- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Remove or Avoid CA Form 3554 from Turbo Tax Business 2020 for Windows 10

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove or Avoid CA Form 3554 from Turbo Tax Business 2020 for Windows 10

Hello,

I am using Turbo Tax Business to file my CA LLC return. When running the State review, I reach a point where I am asked to check an entry on Form 3554. The screen says "Form 3554: Question E must be entered". I opened Form 3554 and found no Question E on it. Furthermore, Form 3554 does not apply to my LLC. I deleted the State return and started over, but again reach the same question. I can again delete the State return and start over, but need to know exactly at what point in the questionnaire screens leading to this am I supposed to enter, or not enter, something to avoid Form 3554.

I am using TurboTax Business 2020 for Windows 10 (not the online version).

Your help is greatly appreciated.

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remove or Avoid CA Form 3554 from Turbo Tax Business 2020 for Windows 10

Form 3554 is used to obtain a credit for new employees acquired during the year. For 2020, you could qualify for the credit if you hired employees in a Designated Geographical Area.

Please see the link below for additional information to determine if you qualify for this credit.

Form 3554 - New Employment Credit

If you determine this credit does not apply to your return, you can delete the form as follows:

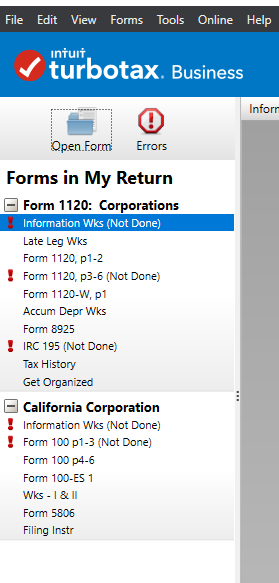

- Go to the Forms section

- In the left panel, select Open Form

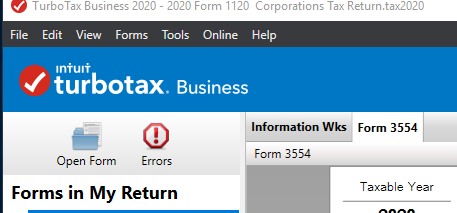

Type in 3554, scroll down and select Form 3554: New Employment Credit and open the form.

Once you see the form on your screen, go to the top menu and select Forms.

Select Delete Form 3554.

This will remove the form for your tax return and allow you to proceed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user26879

Level 1

RicsterX

Returning Member

aubutndan

Level 2

andredreed50

New Member

Bwcland1

Level 1