- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- S corporation Sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S corporation Sale

I filed my S corporation taxes 1120S with the sale of my business allocation (Inventory, Assets, Allocation to Non Compete, and Goodwill) as agreed to in the sale. I am now doing my personal tax return and it is asking the sales price and price allocation. My first question is wasn't this already reported on my S corporation tax return? Also, if not, my husband and I own the business 50/50 so do I split the purchase price and cost allocation by 50/50?

Sales Price was: $275,000 so $137,500 each?

THANK YOU For your help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S corporation Sale

On you corp's return, right, but all of that gets passed to you and your husband from your K1s

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S corporation Sale

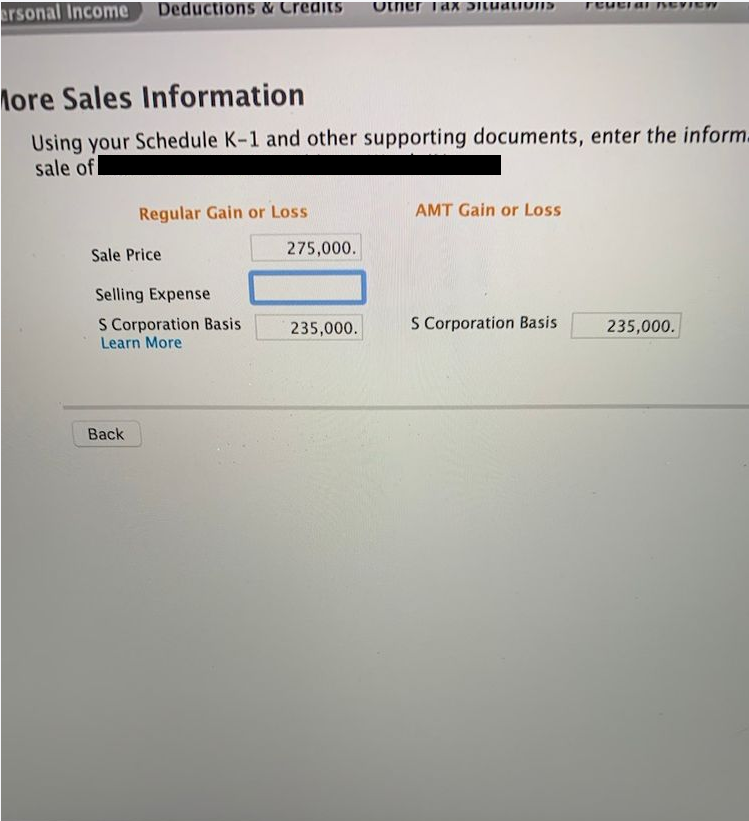

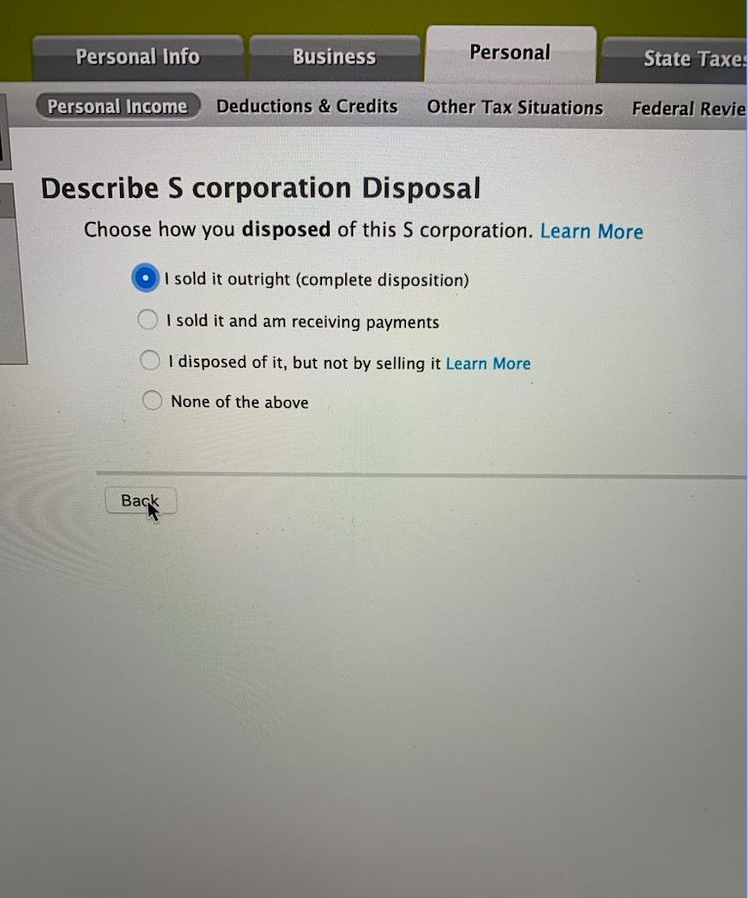

Thank you for your help! This is what shows on my Personal Home & Business Taxes when I go to enter my K1. I select that my business has been sold (complete disposition) and then they want my sales information like it is a sale of stock. The stock was not sold and I've already completed the different classes of the sale on my S corp. tax so would I not fill this out and just fill out my K1 Schedule. If I do fill it out, would I split the sales price with the my tax basis 50/50 with my spouse?

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S corporation Sale

Also, my k1 box 17 clearly starts to refer to my Section 179 report so this isn’t a stock sale so I would skip that part & simply entered info found on my k1. Correct??

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

William--Riley

New Member

cm-jagow

New Member

oaosym

New Member

PGW1

Returning Member

user17525279893

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More