- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Sale of primary home with Joint ownership and lived there for only 23 months

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of primary home with Joint ownership and lived there for only 23 months

My son and his fiancé purchased a condo on for $192,500 on 9/15/2019 and sold it on 8/27/2021 for $230,000. The deed and mortgage is listed in both names even though my son makes all mortgage and property tax payments. So I have 2 questions. Because they lived there for 23 of 24 months and didn’t meet the 2 year requirement, can they still be excluded from the gain on the sale of the property or Would he have to pay a pro rated amount (23/24= 4%)?

He received 1099-s in only his name, for $115,000, 50% of the sale proceeds so when entering the cost of the condo when they purchased it should I only enter 50% of that amount ($192,500/2 = $96,250) or the full $192,500?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of primary home with Joint ownership and lived there for only 23 months

Yes, if the proceeds are split 50% then you will only enter 50% of the purchase price. Please see Basis Adjustments for additional information.

Since he didn't meet the Eligibility Test, he may still qualify for a partial exclusion of gain. Your son can meet the requirements for a partial exclusion if the main reason for his home sale was a change in workplace location, a health issue, or an unforeseeable event. Please see Does Your Home Qualify for a Partial Exclusion of Gain? for details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of primary home with Joint ownership and lived there for only 23 months

Thank you. I do have a follow up question...

He lived in the house for almost 24 months (12 days short) can this be rounded up to 24 months? The reason for the move is change of employment where new job is over 1000 miles from previous place of employment but for some reason, Turbo Tax is still calculating a gain where I believe it should be excluded, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of primary home with Joint ownership and lived there for only 23 months

You can't round the days up. That might have worked years ago, but computers are too smart for that now. What can be done is tell TurboTax that the sale was due to unforeseen circumstances and TurboTax will calculate the percentage of the exclusion that applies. In this case, all but 12 days. The home was no longer suitable due to work being more than 1000 miles aways.

Keep all records of the sale and the move for work with 2021 tax records. Nothing has to be sent to the IRS for this exception, but you need the records in case it is ever questioned.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of primary home with Joint ownership and lived there for only 23 months

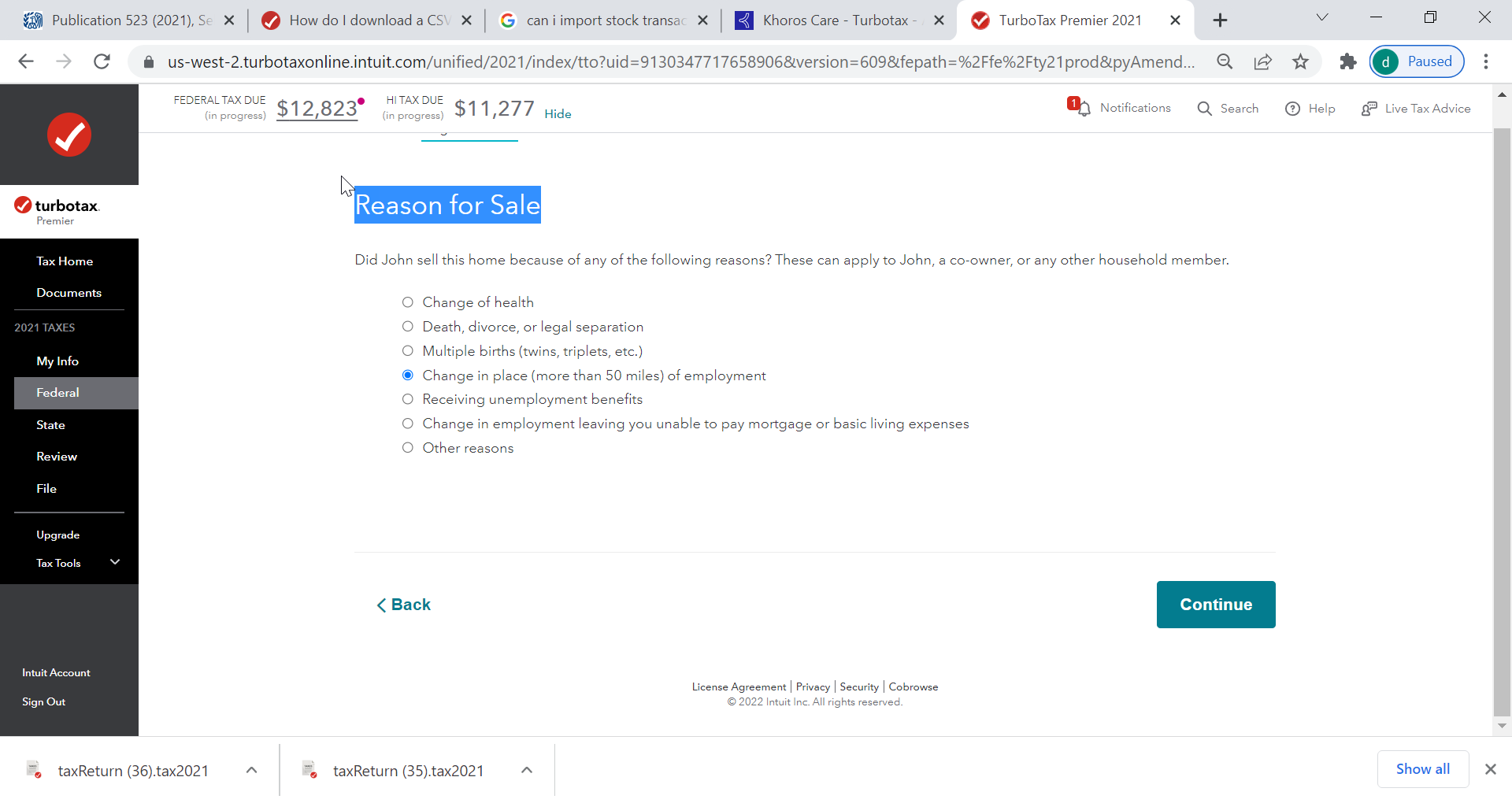

There are follow-up questions in the screen after entering the information about the time spent in the home. One screen of particular interest is a screen that says Reason for Sale. Here put in change of place more than 50 miles of employment. If this is mentioned there should be a partial exclusion of the gain as DanP0428 mentions in the previous screen. Here is what that screen looks like. @Krazyrae

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eric6688

Level 2

atn888

Level 2

Sangd

Level 1

LitaC4

New Member

uncle-sam

Returning Member