- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule K box 17 last year has v, w, x. This year it only has a V. Do I just enter the ordinary income there? Where will I enter the wages(W) and unadjusted wages(X)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K box 17 last year has v, w, x. This year it only has a V. Do I just enter the ordinary income there? Where will I enter the wages(W) and unadjusted wages(X)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K box 17 last year has v, w, x. This year it only has a V. Do I just enter the ordinary income there? Where will I enter the wages(W) and unadjusted wages(X)?

The Form 1120S Schedule K-1 codes changed in 2019.

Enter the code V when you enter the K-1 box 17 screen, but you don't need to enter an amount. Continue on, and you'll find the screen(s) you need to enter the Section 199A Statement/STMT information. Later in the questions is a screen titled "We need some more information about your 199A income or loss". This screen must be completed with the box 17 code V Section 199A Statement or STMT that came with your K-1, in order for your QBI deduction to be calculated.

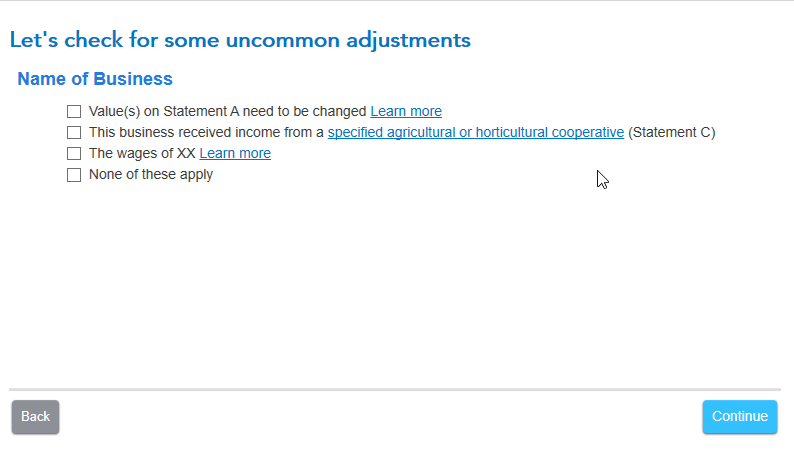

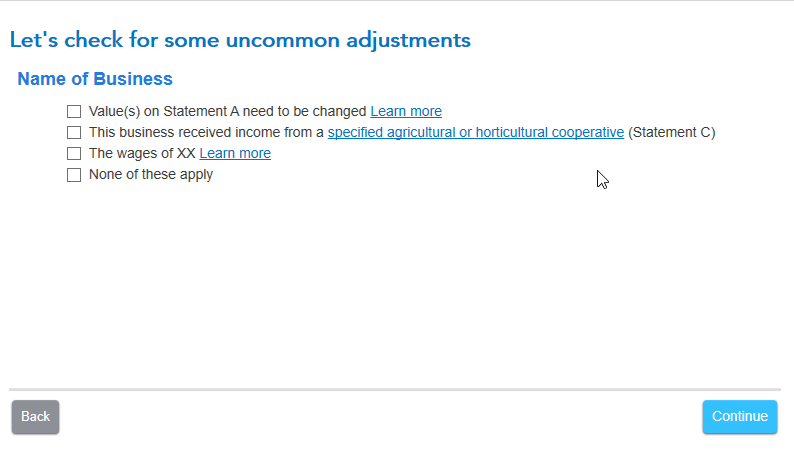

And, depending on what is reported on your Section 199A Statement/STMT, you may need entries on the next "Let's check for some uncommon adjustments" screen as well.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are screenshots of the two screens to enter your Section 199A Statement/STMT information:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K box 17 last year has v, w, x. This year it only has a V. Do I just enter the ordinary income there? Where will I enter the wages(W) and unadjusted wages(X)?

The Form 1120S Schedule K-1 codes changed in 2019.

Enter the code V when you enter the K-1 box 17 screen, but you don't need to enter an amount. Continue on, and you'll find the screen(s) you need to enter the Section 199A Statement/STMT information. Later in the questions is a screen titled "We need some more information about your 199A income or loss". This screen must be completed with the box 17 code V Section 199A Statement or STMT that came with your K-1, in order for your QBI deduction to be calculated.

And, depending on what is reported on your Section 199A Statement/STMT, you may need entries on the next "Let's check for some uncommon adjustments" screen as well.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are screenshots of the two screens to enter your Section 199A Statement/STMT information:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K box 17 last year has v, w, x. This year it only has a V. Do I just enter the ordinary income there? Where will I enter the wages(W) and unadjusted wages(X)?

Thanks!!! I couldn't figure where the amounts went this year and was going crazy figuring it out.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abarmot

Level 1

dinesh_grad

New Member

rpaige13

New Member

grgarfie

New Member

kms369

Level 2