amount from line 13 from 2022 in the box for section 179 carryover. When it does the smart check I get errors. The first one is: Schedule E Worksheet : Sec 179 Carryforward-Reg should not be entered, because this rental property is not a commercial property. I went to form 4562 for this year (2023) to check if the amount I entered for section 179 carryover shows on line 10 of form 4562 for the property and it is not there. It won't let me manually enter the amount on line 10 of form 4562. How do I get turbotax premier desktop version to place the Carryover of disallowed deduction to 2023 on line 13 of 2022 form 4562 onto line 10 of 2023 form 4562? I tried entering it under section 179 carryover and QBI section 179 carryover but both ways do not put it on 2023 form 4562 line 10 like it needs to be. I tried the online version and couldn't do it on there either. Anyone figured out how to handle this problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 Carryover of Disallowed Deduction from 2021 to 2022

We have tested the Section 179 carryover but are unable to reproduce the experience you have seen. It would be helpful to have a TurboTax ".tax2023" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, please follow these instructions:

In TurboTax Online, open your return, go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number and tag (@) the Expert requesting the token from you.

- Please include any States that are part of your return.

We will then be able to see the same experience you are having. If we are able to determine the cause, we'll reply here and provide you with a resolution.

If you are using TurboTax for Desktop, go to Online in the top menu, then choose "Send Tax File to Agent." On a Mac computer, choose File >> Share or Help >> Send to Agent.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 Carryover of Disallowed Deduction from 2021 to 2022

I have this exact problem in 2023

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 Carryover of Disallowed Deduction from 2021 to 2022

This experience has been verified and is under investigation. We do not expect a resolution before the tax filing deadline for tax year 2023.

You will need to remove the Section 179 carryover from your current year return in order to resolve the form error. See previous post for instructions to edit this entry for your Rental Property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ssolfest

Level 2

mjtax20

Returning Member

rspalmera

New Member

purkettsanbdee2-

New Member

DIY79

New Member