- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- RSU Sell-To-Cover - Single release statement vs 2 transactions in 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

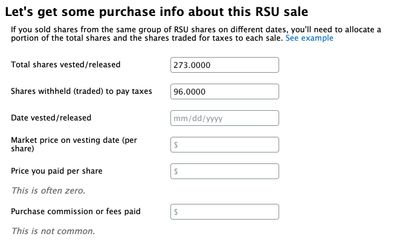

RSU Sell-To-Cover - Single release statement vs 2 transactions in 1099-B

Hi

I got a single release statement for my sell-to-cover transaction, but two different entries in my 1099-B.

273 shares vested = 177 shares sold and 96 shares sell-to-cover (these are the 2 separate entries in my 1099-B).

How do I treat those two entries in the 1099-B with respect to this screen. Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU Sell-To-Cover - Single release statement vs 2 transactions in 1099-B

RSUs are pretty straight forward; therefore, I recommend you enter your transactions without indicating you are reporting the sale of company stock. Indicating that is company stock has no impact on what's reported to the IRS. It only affects what screens and questions you get in the TurboTax interview. When RSUs vest (the stock is delivered) the entire amount is ordinary income. Your employer must collect payroll taxes, or sell shares to pay it. Since you are taxed on the entire amount, you basis is the amount that is added to your W-2 which you are taxed on. If you retain the stock, any gains on the sale will be short term if you hold the stock one year or less, and long term if you hold it more than one year.

Your cost basis is the total value on the date the RSUs vested. This is also the amount that it is added to your income and included in Box 1 of your W-2. To get your cost basis per share, divide the total value upon vesting (the amount added to your income) by the total number of shares represented by the RSUs.

You will have two transactions. The cost basis (per share) and acquisition date will be the same for both transactions, and they will both be short term. The proceeds and sales date will be whatever is reported on the 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU Sell-To-Cover - Single release statement vs 2 transactions in 1099-B

Are you suggesting that the RSU screen then won't even come into the picture? I read some previous posts pointing to this RSU screen. Is there a way to treat this as a proper RSU sale, and yet achieve the goals you mention in your reply? Also, do I have to enter the taxes withheld for the RSU (i.e the sell to cover)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU Sell-To-Cover - Single release statement vs 2 transactions in 1099-B

Yes, I am suggesting that you bypass the RSU screen. In my opinion it just unnecessarily complicates the situation and is not helpful as long as your employer reported the RSUs vesting as income and withheld and paid the necessary taxes. I don't know what you mean by "proper RSU sale". The RSUs vested, stock was issued and sold. The RSUs vesting is a taxable event reported on your W-2. The two sales of the stock issued are investment sales reported on 1099-B that need to be reported on your tax return just like any other stock sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU Sell-To-Cover - Single release statement vs 2 transactions in 1099-B

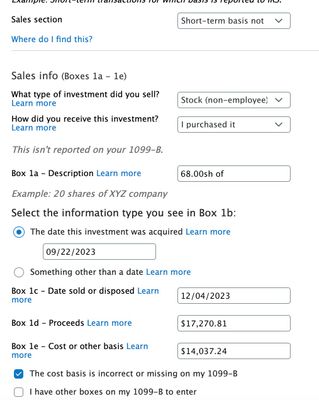

Since my imported 1099-B also contains my ESPP, can I answer Yes to the Employee Stock question, but then treat the RSU ones as "Stock (non-employee)" to the question that says "What type of investment did you sell". AND "I purchased it".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU Sell-To-Cover - Single release statement vs 2 transactions in 1099-B

Yes you can indicate that the ESPP transactions are employer stock and answer that the RSU transactions are not. And I do recommend you use the employer stock interview for ESPP shares sold.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU Sell-To-Cover - Single release statement vs 2 transactions in 1099-B

When you say employer stock interview, I wasn’t presented with an interview unless you mean the part it asks if I know the adjusted cost basis which is the next screen that I used to enter the adjusted cost basis. Is that what you mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU Sell-To-Cover - Single release statement vs 2 transactions in 1099-B

Here's how you would enter Espp and RSU transactions:

1-On the top right hand side of the screen, enter "Espps"

2-then click "Jump to "Espps"

3-Go through the screens until you get to Do these sales include Espp , Rsu.

then enter the sales one by one

In the sales information section, you'll indicate under "What type of Investment did you sell" whether it was an Espps or an RSU.

In the cost or other basis further down in the screen, you'll enter the adjusted cost basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jpeschel1038

New Member

jpeschel1038

New Member

dave-j-norcross

New Member

teerasripongsakorn

New Member

bgoodreau01

Returning Member