- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

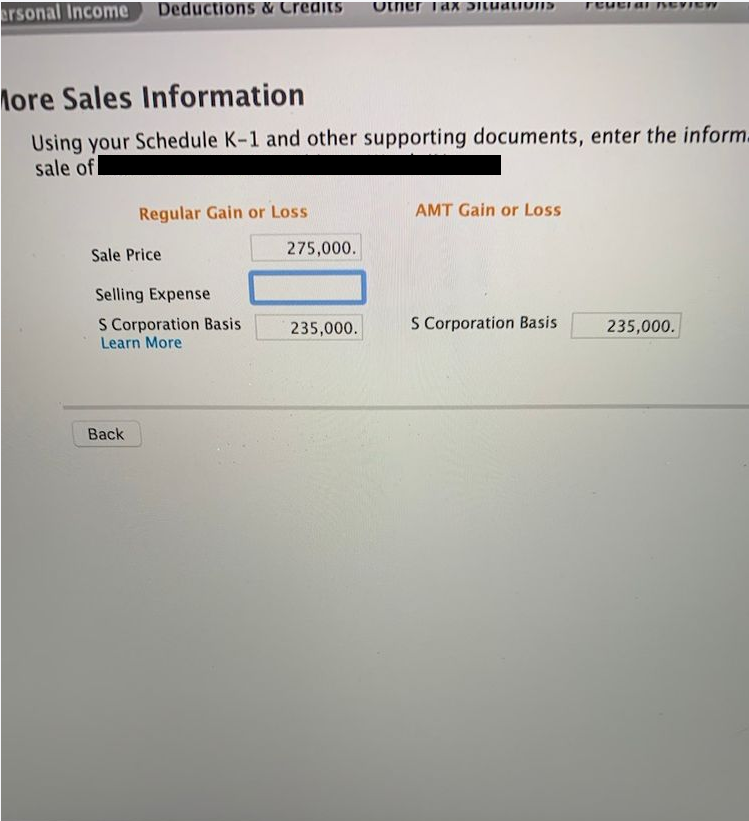

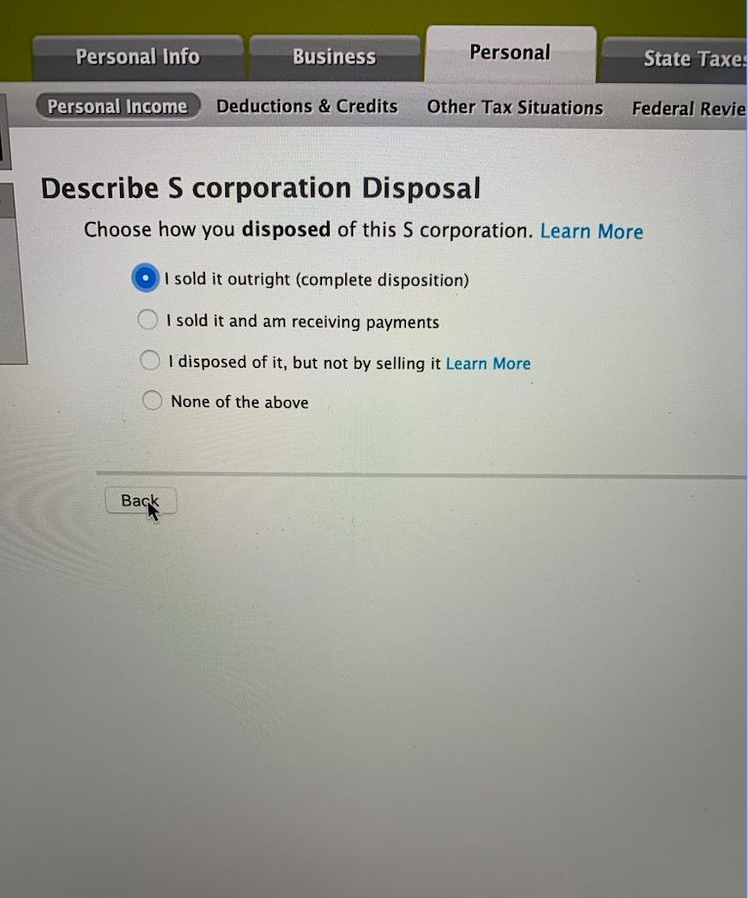

Thank you for your help! This is what shows on my Personal Home & Business Taxes when I go to enter my K1. I select that my business has been sold (complete disposition) and then they want my sales information like it is a sale of stock. The stock was not sold and I've already completed the different classes of the sale on my S corp. tax so would I not fill this out and just fill out my K1 Schedule. If I do fill it out, would I split the sales price with the my tax basis 50/50 with my spouse?

Thank you so much!

March 9, 2020

4:58 PM