- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Reporting 1099-Misc and W2 with same amount in Turbo Tax Deluxe so it is not taxed twice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting 1099-Misc and W2 with same amount in Turbo Tax Deluxe so it is not taxed twice.

I received a 1099-MISC and a W-2 form for the exact same payment (settlement for back wages). How do I enter this in Turbo Tax Deluxe, so I am not taxed twice in Turbo Tax Deluxe

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting 1099-Misc and W2 with same amount in Turbo Tax Deluxe so it is not taxed twice.

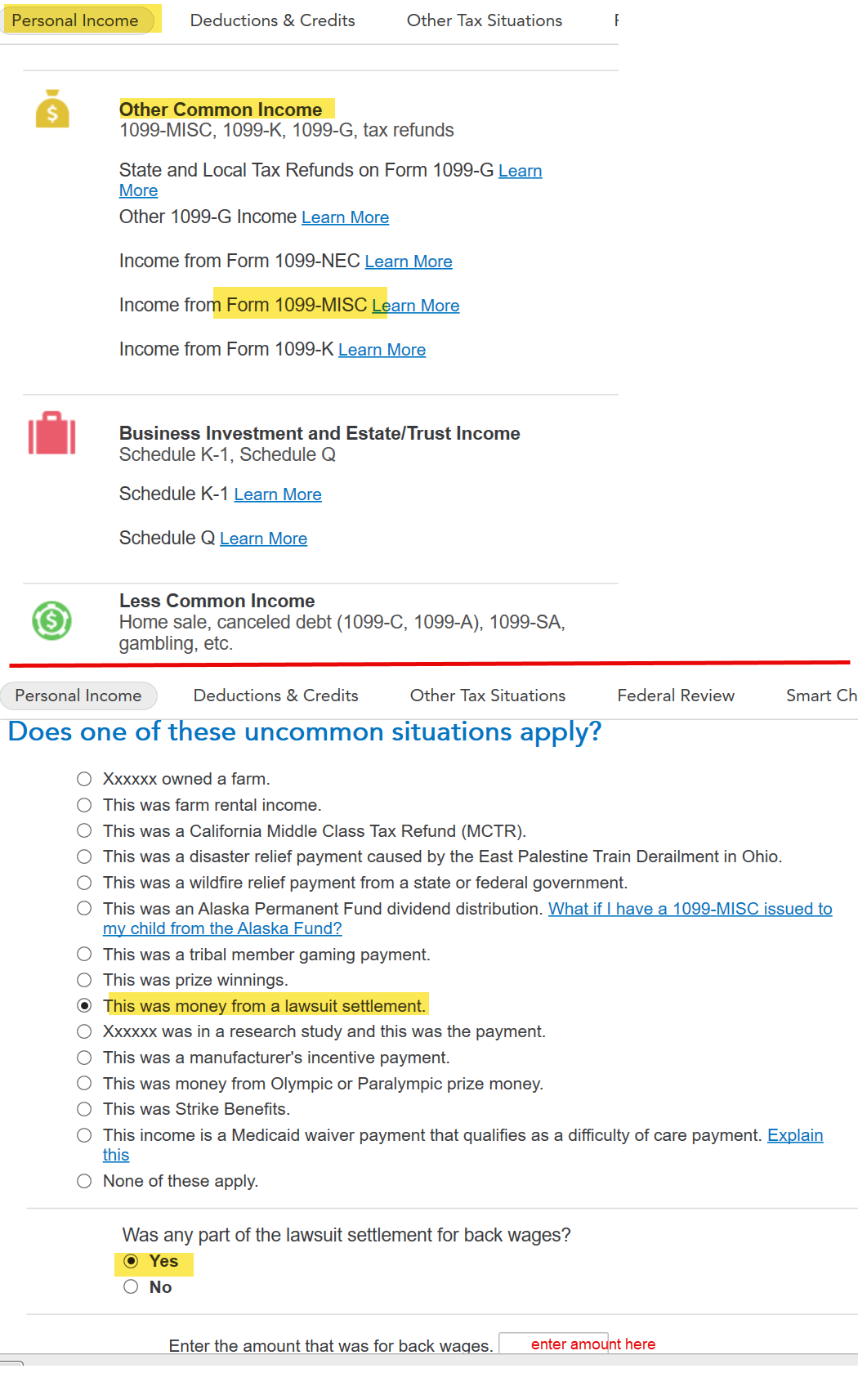

Go to the 1099-MISC entry spot. See below or search for 1099-misc and use the jump to link. You will be asked what the payment was for. Choose this was for a lawsuit settlement.

Answer YES to the back wages question and enter the amount of the w-2. This will record the 1099-misc and subtract it out, leaving only the W-2 income taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting 1099-Misc and W2 with same amount in Turbo Tax Deluxe so it is not taxed twice.

You need to refer back to the settlement agreement. You MAY need to report both. Often in settlements, it is split between back wages and 1099 for emotional distress or pain and suffering.

Do NOT make the mistake of only reporting one, and ignoring the other. Remember BOTH of those forms have been reported to the IRS. I dare say they likely are NOT duplicated.

Refer back to the settlement agreement. You may need to contact your attorney for guidance as to WHY the settlement was staggered between the W-2 AND the 1099. They should be able to clarify. Many do not understand how or why this is done. You do not want to receive a CP 2000 ( Under Reported Income). Those are generated automatically when there is an under reported mismatch between the forms and the amounts reported on your tax return.

If you cannot figure out how it should be reported, Turbo Tax does offer Live Tax Assistance for about $60. It will be the best $60 you have ever spent to help report it correctly.

They also offer Audit Defense for $75 +/-. That will protect you should it be reported incorrectly and you need assistance to resolve the issue(s).

I am a Tax Manager for a large firm. I do NOT work for Intuit or any of its affiliates. We recommend this service for lower priced tax returns. Intuit uses Enrolled Agents and/or CPA's both of whom are qualified to give tax advice and/ or represent you if you need assistance before the IRS.

Best wishes!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jmgretired

New Member

maya-cooper-brill

New Member

TD2830819D

New Member

kensings

New Member

SingleNoProceedsFromHouse1099S

New Member